|

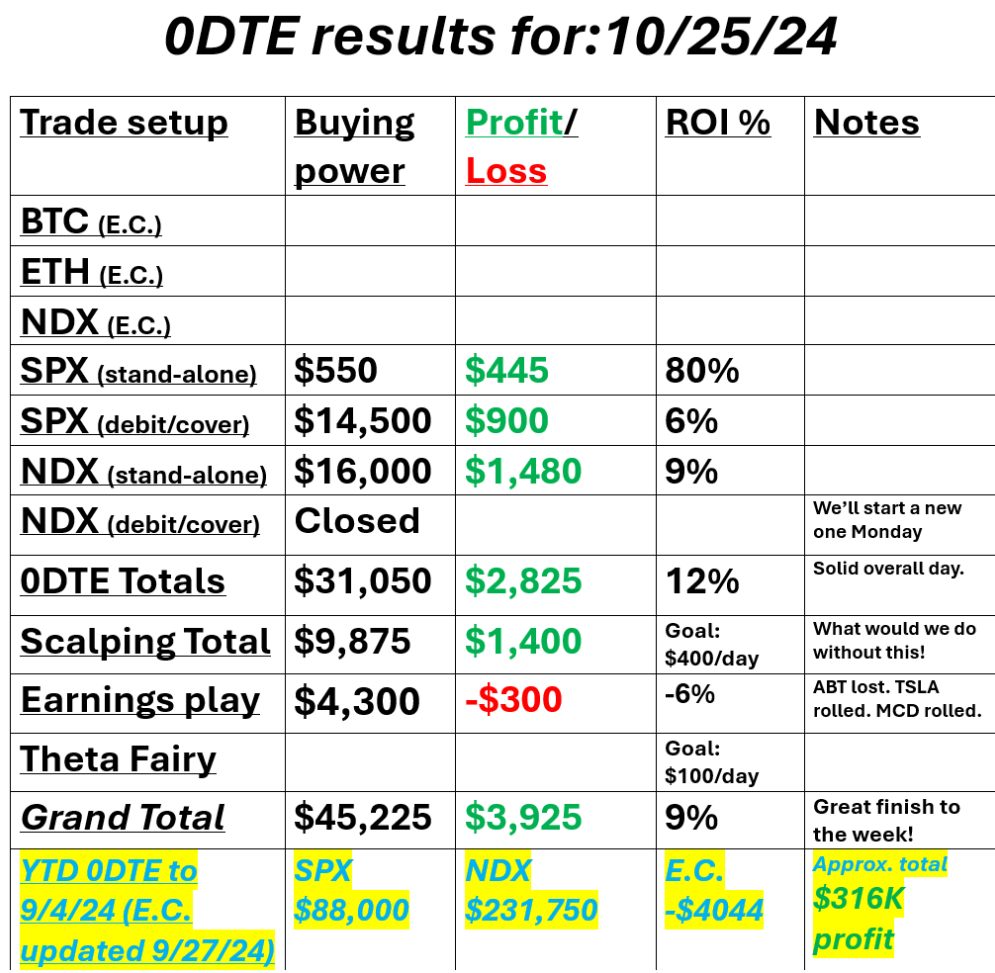

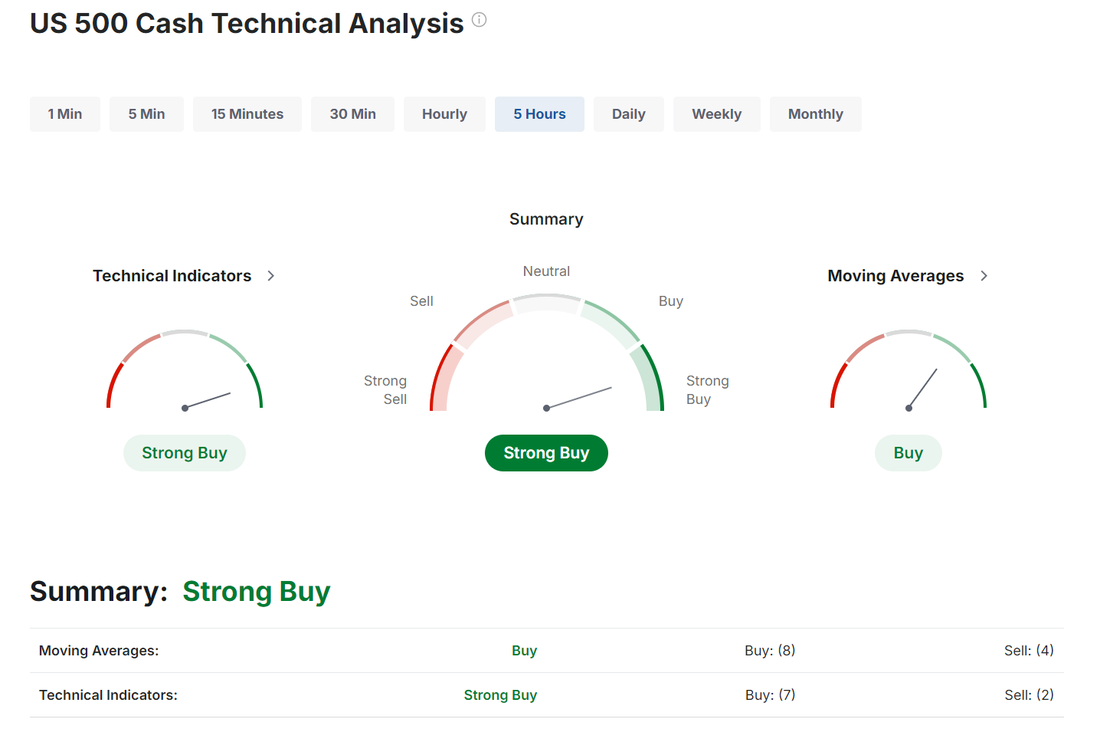

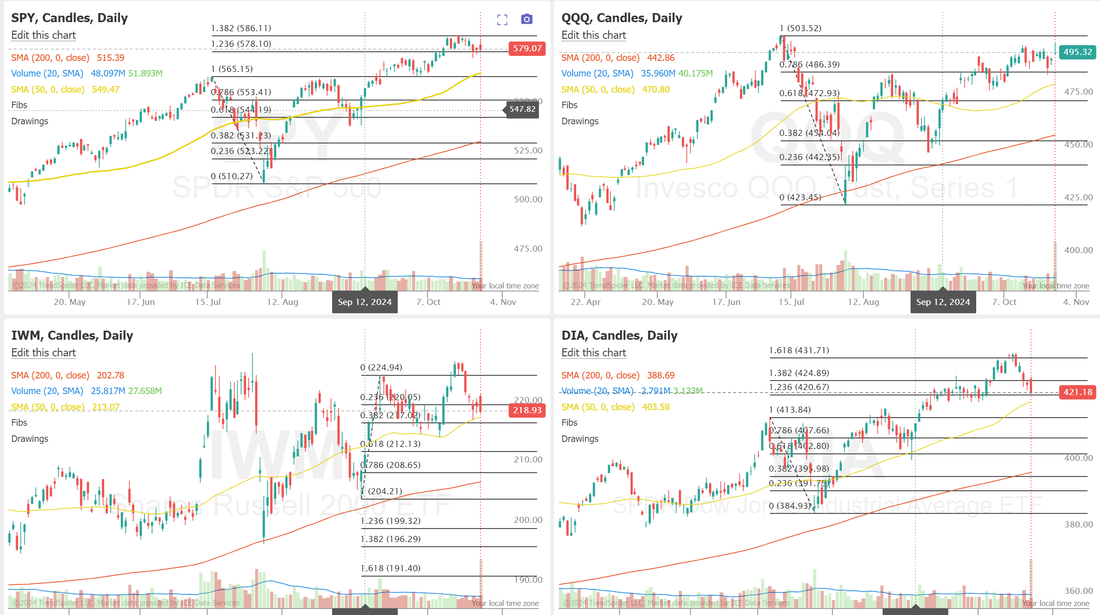

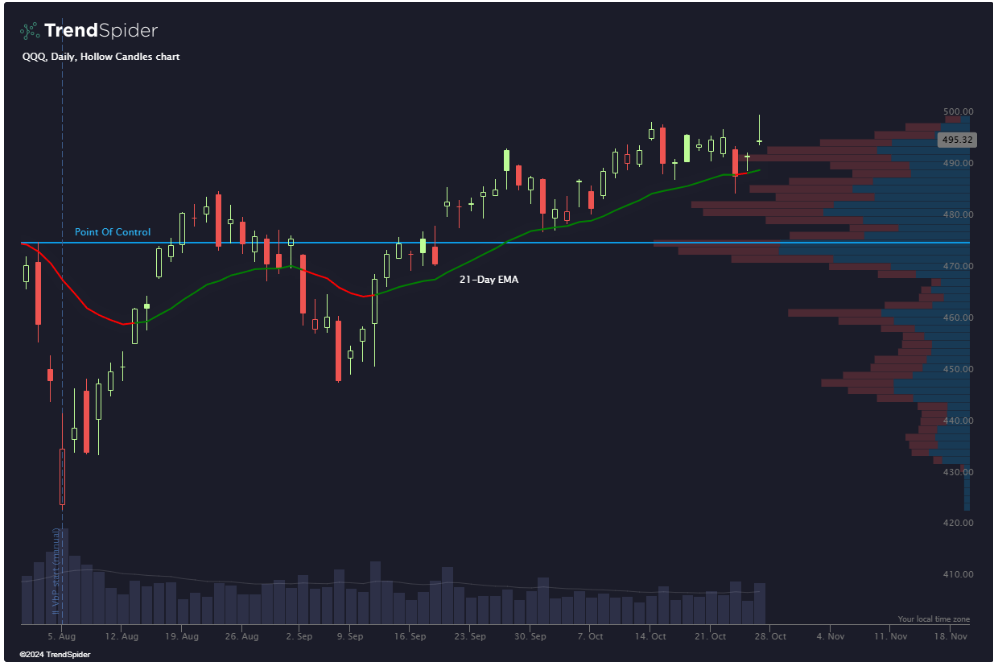

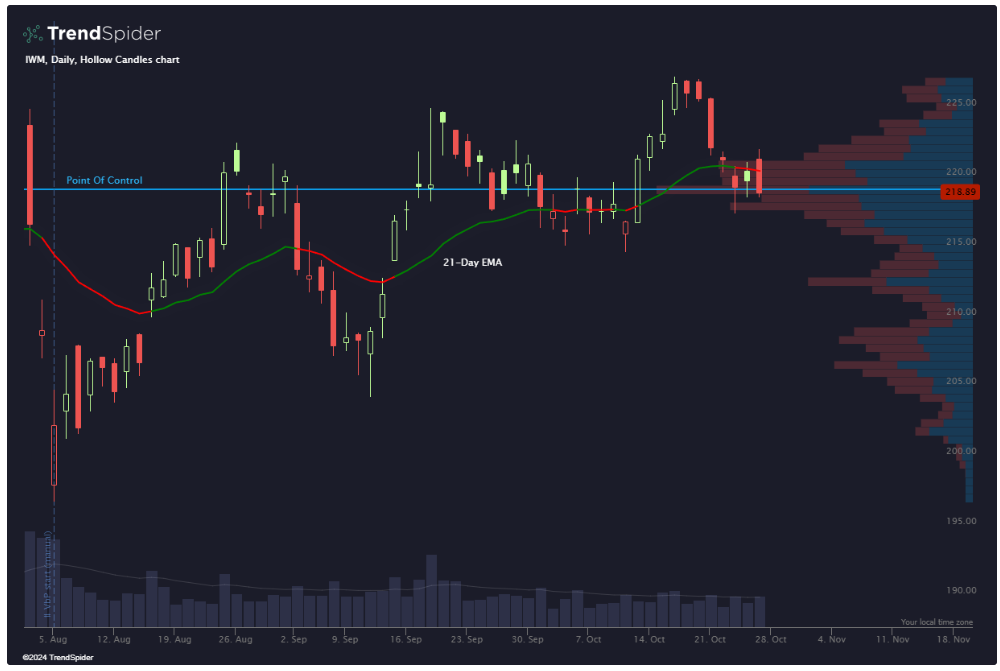

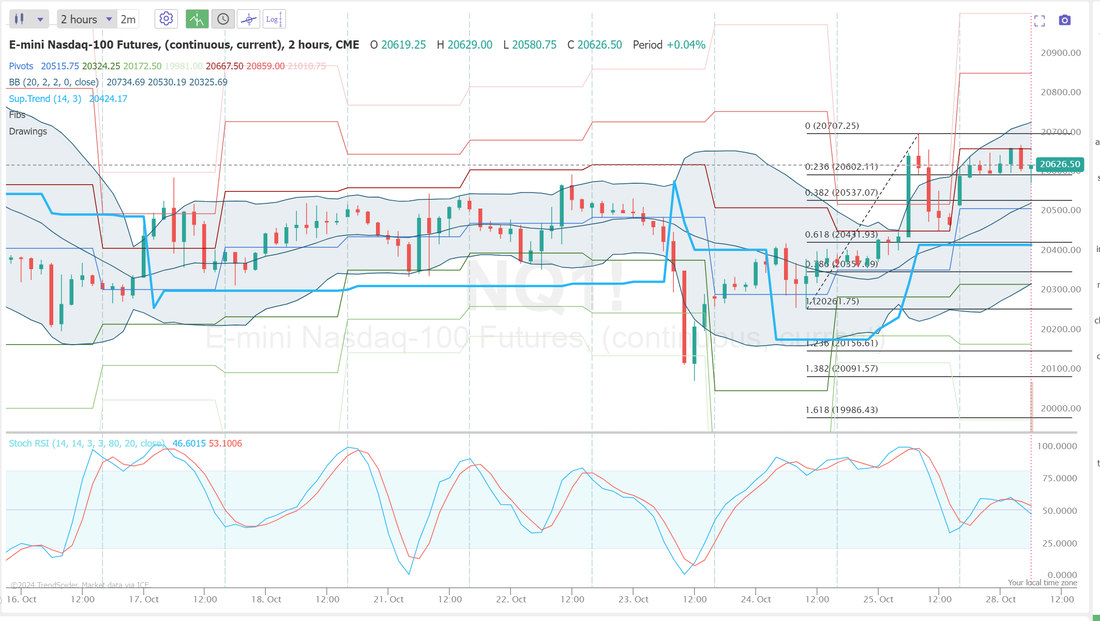

Welcome back traders. The last week of October and Snow is in the forecast for my town. Halloween parties means time to break out the Chewbaca outfit. It's a fun time of year. I hope you all get some time off to enjoy. We had a bang up finish to our week on Friday. We worked right up to the close and Scalping killed again. It all added up to a good day. See our results below. Let's take a look at the markets. Futures are pushing higher this morning and trying to keep the bullish bias in place. There's certainly been some weakness trying to creep in but all the major indices remain above their 50DMA. It was a challenging week for the SPY, breaking a six-week winning streak and failing to put in a new all-time high despite a solid attempt from the bulls on Friday. Key support came from the 21-day EMA, which provided a bounce that helped the index close only slightly lower at $580.21 (-0.94%). If this level is lost next week, all eyes will be on the Volume Point of Control from the September lows, at $570. Despite putting in a new weekly high and closing in the green at $495.32 (+0.17%), QQQ is still facing resistance just below its all-time high. Similar to the SPY, the 21-day EMA has provided solid support, but if that level is to fail, perhaps the Volume Point of Control could become a key target for the bears as we approach the election. IWM struggled the most this week, closing at $218.89 (-2.99%). The crucial 21-day EMA was lost on Wednesday, and attempts to regain it were thwarted by the bears. As they say, nothing good happens below the 21-day EMA, so bulls will be hoping that the Volume Point of Control holds despite Friday’s precarious close just below the level. Let's look at the expected moves this week: The ranges are not much different than what we've been getting as of late. That could change as we get closer to the election. December S&P 500 E-Mini futures (ESZ24) are up +0.37%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.48% this morning as investors looked ahead to earnings reports from some of the biggest tech heavyweights as well as key economic data, including a payrolls report, the Fed’s favorite inflation gauge, and the first estimate of third-quarter GDP. Oil prices plunged on Monday after Iran said that its oil industry was functioning normally following Israel’s retaliatory strikes on military targets across the country over the weekend. That resulted in some easing of geopolitical tension as markets geared up for a week filled with event risks. In Friday’s trading session, Wall Street’s major averages closed mixed, with the blue-chip Dow falling to a 2-week low and the tech-heavy Nasdaq 100 rising to a 3-1/4 month high. Tapestry (TPR) surged over +13% and was the top percentage gainer on the S&P 500 after a federal judge blocked the company’s $8.5 billion acquisition of Capri Holdings. Also, Western Digital (WDC) gained more than +4% to lead chip stocks higher after reporting better-than-expected Q1 adjusted EPS. In addition, Deckers Outdoor (DECK) climbed over +10% after the company posted upbeat Q2 results and raised its full-year revenue growth forecast. On the bearish side, Mohawk Industries (MHK) plunged more than -13% and was the top percentage loser on the S&P 500 after providing below-consensus Q4 adjusted EPS guidance. Also, McDonald’s (MCD) fell about -3% and was the top percentage loser on the Dow after the CDC said that the E. coli outbreak linked to the fast-food chain’s burgers has now spread to 13 states and infected 75 people. Economic data released on Friday showed that the University of Michigan’s U.S. consumer sentiment index was revised upward to a 6-month high of 70.5 in October, stronger than expectations of 68.9. Also, U.S. September durable goods orders fell -0.8% m/m, a smaller drop than the -1.1% m/m expected, while core durable goods orders, which exclude transportation, rose +0.4% m/m, stronger than expectations of -0.1% m/m. “Certainly better news for Jerome Powell and Company,” said Jeff Roach at LPL Financial. “Consumers feel confident that inflation is easing. Investors are anticipating Friday’s employment release as the Fed attempts to stick the soft landing.” Meanwhile, U.S. rate futures have priced in a 96.8% chance of a 25 basis point rate cut and a 3.2% chance of no rate change at the Fed’s monetary policy committee meeting next week. Third-quarter earnings season continues in full force, and investors anticipate fresh reports from major companies this week, including Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (META), Amazon (AMZN), Apple (AAPL), Visa (V), AMD (AMD), McDonald’s (MCD), Pfizer (PFE), Ford Motor (F), Eli Lilly (LLY), Caterpillar (CAT), Starbucks (SBUX), Doordash (DASH), Mastercard (MA), Intel (INTC), Merck (MRK), Altria (MO), Uber Technologies (UBER), Exxon Mobil (XOM), and Chevron (CVX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, the September reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation measure, and the Nonfarm Payrolls report for October will be the main highlights. Also, market participants will be monitoring a spate of other economic data releases, including U.S. GDP (preliminary), the CB Consumer Confidence Index, JOLTS Job Openings, the S&P/CS HPI Composite - 20 n.s.a., Wholesale Inventories (preliminary), ADP Nonfarm Employment Change, Pending Home Sales, Crude Oil Inventories, the Employment Cost Index, Initial Jobless Claims, Personal Income, Personal Spending, Chicago PMI, Average Hourly Earnings, the Unemployment Rate, Construction Spending, the ISM Manufacturing PMI, and the S&P Global Manufacturing PMI. Federal Reserve officials are in a media blackout period before the November meeting, so they are prohibited from making public comments this week. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.281%, up +1.09%. Trading docket for us is busy today: /MNQ, QQQ scalpiing. F, GOOG, /ZC, LRN, MCD, TSLA, FSLR, WYNN, UPST, CCL, PLTR, PYPL< SHOP, CRM?, SPY/QQQ 4DTE, 0DTE's. Let's take a look at some intra-day 0DTE levels of focus /ES: We start the day sitting smack dap on the PoC for a 2hr. chart. Even with futures up this morning it's hard to tell what direction we move today. That PoC is a magnet. 5886 and 5900 are the first two key resistance levels. 5859 and 5835 are key support. Below 5835 there is some substantial downside potential. /NQ; Two keys for me today. 20708 is resistance. 20531 support. Anything between is just chop. BTC: Bitcoin is back up to the high point it hit last week before the big reversal. 70,887 is current resistance wit 67,092 support. My lean or bias today is more neutral. Bulls are trying but reistance levels are strong and have been tested several times. We continue to look for a break with a directional move. Let's have a great day! Our Nat gas trade looks to yield some good results today with the calls expiring.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |