|

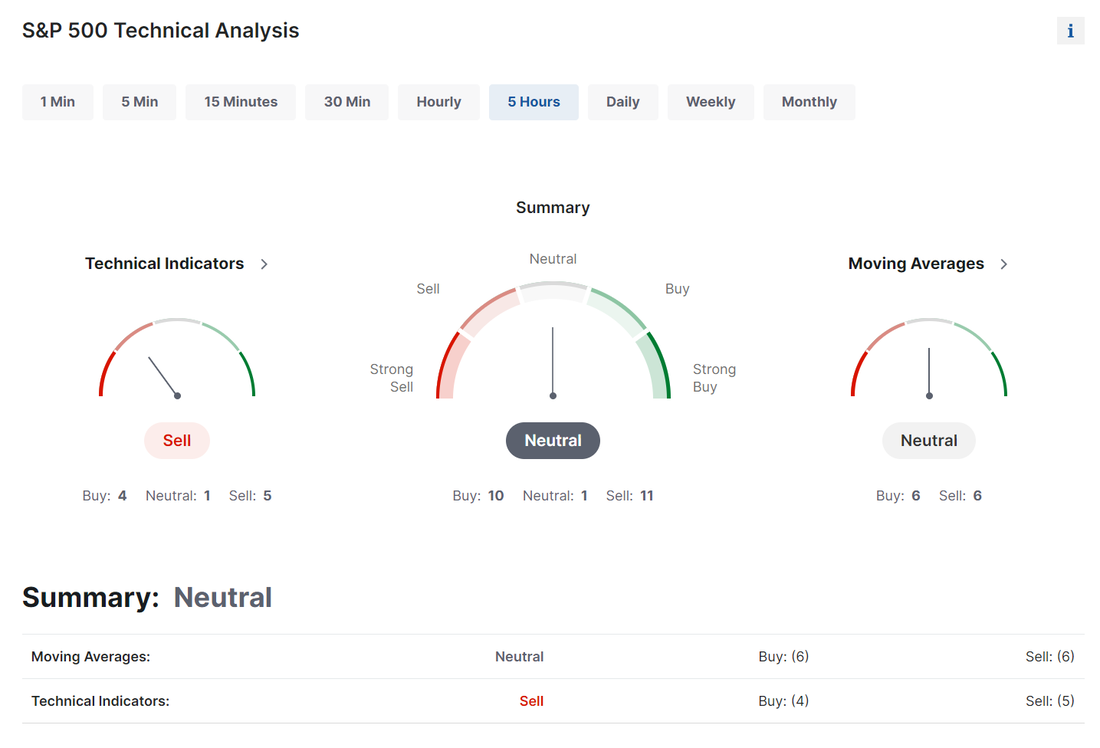

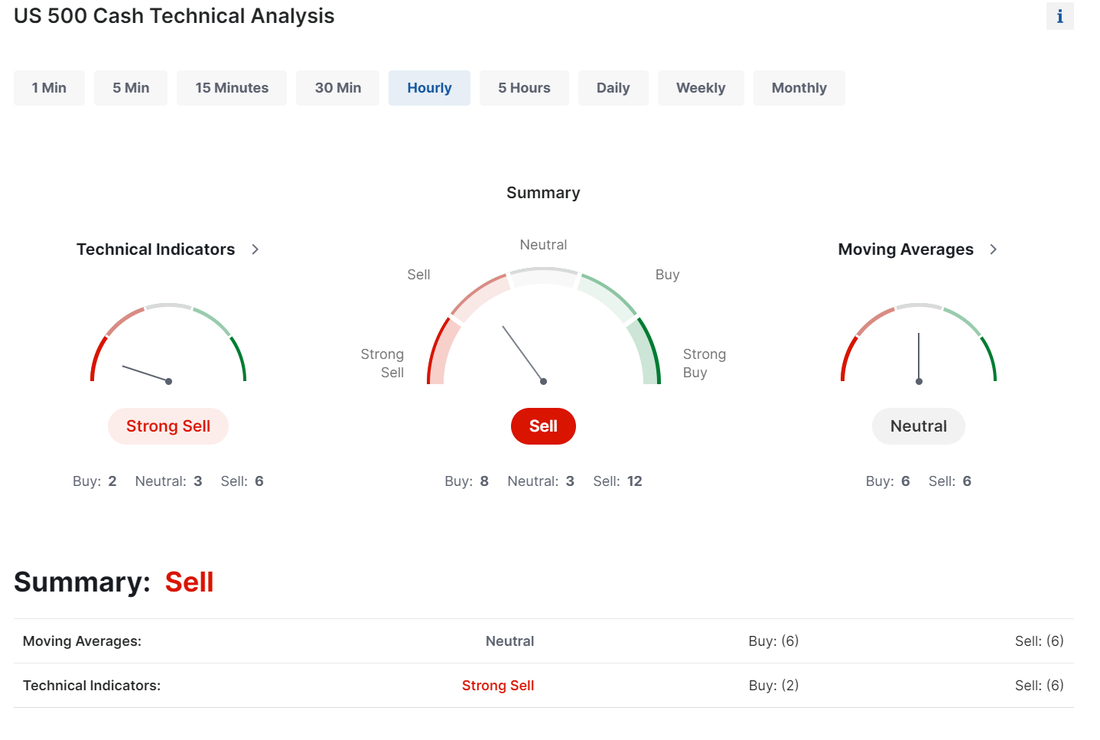

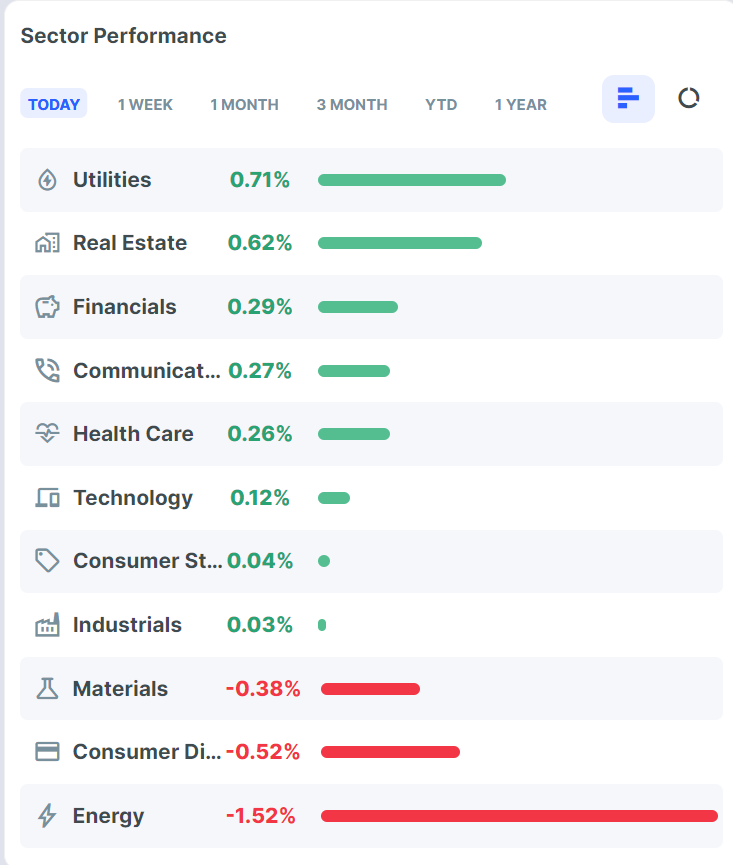

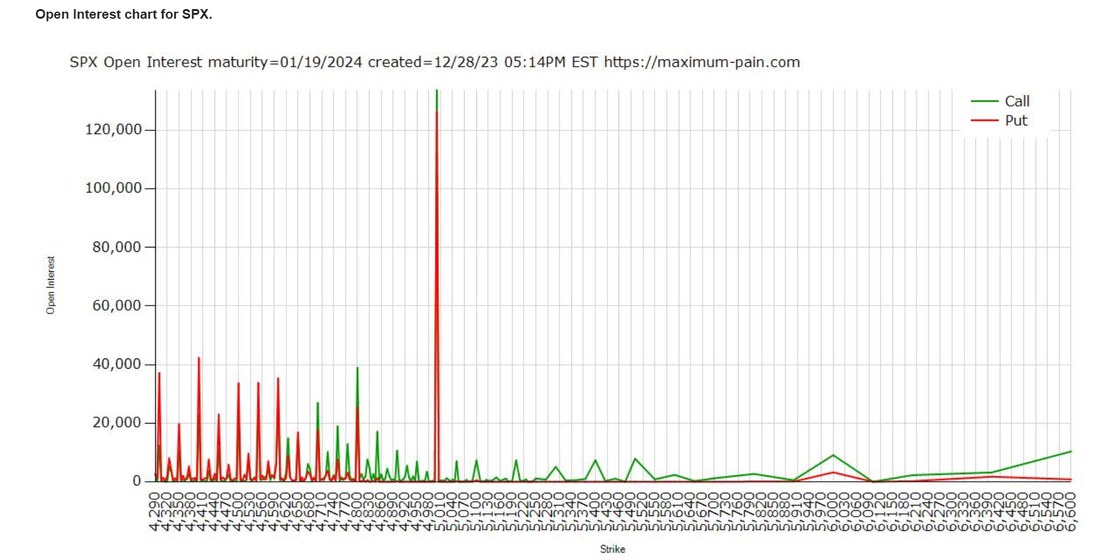

It feels like ground hog again, once again. Same old story. The market is bullish. It seems to be running out of gas. Bears try (almost daily now) to turn the tide with little success. Friday is going to be a light vol day with the three day holiday coming up. Algos that would normally be absorbed by normal order flow can and do create erradic moves. Trade small and pick you best setups for tomorrow or, take an early weekend. We've had a stellar week with yesterday adding $7,000 to my net liq with our NDX 0DTE hitting for another full profit and our long suffering RUT and Bond trades contributed to our gains. As you can see, the normal 5 hr. technicals we pull from every day are still quite nicely flashing bullish but... Taking a look at the hourly shows the bears are trying at the close to change the directional bias. Heat map was not impressive save for the Utilities. That can often be the canary in the coal mine. Tech strength usually leads us up and strong rotation into Utilities can be an indication that "risk on" money is rotating to "safe haven" It's also interesting to see where all the open interest lies. You can see that there is a lot of call selling above us and lots of put buying (cheap insurance) below us. As I stated above; The trend is clear...its up but, the technicals are overstretched to the upside. It wouldn't take much to pull 3% right out of this market Intra day levels for me: 4833/ 4836/ 4841/ 4850 (key level) to the upside. 4826/ 4822/ 4817/ 4811 to the downside.

See you all in the trading room tomorrow. I'm flying out of Paris early through London and then on to Scotland so it will be a long day for me but rest assured, we'll get our trading in!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |