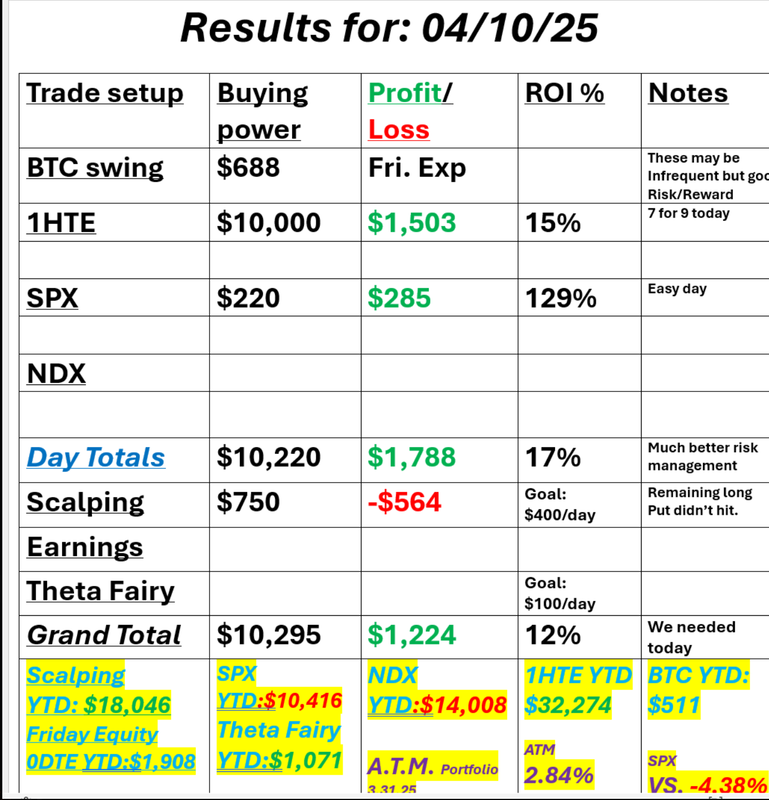

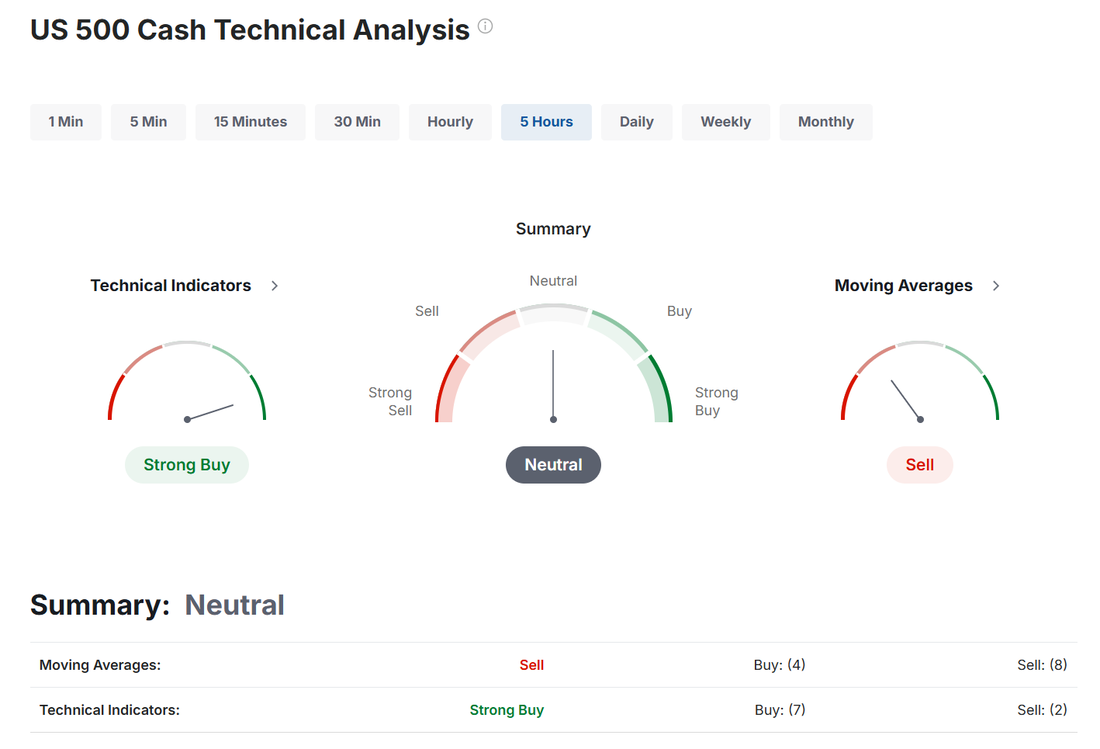

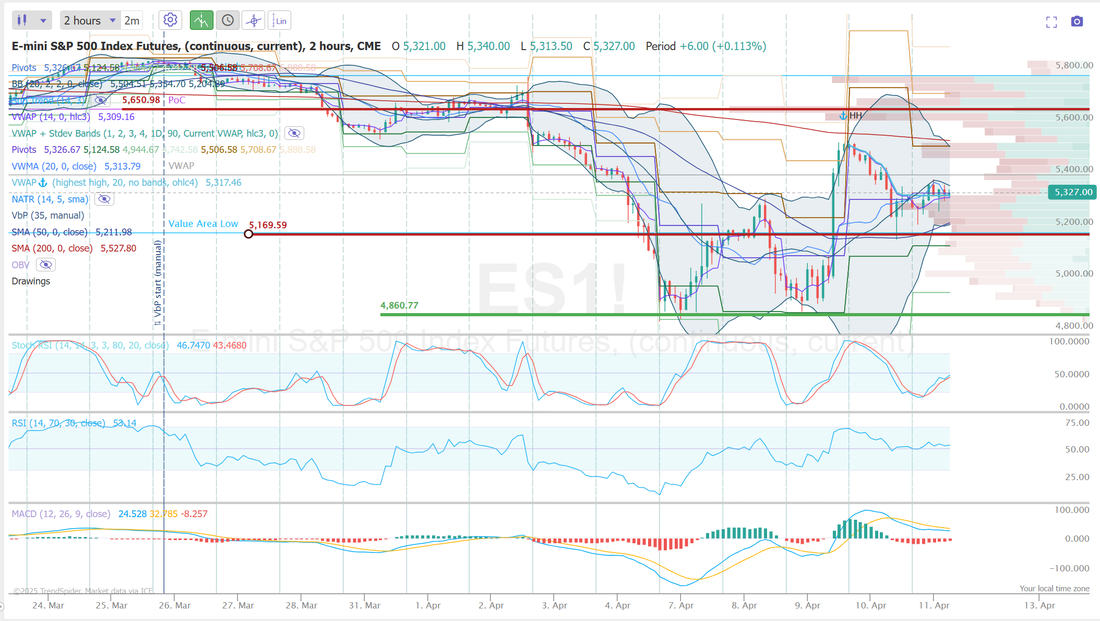

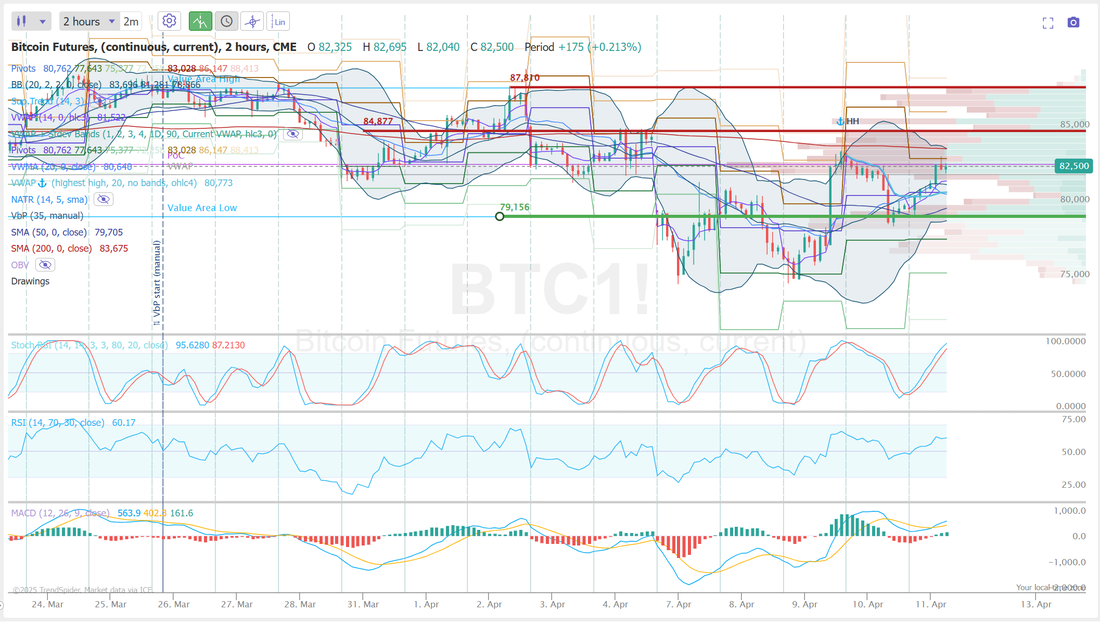

Respite care dayGood Friday to you all! For some (myself included) the weekend can't come fast enough! These are some crazy times for sure. I've been at this for over four decades. I was on Wallstreet for the 1987 crash. The 2000 tech bubble burst and the financial melt down of 2008. These times don't come along often but they certainly test you when they do. I needed a reset day yesterday. A repite day, if you will. We traded small. Took risks that would not be a big deal to us, if they didn't work and guess what? We did better with that approach profit wise as well. Here'a a look at our day. I'll be out of the office today at a 2 day mastermind but should (hopefully) have the ability to get my laptop in. This will allow us to still trade today. I'm looking at four trades today. BITO. We need to generate a bit more income from it today. /MNQ scalp. We have a short futures on for today and may add an /NQ cover, if needed. SPX 0DTE. I'll attempt to start us off today with up to three butterflies or (more likely) very slightly broken butterflies. Each one hopefully around $300 buying power for a total capital commitment of less than $1,000 dollars. This should accomplish three things: #1. Give us enough profit potential that we will be happy with the result, if it works. #2. Keep our risk low, once again. #3. Allow us the ability to fix it, later in the day, with relative ease, should it not work. I'd also like to continue our experiment yesterday with the "Range" BTC hourly setups. Yesterday was successful but with "only" 10-13% profit potential I'm still not sure how best to scale the losers. Let's look at the market news: June S&P 500 E-Mini futures (ESM25) are trending up +0.69% this morning as investors await crucial U.S. producer inflation data and earnings reports from some of the biggest U.S. banks. U.S. equity futures initially moved sharply higher, attempting to rebound from yesterday’s selloff on Wall Street. Later, stock index futures briefly turned lower after China raised tariffs on all U.S. goods to 125% from 84%, effective April 12th. The move came after the White House clarified on Thursday that, including a 20% levy imposed earlier this year, total tariffs on China now stand at 145%. China stated it would not match any additional tariff hikes from the U.S., but affirmed it would continue to retaliate against perceived U.S. offenses. However, stock index futures erased losses and continued to rise as investors appeared to shrug off the latest escalation in the U.S.-China trade war. In yesterday’s trading session, Wall Street’s major indices closed in the red. The Magnificent Seven stocks retreated, with Tesla (TSLA) sliding over -7% and Meta Platforms (META) falling more than -6%. Also, chip stocks slumped, with Microchip Technology (MCHP) plunging over -13% to lead losers in the Nasdaq 100 and ON Semiconductor (ON) dropping more than -11%. In addition, CarMax (KMX) tumbled -17% after the company posted weaker-than-expected FQ4 EPS. On the bullish side, Enact Holdings (ACT) rose more than +4% after S&P Dow Jones Indices announced that the stock would join the S&P SmallCap 600 Index, effective April 16th. The U.S. Bureau of Labor Statistics report released on Thursday showed that consumer prices slipped -0.1% m/m in March, weaker than expectations of +0.1% m/m. On an annual basis, headline inflation eased to +2.4% in March from +2.8% in February, weaker than expectations of +2.5% and the smallest increase in 6 months. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.1% m/m and +2.8% y/y in March, weaker than expectations of +0.3% m/m and +3.0% y/y. In addition, the number of Americans filing for initial jobless claims in the past week rose +4K to 223K, in line with expectations. “Healthy drop in inflation or big fall drop in demand?” said Bret Kenwell at eToro. “While the Fed will want more than one data point to just justify its next rate cut, [yesterday’s] CPI numbers are certainly a step in the right direction. Unfortunately, the trade-war rhetoric over the last month has muddied the economic waters. Is inflation moving sustainably lower, or did businesses and consumers pull in the reins as they brace for an economic slowdown?” Kansas City Fed President Jeff Schmid stated on Thursday that he would prioritize curbing inflation if policymakers are forced to balance their goal of price stability against their mandate for full employment. Also, Dallas Fed President Lorie Logan said, “To sustainably achieve both of our dual-mandate goals, it will be important to keep any tariff-related price increases from fostering more persistent inflation. For now, I believe the stance of monetary policy is well positioned.” In addition, Chicago Fed President Austan Goolsbee described tariffs as a “stagflationary shock” that places the central bank’s objectives of price stability and full employment in conflict with each other. U.S. rate futures have priced in a 63.6% chance of no rate change and a 36.4% chance of a 25 basis point rate cut at the next central bank meeting in May. Meanwhile, the first-quarter corporate earnings season gets underway, with some of the biggest U.S. banks, including JPMorgan Chase (JPM), Wells Fargo (WFC), and Morgan Stanley (MS), slated to report their quarterly results today. BlackRock (BLK) and Fastenal (FAST) are other prominent companies scheduled to deliver their quarterly updates today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. March PPI will come in at +0.2% m/m and +3.3% y/y, compared to the previous figures of unchanged m/m and +3.2% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect March figures to be +0.3% m/m and +3.6% y/y, compared to February’s numbers of -0.1% m/m and +3.4% y/y. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists estimate the preliminary April figure will stand at 54.0, compared to 57.0 in March. In addition, market participants will hear perspectives from St. Louis Fed President Alberto Musalem and New York Fed President John Williams throughout the day. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.407%, up +0.34%. Sentiment Wall Street’s elation gave way to dread, with a drop in US stock market futures, oil, and the currency indicating concern that the trade war will cause long-term damage to the American economy. S&P 500 futures fell, predicting a reversal from Wednesday’s nearly 10% gain. The Dollar declined for the third consecutive day. Brent crude fell below $64 per barrel. Bonds rose, while investors sought protection in gold, the Swiss franc, and the Yen. While investors hailed Trump’s promise to suspend certain tariffs, which boosted US equities to a historic one-day surge, traders are now focussing on the implications of an economic slump and protracted volatility. Consumer inflation data is coming later today, and a Treasury auction of 30-year bonds will be closely monitored for any signs of concern about owning US debt. Meanwhile, European and Asian markets rose as investors caught up with Wall Street’s bounce the day before. Docket 08:30 ET US CPI for March YoY – Forecast: 2.5% | Prior: 2.8% | Range: 2.8% / 2.5% MoM – Forecast: 0.1% | Prior: 0.2% | Range: 0.3% / 0% Core YoY – Forecast: 3% | Prior: 3.1% | Range: 3.1% / 2.9% Core MoM – Forecast: 02.3% | Prior: 0.2% | Range: 0.5% / 0.2% US Weekly Jobless Claims Initial Claims – Forecast: 223k | Prior: 219k | Range: 230k / 215k Continued Claims – Forecast: 1.884M | Prior: 1.903M | Range: 1.92M / 1.86M 11:30 ET US sells $85 bln 4-Week Bills 12:00 ET US EIA Short Term Energy Outlook Report 13:00 ET US sells $22 bln 30-Year Bonds Speakers 09:00 ET BoE’s Breeden speaks at a Market News International event on “UK economic and financial stability prospects.” 09:30 ET Fed’s Logan gives welcome remarks at a Dallas Fed event called “Outlook for North American Trade and Immigration.” 10:00 ET Fed’s Bowman has her nomination hearing in front of the Senate Banking Committee for the position of vice chair for supervision. Text & Q&A are expected. Fed’s Schmid speaks on the economic outlook and monetary policy at an event in Kansas City. No indication whether a text is expected, but there will be a Q&A. 11:00 ET Trump participates in a Cabinet Meeting (Closed Press) 12:00 ET Fed’s Harker speaks on fintech at an event at the Philadelphia Fed. Text is expected, but no Q&A. Fed’s Goolsbee speaks at the Economic Club of New York. No indication whether a text is expected, but there will be a Q&A. ECB’s Donnery at Delphi Economic Forum X SNB’s Tschudin Speaks at a Money Market event in Zurich 12:30 ET Trump participates in a Swearing-In Ceremony for the Solicitor General 16:00 ET Trump participates in a Bill Signing Let's take a look at the markets: With PPI today I would imagine it will start the price action movement. There's no reason to believe today won't have swings and the neutral rating technically to start us off suggests as much. Our bullish lines (top lines) on the charts...the level we would declare us back to bullishness is now a long ways away. I added the new support lines (bottom lines) today. A couple observations. #1. It would be a pretty sizable drawdown to get us there. #2. The DIA is almost there right now. #3. The next levels down are wayyyyy down. We'd be going back to 2023 levels. Let's look at the intra-day levels for our /ES and BTC. /ES: As we've seen lately, the levels are really far apart. It's an accurate reflection of the wild price action we are getting but it does make it hard to pinpoint key, intra-day levels for us to trade off of. On the /ES I'm keying in on 5169 as an important support. If that holds and the market likes PPI...and we don't get some additional crazy tariff news (I know this is asking a lot) we could push as high as 5650. 4860 is the support level below 5169, if we lose that level. BTC: Bitcoin was good to us again yesterday. I'm going to continue working the range trades today. Let's see how that goes. Resistance is at 84,877 and then 87,810 with support at 79,156. I look forward to trading with you all again today in the live trading room. Let's see if we can replicate yesterday. Low risk, low stress type day.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |