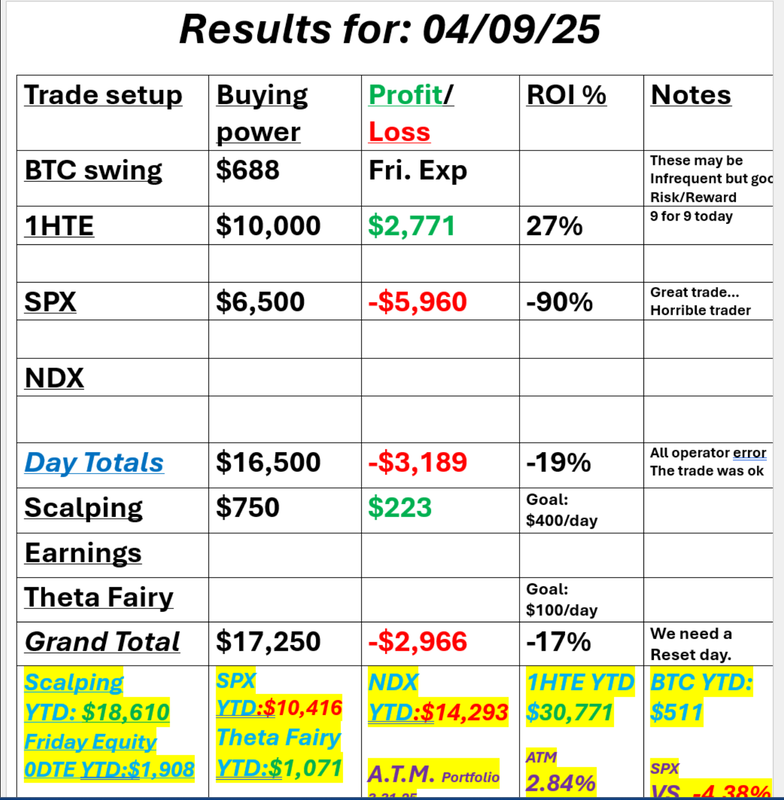

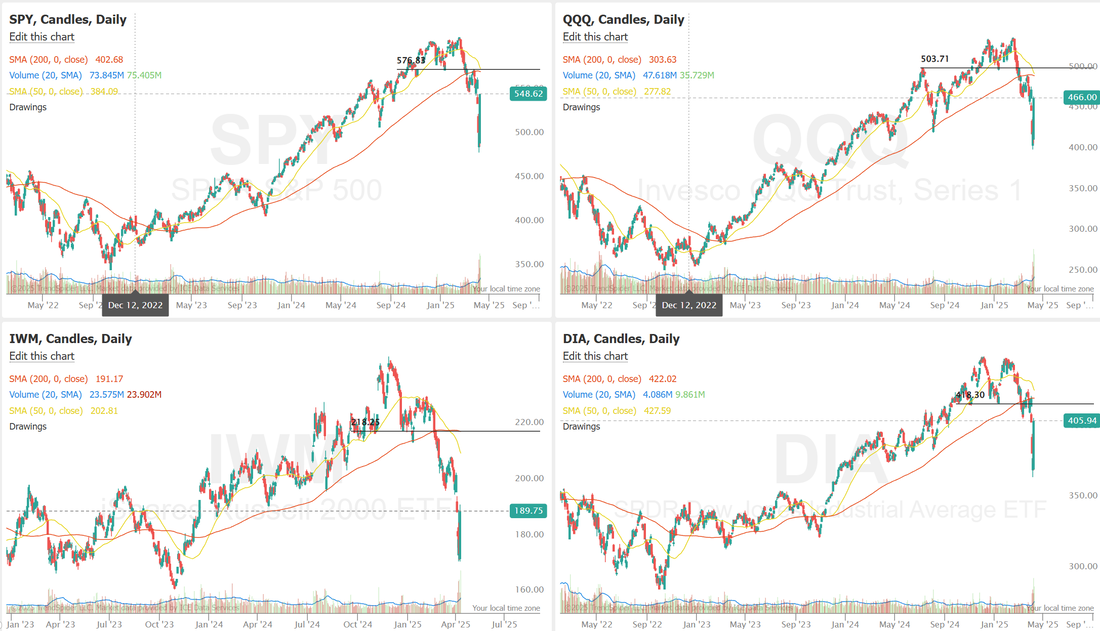

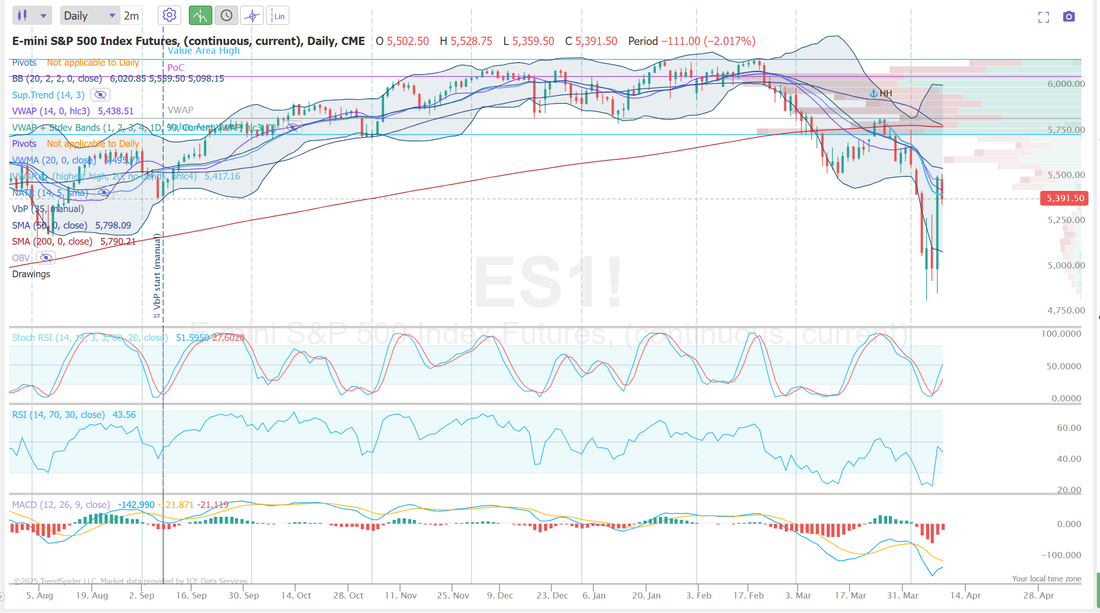

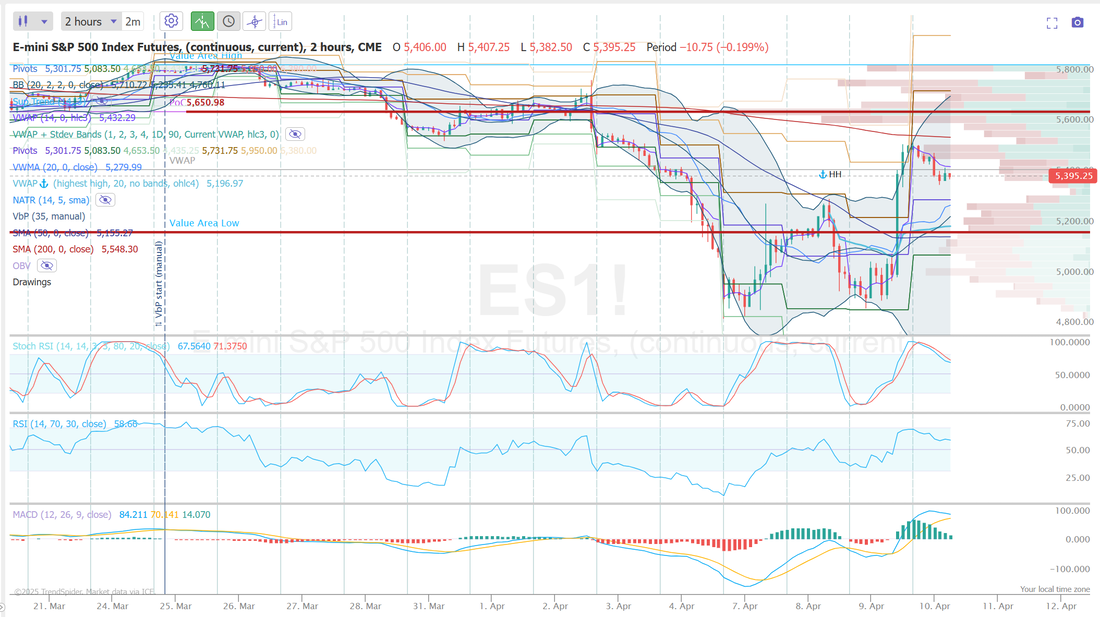

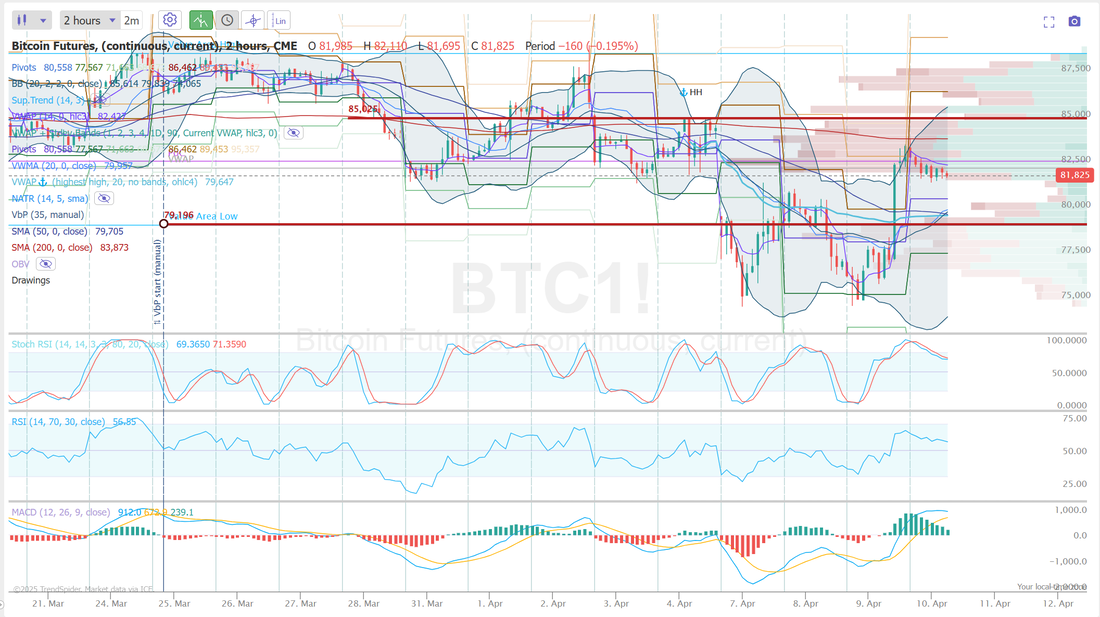

Self realizationGood morning traders! Trading has it's ups and downs. Not every day is sunshine and roses. Almost every day we have some trade setup that isn't working or loses money. That's fine. It's how trading works and as long as the overall day is profitable we're happy. Some days are losing days overall but as long as we did our best and traded well we take it in stride. Yesterday was NOT one of those days. We had an absolutely beautiful SPX 0DTE working. I had $4,950 capital committed and was up $1,250 dollars and didn't lock it in. There was still over $1,000 of extrinsic left and the trade looked perfect. Then came the reversal on the Trump tariff news. It just crushed the calls. There are lots of justifications we (I) can make on losing days...Unexpected Trump news, etc. but the reality is I should have pulled a trade that was that profitable and called it a day. We don't need better setups or trades. I just need to do better on my profit taking. I'm going to use today as a reset day. One small 0DTE and focus most of our effort today on our 1HTE's with bitcoin. Those are working well for us. Here's a look at my day yesterday: Let's take a look at the markets: Yesterdays monster rally brought us right back to those consolidation zones established last year around April. Is it meaningful? I don't think so. Bear markets tend to have violent retraces just like yesterdays. It doesn't really change the overall bearish outlook. une S&P 500 E-Mini futures (ESM25) are down -2.20%, and June Nasdaq 100 E-Mini futures (NQM25) are down -2.33% this morning, pointing to a sharp pullback on Wall Street after yesterday’s historic rally, while investors brace for the release of crucial U.S. inflation data. After $10 trillion was erased from global equity markets, U.S. President Donald Trump announced a 90-day pause on most of his sweeping reciprocal tariffs. Countries affected by the higher reciprocal duties that took effect Wednesday will now be taxed at the earlier 10% baseline rate applied to other nations, except for China, which remains subject to a 125% tariff. This sparked a massive rally on Wall Street, with the benchmark S&P 500 notching its largest daily gain since 2008 and the tech-heavy Nasdaq 100 posting its biggest one-day surge since 2001. Still, numerous strategists cautioned investors against buying the dip in equities due to the risks that lie ahead. “The damage has been done. They’ve opened Pandora’s box, and they can’t undo what’s been done in one statement. We would definitely be a bit more of a seller at this point,” said Colin Graham, head of multi-asset strategies at Robeco Groep. The minutes of the Federal Open Market Committee’s March 18-19 meeting, released Wednesday, showed that officials were worried about tariffs. They referenced President Trump’s trade policy 18 times in the minutes, a sharp increase from just one mention in January’s minutes. “Participants assessed that uncertainty around the economic outlook had increased, with almost all participants viewing risks to inflation as tilted to the upside and risks to employment as tilted to the downside,” according to the FOMC minutes. Also, some officials outlined a possible “stagflation” scenario, in which inflation rises while the economy either stagnates or contracts. “Some participants observed, however, that the committee may face difficult tradeoffs if inflation proved to be more persistent while the outlook for growth and employment weakened,” the minutes said. In yesterday’s trading session, Wall Street’s major indexes ended sharply higher. The Magnificent Seven stocks rallied, with Tesla (TSLA) soaring over +22% and Nvidia (NVDA) climbing more than +18%. Also, chip stocks spiked, with Microchip Technology (MCHP) soaring over +27% to lead gainers in the S&P 500 and Nasdaq 100 and Arm Holdings (ARM) rising more than +24%. In addition, Delta Air Lines (DAL) surged over +23% after the airline posted better-than-expected Q1 results. Economic data released on Wednesday showed that U.S. wholesale inventories came in at +0.3% m/m in February, compared to expectations of +0.4% m/m. Minneapolis Fed President Neel Kashkari stated on Wednesday that the central bank is less likely to cut interest rates in the face of tariffs due to their inflationary impact, even if the economy starts to weaken. “The hurdle to change the federal funds rate one way or the other has increased due to tariffs,” Kashkari wrote in an essay. Meanwhile, U.S. rate futures have priced in an 81.2% probability of no rate change and an 18.8% chance of a 25 basis point rate cut at the May FOMC meeting. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. March CPI will come in at +0.1% m/m and +2.5% y/y, compared to the previous numbers of +0.2% m/m and +2.8% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.0% y/y in March, compared to February’s figures of +0.2% m/m and +3.1% y/y. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 223K, compared to last week’s number of 219K. In addition, market participants will be looking toward speeches from Fed officials Logan, Schmid, Goolsbee, and Harker. First-quarter corporate earnings season begins in earnest on Friday, with major banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), and Morgan Stanley (MS) set to report their quarterly results. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.283%, down -2.57%. I'm using today as a re-set day. Yesterday was very frustrating. When trades don't work, they don't work and that's fine. It's how it goes sometimes but when I make an "operator error" like yesterday it's frustrating. Today I'm going to do a very small SPX 0DTE and mainly focus on our 1HTE Bitcoin setups. We'll be back at it full force tomorrow. Let's take a look at /ES and BTC levels for today: /ES: Yesterdays rally brought us back to a key support level from Sept. of last year. On the intra-day basis the zone is wide. 5650 is resistance and 5174 is support. It's a wide zone folks. It may or may not be helpful for us today. BTC: Bitcoin was kind to us yesterday. It wasn't enough to get us profitable overall but it really helped. 85,000 is resistance wit 79,000 support. That's our range today. Let's see how many 1HTE's we can pull off. Yesterday was a bummer folks. We are in interesting times. Be safe. Trade small. Let's see if we can put up some green today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |