|

Welcome to Thursday traders! I hope your day went well yesterday at "work". Our work went well...yet again. We've been on an absolute rip lately and it's come at a good time for me. Apparently my bottom row of teeth need $10,000 of repair and work (bad genetics the Dentist said) and one of the roofs on the house where a hot tub sits needs $15,000 or repairs. Ugh! It's been nice to be able to pull out $1,500 a day over the last two weeks to help pay for it all and still keep the account growing. What a blessing trading has been in my life. Heres our results from yesterday. Markets still look a little bearish here. Nothing crazy bearish here. Just having a hard time making new ATH's. December S&P 500 E-Mini futures (ESZ24) are down -0.09%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.21% this morning as investors awaited a new round of U.S. economic data and remarks from a Federal Reserve official. Crude oil extended gains on Thursday as investors anticipated Israel’s response to Iran’s missile attack, with U.S. President Joe Biden urging Israel to refrain from targeting Iran’s nuclear facilities. Israel’s fighter jets struck Beirut overnight following the death of eight of its soldiers in southern Lebanon during clashes with Hezbollah. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Caesars Entertainment (CZR) climbed over +5% and was the top percentage gainer on the S&P 500 after announcing a $500 million stock buyback program. Also, chip stocks gained ground, with KLA Corp. (KLAC) advancing more than +3% and Lam Research (LRCX) rising over +2%. In addition, Salesforce (CRM) rose more than +3% and was the top percentage gainer on the Dow after Northland Securities upgraded the stock to Outperform from Market Perform with a price target of $400. On the bearish side, Nike (NKE) slumped over -6% and was the top percentage loser on the Dow after the world’s largest sportswear company reported weaker-than-expected Q1 revenue and withdrew its full-year guidance. Also, Tesla (TSLA) slid more than -3% after reporting weaker-than-expected Q3 deliveries. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls increased by 143K in September, up from 103K in August (revised from 99K) and exceeding the consensus estimate of 124K. “[Yesterday’s] ADP employment number surprised to the upside, suggesting the labor market is bending but not breaking,” said Chris Larkin at E*Trade from Morgan Stanley. “Friday’s monthly jobs report will have the final word on the current jobs picture, and more than likely, on near-term market sentiment.” Richmond Fed President Tom Barkin said on Wednesday that there is progress on inflation and signs that pricing power is diminishing in the economy, although he mentioned it is too premature for the central bank to declare victory. “It remains difficult to say that the inflation battle has yet been won,” Barkin said. “There is still work to do on inflation.” Meanwhile, U.S. rate futures have priced in a 65.9% probability of a 25 basis point rate cut and a 34.1% chance of a 50 basis point rate cut at the November FOMC meeting. Today, investors will focus on U.S. Initial Jobless Claims data. Economists estimate this figure to arrive at 222K, compared to last week’s number of 218K. The U.S. ISM Non-Manufacturing PMI and the S&P Global Services PMI will also be closely watched today. Economists forecast the September ISM Non-Manufacturing PMI to arrive at 51.7 and the September S&P Global Services PMI to be 55.4, compared to the previous values of 51.5 and 55.7, respectively. U.S. Factory Orders data will be reported today as well. Economists foresee this figure to stand at +0.1% m/m in August, compared to the previous figure of +5.0% m/m. In addition, market participants will be anticipating a speech from Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.812%, up +0.64%. My bias today is very slightly bullish. Trade docket today: /ES (theta fairy), MSTR, SMCI, /MCL, LEVI?, 0DTE's. Let's take a look at our intra-day levels for 0DTE's. /ES; Two key levels for me today. 5764 is resistance and PoC on the 2 hr. chart. Above that is very bullish for me. 5724 is current support. Below that we have plenty of downside potential. /NQ; I've got two key levels on the Nasdaq as well. 20026 is resistance and PoC while 19831 is not only support but also the 200 period M.A. on the 2hr. chart. This is a key support area. If we break below this I think we get some decent downside potential. BTC; It's a wide range today but I'm looking at 63,400 as resistance and 60,000 as support. Let's make it happen today folks! I need to keep pulling $1,500 a day of profits to fund all my life challenges!

0 Comments

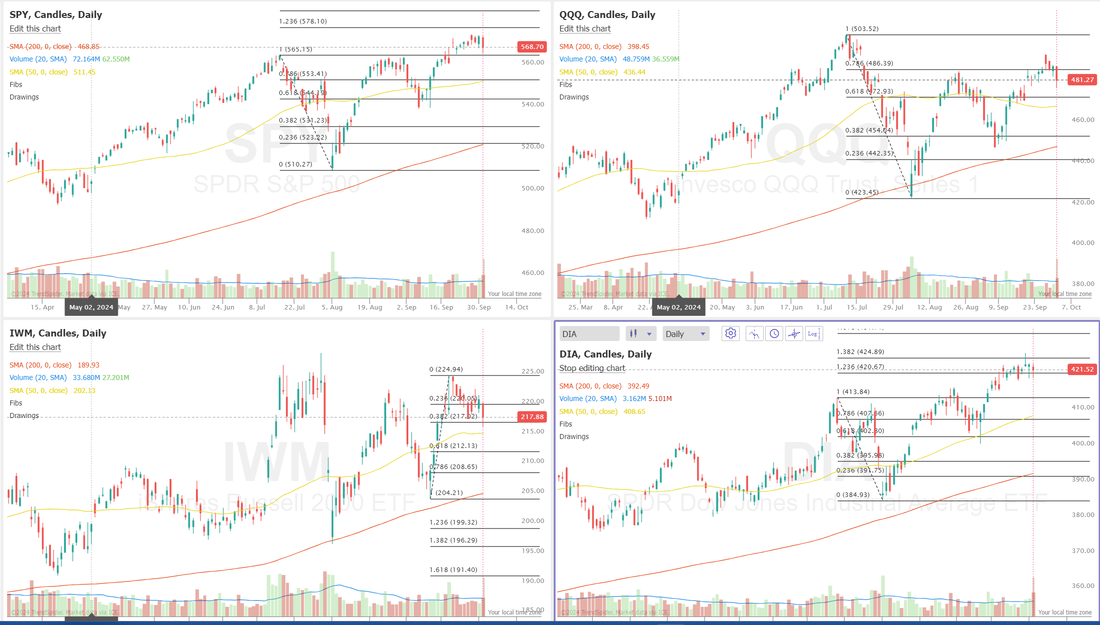

Welcome back taraders. Yesterday was a "traders market". It's easy to go long something in a bull market, make money and feel like your a genius but it's markets like we had yesterday that test the true metal of a trader. Can you be patient enough, nimble enough, and confident enough to commit capital on a day that? I don't like bragging and I don't like braggards. If you want to set yourself up for failure, just bragg about your results. The karma Gods will surely make you look like a fool the next day. That being said, I'm super proud of our day yesterday. It was an absolute home run! More important, it illustrated how important it is to have multiple strategies working at the same time. It was a scalping mania day! We were also very patient on our 0DTE entries. See our results below: Again...braggards ALWAYS, eventually get what's coming to them but gosh darn it if yesterday wasn't amazing for us. Let's take a look at what yesterdays crazyness did to the market structure. We have flipped to a sell signal but will it last? The last time Iran did this the markets shrugged it off. Or...it this a definative change of direction? Those new ATH's will have to wait, for now. You'll notice though, very little damage was done to the SPY or DIA. December S&P 500 E-Mini futures (ESZ24) are trending down -0.37% this morning as flaring tensions in the Middle East dampened sentiment, while investors braced for the ADP National Employment numbers due later in the day. Nike (NKE) slumped over -5% in pre-market trading after the world’s largest sportswear company reported weaker-than-expected Q1 revenue and withdrew its full-year sales guidance. Market participants continue to keep a close watch on developments in the Middle East. Iran launched approximately 200 ballistic missiles at Israel on Tuesday in response to Israeli strikes on Hezbollah in Lebanon, marking a sharp but brief escalation between Middle Eastern adversaries, which risked sparking a new wave of attacks as Prime Minister Benjamin Netanyahu pledged to retaliate. Tehran warned that any retaliation would result in “vast destruction,” heightening fears of a broader regional conflict. In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Humana (HUM) plunged over -11% and was the top percentage loser on the S&P 500 after releasing its Medicare Advantage plan for 2025. Also, chip stocks lost ground, with Arm (ARM) slumping more than -4% to lead losers in the Nasdaq 100 and Intel (INTC) sliding over -3% to lead losers in the Dow. In addition, Apple (AAPL) fell nearly -3% after Barclays said that the availability of the iPhone 16 suggests “softer demand” compared to last year. On the bullish side, Paychex (PAYX) climbed about +5% and was the top percentage gainer on the S&P 500 after the payroll processing firm reported better-than-expected Q1 results. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings unexpectedly climbed to a 3-month high of 8.040M in August, stronger than expectations of 7.640M. Also, the U.S. September ISM manufacturing index remained steady from August at 47.2, below the consensus of 47.6 and marking the sixth consecutive month of contraction. In addition, the U.S. S&P Global manufacturing PMI was revised upward to 47.3 in September, though it still declined from 47.9 in August. Finally, U.S. August construction spending unexpectedly fell -0.1% m/m, weaker than expectations of +0.2% m/m. Meanwhile, U.S. rate futures have priced in a 63.2% chance of a 25 basis point rate cut and a 36.8% chance of a 50 basis point rate cut at the next FOMC meeting in November. Today, all eyes are focused on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the September ADP Nonfarm Employment Change will stand at 124K, compared to the previous number of 99K. U.S. Crude Oil Inventories data will also be released today. Economists estimate this figure to be -1.500M, compared to last week’s value of -4.471M. In addition, market participants will be anticipating speeches from Fed Governor Michelle Bowman and Richmond Fed President Thomas Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.767%, up +0.59%. My bias or lean today is...bullish! We've seen this movie before. I think we shake off yesterday and push higher today. I've also put my money where my mouth is in our scalping room. We have two bullish setups to key off today. Trade docket for today: STZ, LEVI, /MCL, /MNQ,QQQ scalping, /ZC, LW, NKE, 0DTE's Let's take a look at the intra-day levels. /ES; I've got a couple key levels I'm watching today. 5767 is the first big resistance. 5788 is the important one. That's not only the PoC, it's also the 50 period M.A. on the 2hr. chart. Above that we are back to full on bullishness. 5732 is the one key support I'm watching today. Below that we have some big potential downside. /NQ: The Nasdaq got beat up the most yesterday. It's got the most work to do. 20019 is the first resistance with 20130 next. 19892 is first support then comes 19820. If we lose 19820 it could be "look out below" I would lay on the shorts pretty heavily there. BTC: Bitcoin got beat up yesterday along with equities. It's sitting right now on its 200 period M.A. on the 2hr. chart. Thats the only level I'm watching today. If it holds through the morning we'll play it long. If it can't hold it, we go short. One final comment on having lot of "tools in the tool chest". Sometimes there are 5-7 day stretches that our scalping program doesn't find setups or worse, does find setups that just don't produce. You may think it's not a strategy you want to continue with. Then, you get a day like yesterday. It proved invaluable. The same can be said about the Theta fairy. Sometimes we go a month without getting a set up. Sometimes we get yesterday. I'm starting off the day with $300 profit already in my pocket. It's an amazing trade setup IF...you are disciplined enough to use the built in stop loss and know when NOT to trade it. Long live the Theta fairy. I'll see you all in the live trading room shortly. Let's do it again!

Welcome to a new month traders! We finished off the month strong! We've been on a nice run lately. Check out our results below. We've had a stellar few weeks. It's a nice feeling. It wasn't that long ago that we had three losing days in a row. That's a whole different feeling. Emotions are such a big part of trading. Bullish bias is still in place. Markets are still hanging around their ATH's. 83% of S&P 500 stocks are above their 50-day average 73.6% of S&P 500 Stocks are within 10% of their 52-week Highs... This is the highest level since July 2021 December S&P 500 E-Mini futures (ESZ24) are down -0.13%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.06% this morning as investors awaited the latest reading on U.S. job openings, comments from Federal Reserve officials, and an earnings report from the world’s largest shoemaker Nike. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Apple (AAPL) rose over +2% and was the top percentage gainer on the Dow after JPMorgan Chase noted that lead times for the latest iPhone indicate that initially slower demand for Pro models was “starting to correct.” Also, CVS Health (CVS) gained more than +2% after the Wall Street Journal reported that hedge fund Glenview Capital Management is scheduled to meet with CVS Health’s top executives to suggest operational improvements. In addition, FedEx (FDX) advanced over +2%, and United Parcel Service (UPS) rose more than +1% after Stifel stated that the companies are the “most obvious beneficiaries” of extended disruption due to an impending port workers’ strike. On the bearish side, Boeing (BA) fell over -2% and was the top percentage loser on the Dow after the machinists union announced that negotiations to resolve the strike with the company had collapsed, with no further talks scheduled. Also, chip stocks came under pressure as Treasury yields climbed, with Micron Technology (MU) slumping more than -3% and On Semiconductor (ON) falling over -2%. Economic data released on Monday showed that the Chicago PMI unexpectedly edged up to 46.6 in September, stronger than expectations of 46.1. Fed Chair Jerome Powell said Monday that the central bank will reduce interest rates “over time” while reiterating that the overall economy continues to be on solid footing. Powell also reaffirmed his belief that inflation will keep moving toward the central bank’s 2% target, adding that current economic conditions “set the table” for a continued easing of price pressures. At the same time, he noted that the U.S. did not yet have the data necessary to make a decision regarding the November meeting. Also, Atlanta Fed President Raphael Bostic stated he would be open to another half-percentage-point interest rate cut at the November meeting if forthcoming data indicate job growth is slowing more rapidly than anticipated. “A surprise to the weak side .... would pull me much further into really needing another dramatic move,” Bostic said in an interview with Reuters. Meanwhile, U.S. rate futures have priced in a 64.7% chance of a 25 basis point rate cut and a 35.3% chance of a 50 basis point rate cut at the conclusion of the Fed’s November meeting. On the earnings front, notable companies like Nike (NKE), Paychex (PAYX), and McCormick & Co. (MKC) are set to report their quarterly figures today. On the economic data front, all eyes are focused on the U.S. JOLTs Job Openings data, which is set to be released in a couple of hours. Economists, on average, forecast that the August JOLTs Job Openings will stand at 7.640M, compared to July’s figure of 7.673M. Also, investors will focus on the U.S. ISM Manufacturing PMI, which stood at 47.2 in August. Economists foresee the September figure to be 47.6. The U.S. S&P Global Manufacturing PMI will come in today. Economists expect September’s figure to be 47.0, compared to 47.9 in August. U.S. Construction Spending data will be reported today as well. Economists foresee this figure to stand at +0.2% m/m in August, compared to the previous number of -0.3% m/m. In addition, market participants will be looking toward speeches from Atlanta Fed President Raphael Bostic, Fed Governor Lisa Cook, Boston Fed President Susan Collins, and Richmond Fed President Thomas Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.750%, down -1.57%. Trade docket for today: /ES (theta fairy), /MNQ,QQQ scalps, /NG, /ZC, FDX, LW/NWL, MRK/MRNA, SPY, 2 new pairs trades, 0DTE's NKE, LW. Let's look at intra-day 0DTE levels: /ES; 5822 is the first resistance with 5830 being the big one. It's our ATH. 5797 is first support and 5788 the next which is also the PoC on the 2hr. chart. /NQ: 20331 is the first resistance and 20438 is the next. Support is 20213 which is PoC on 2hr. chart with 20159 as the next. Bitcoin: BTC has had a nice run but looks to be rolling over a bit. 65117 is current resistance with 63045 is support. Let's have a great day folks! See you in the trading room.

|

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |