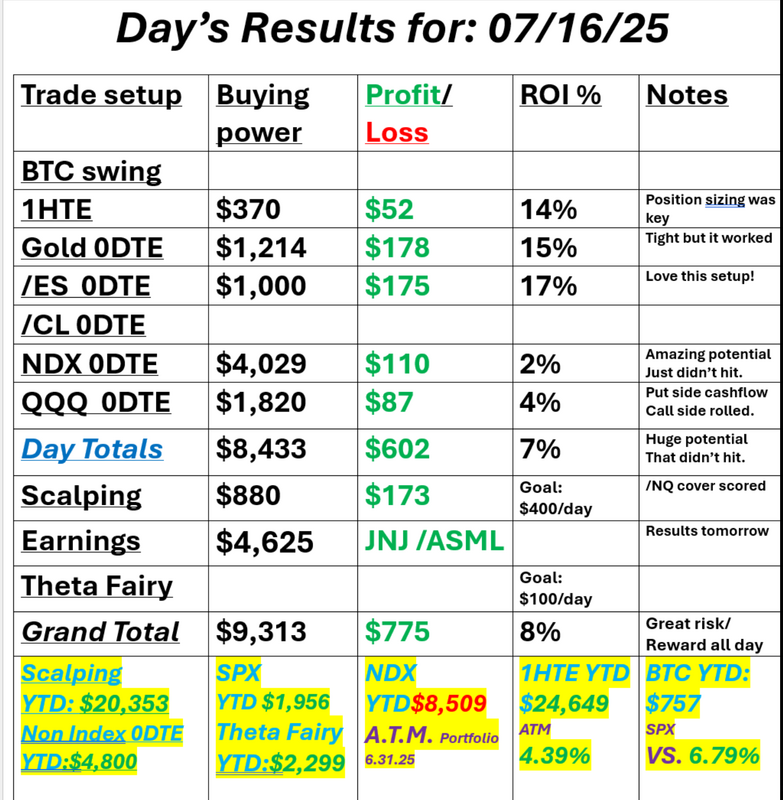

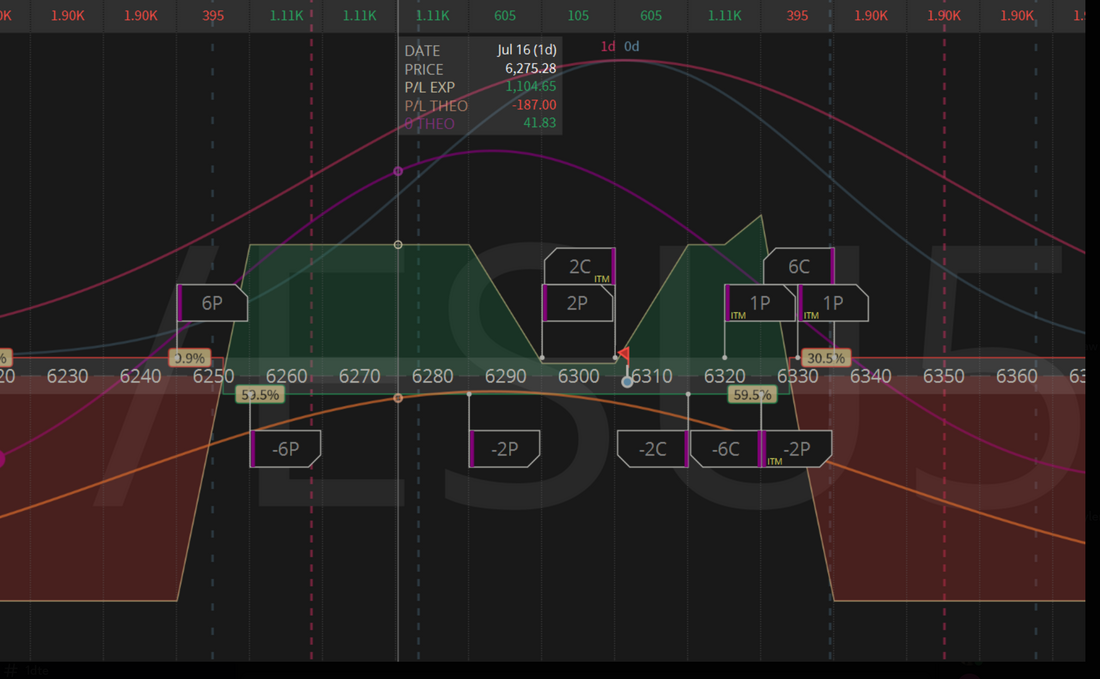

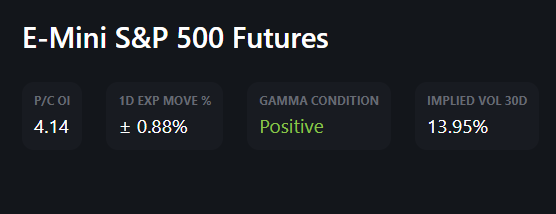

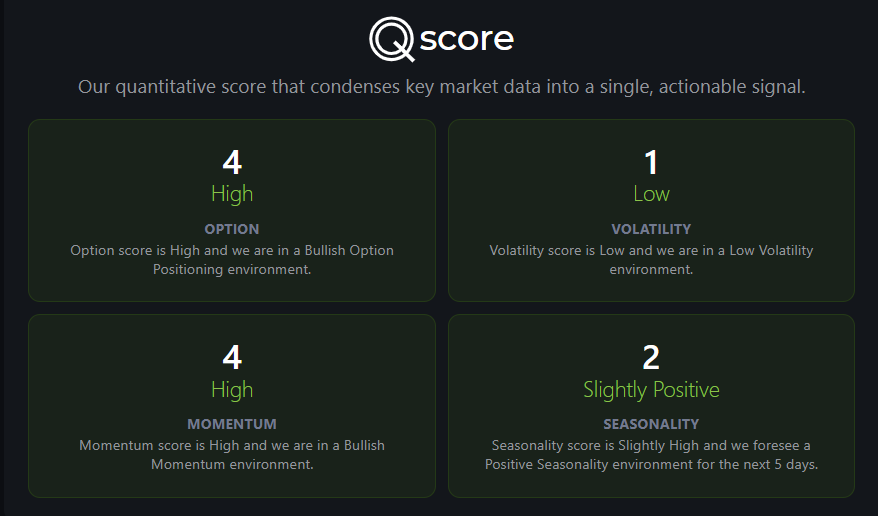

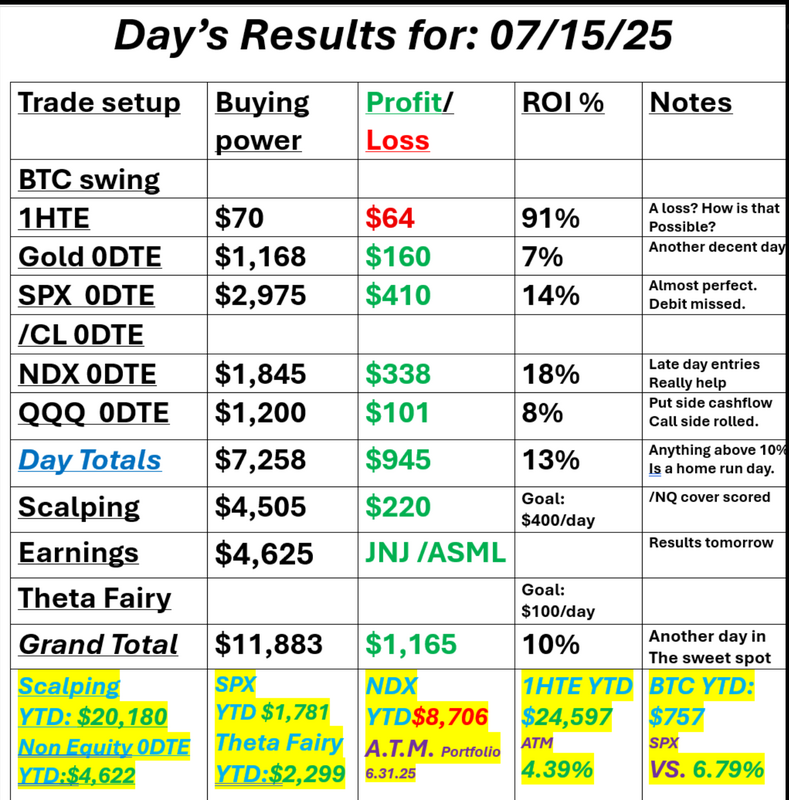

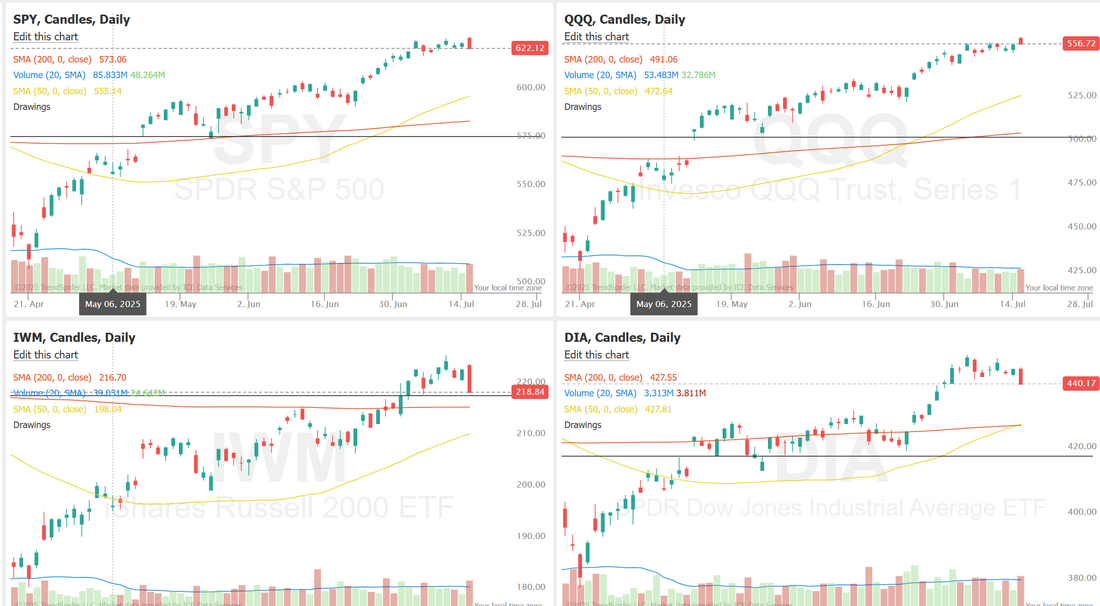

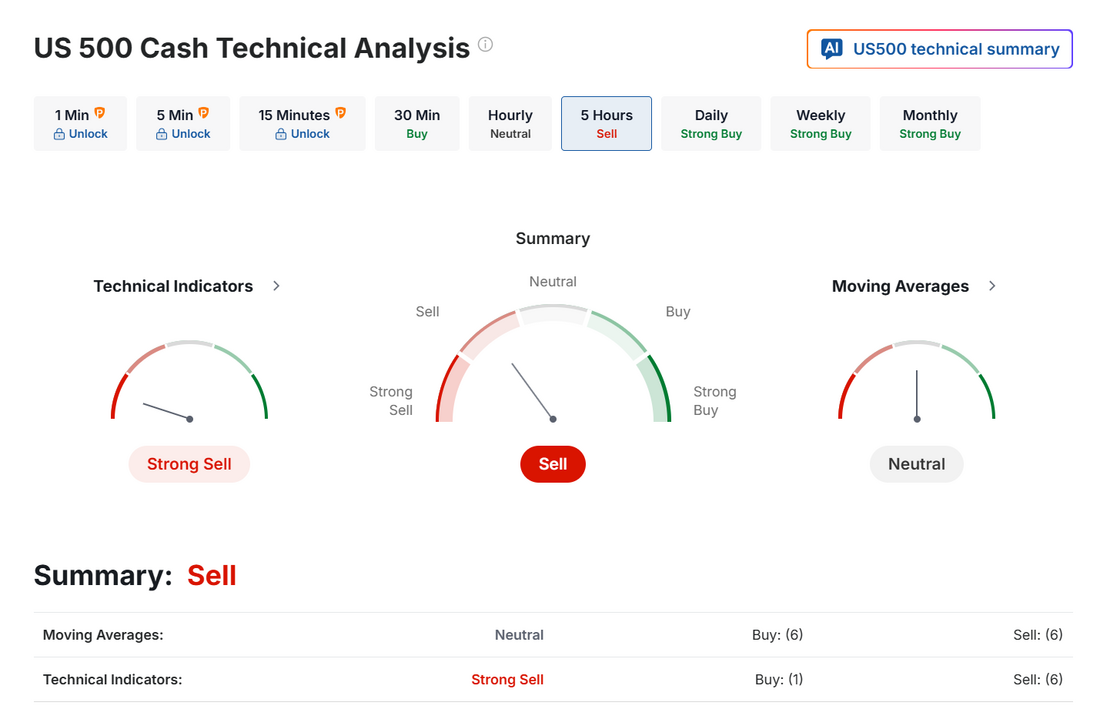

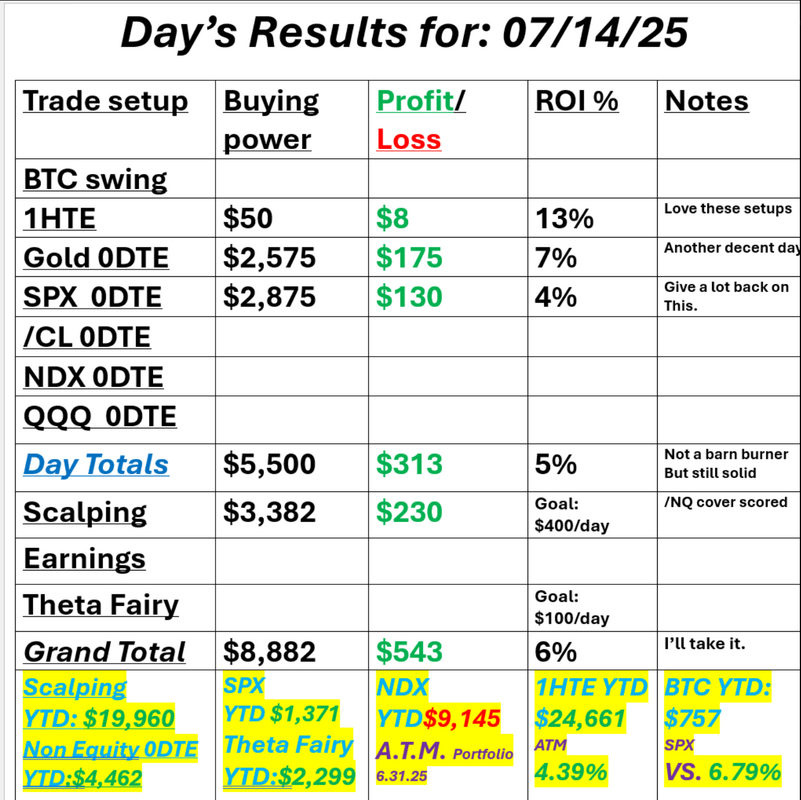

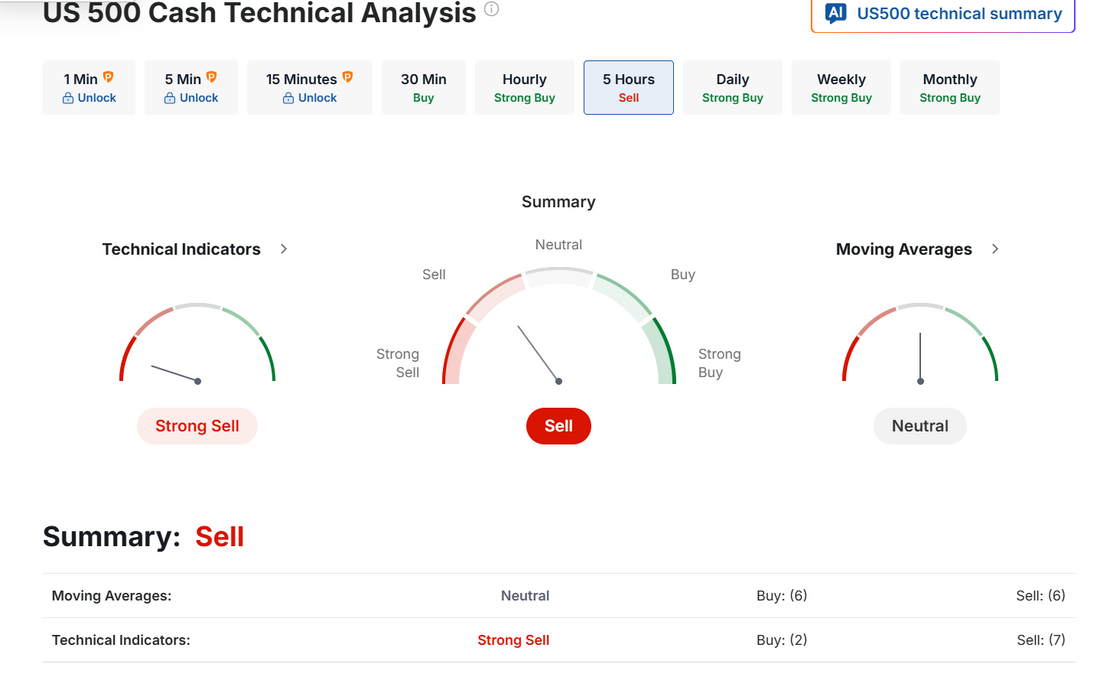

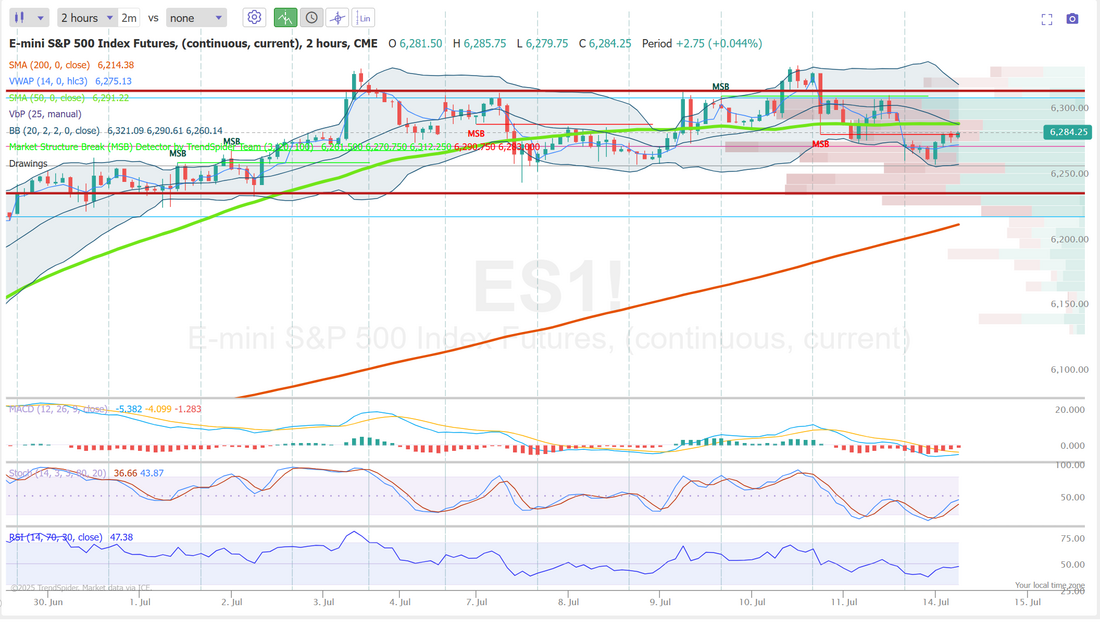

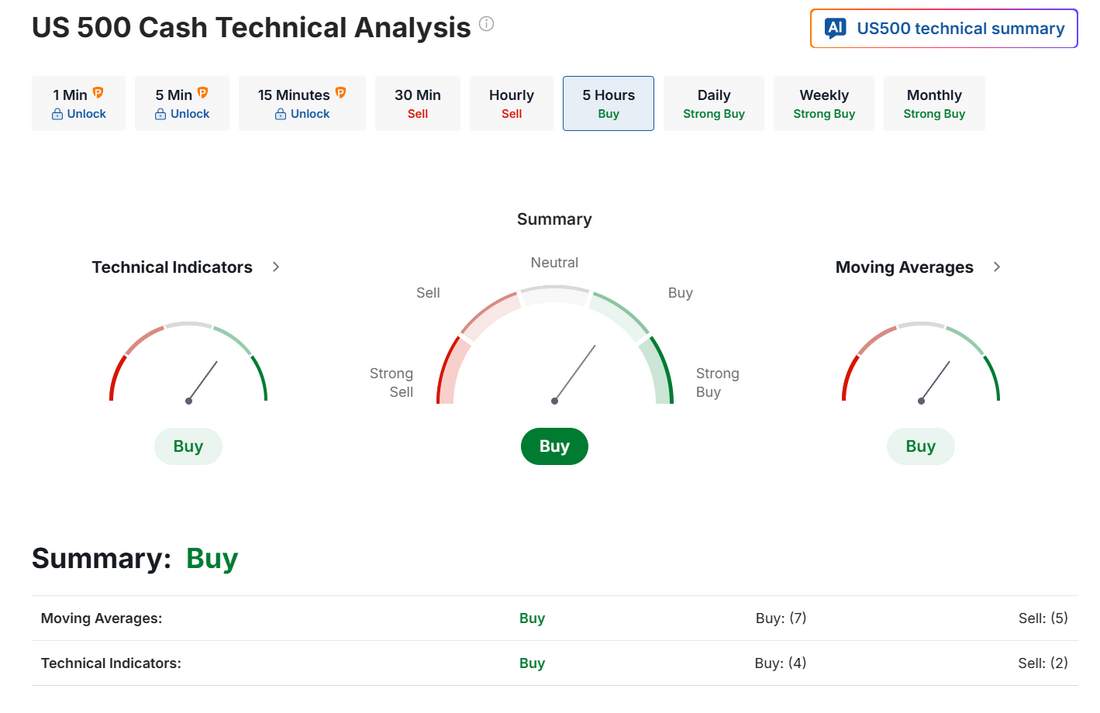

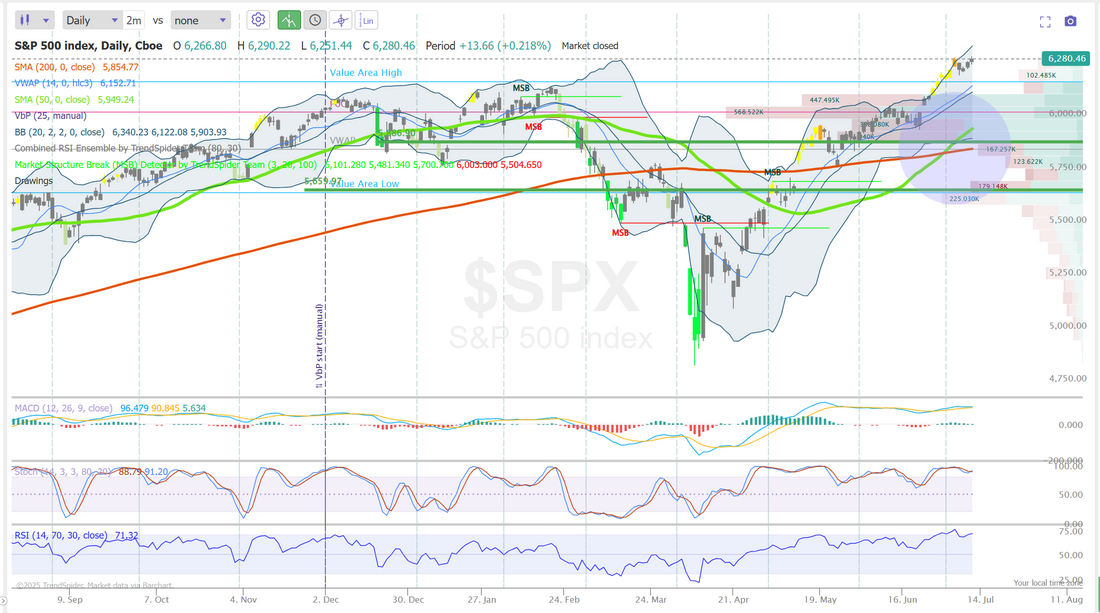

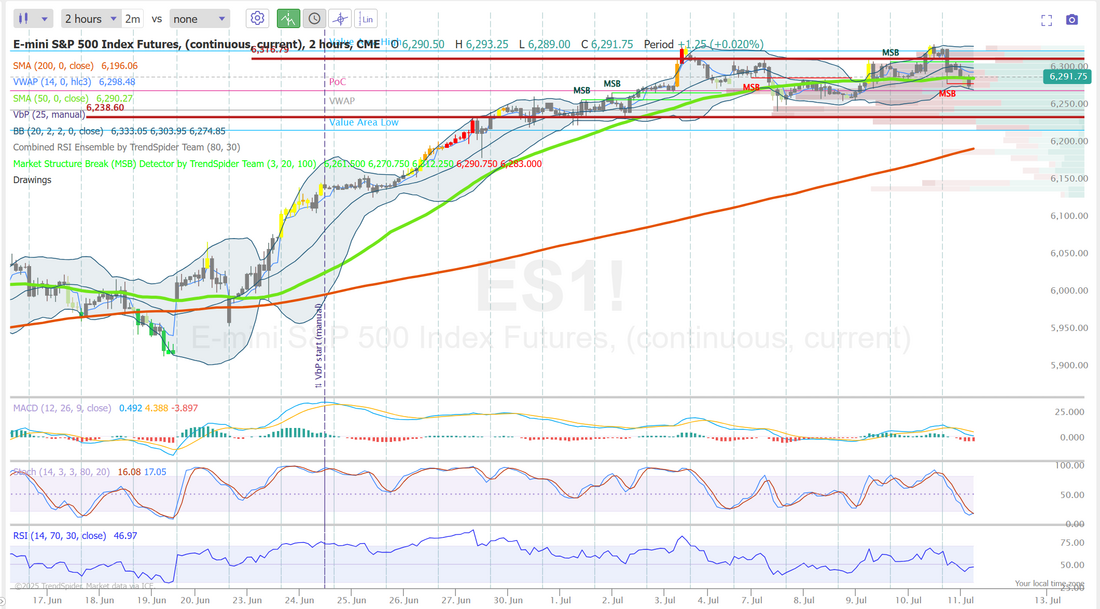

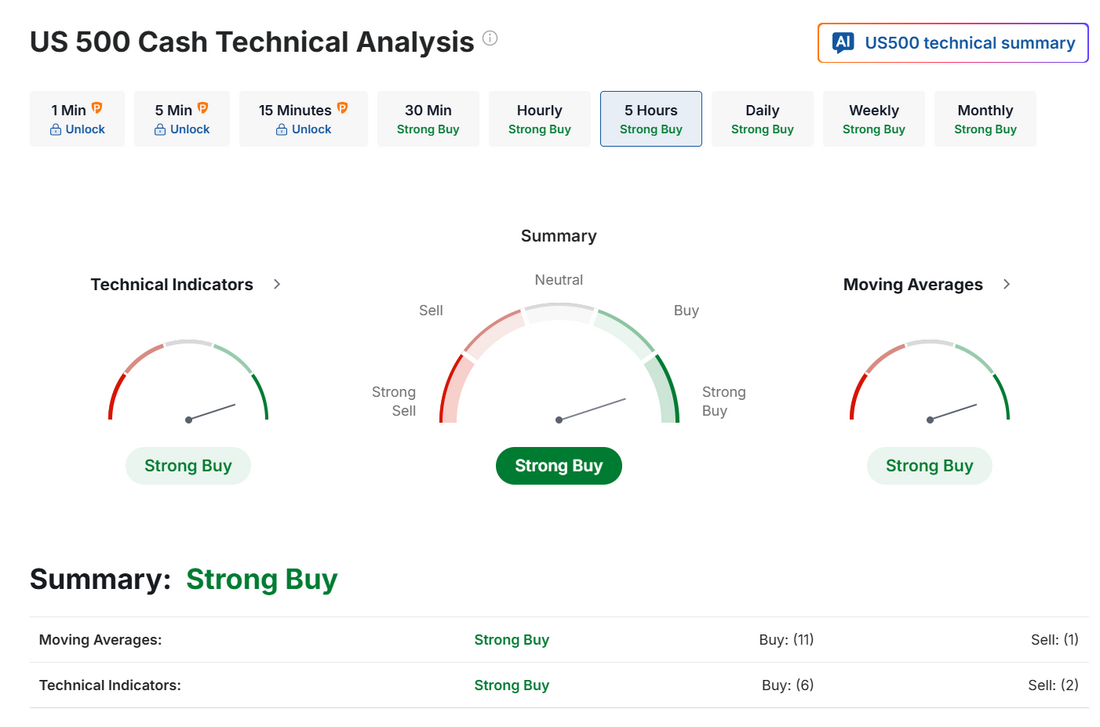

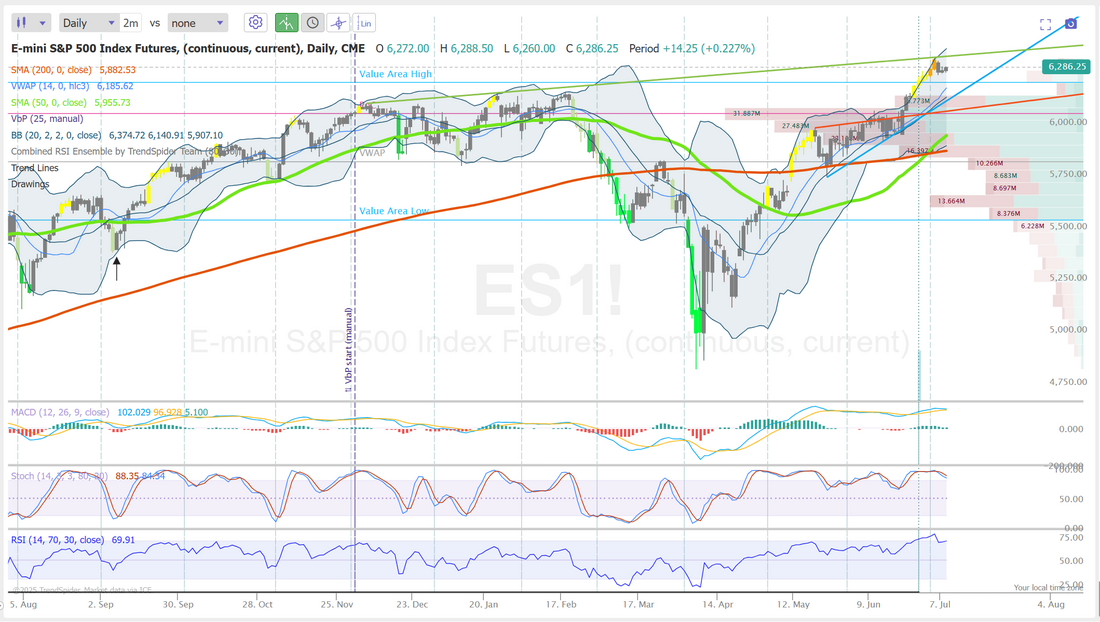

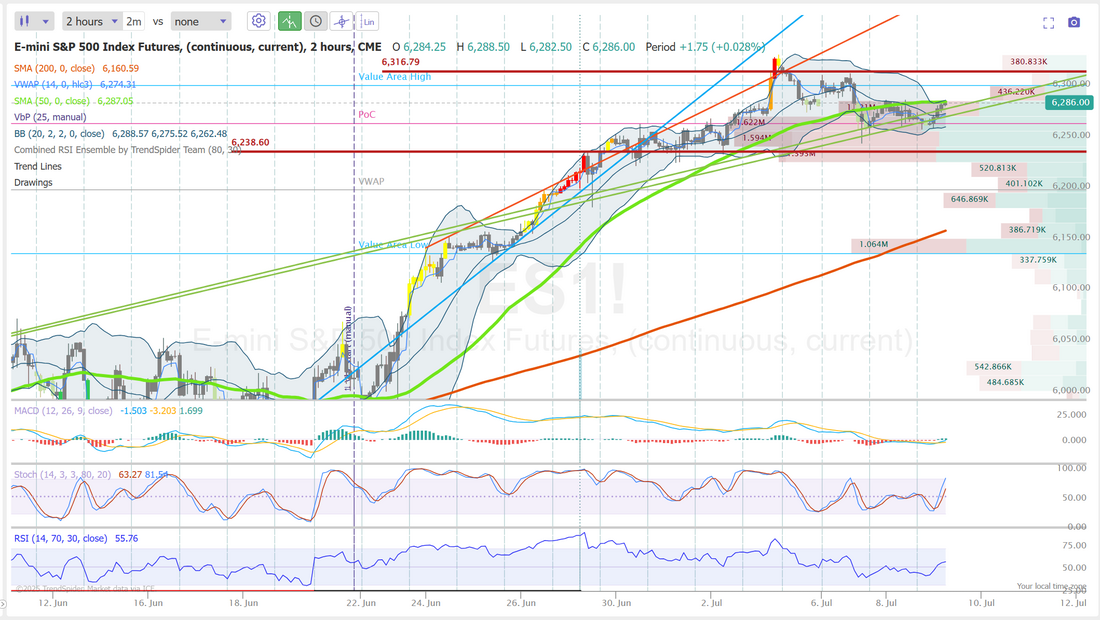

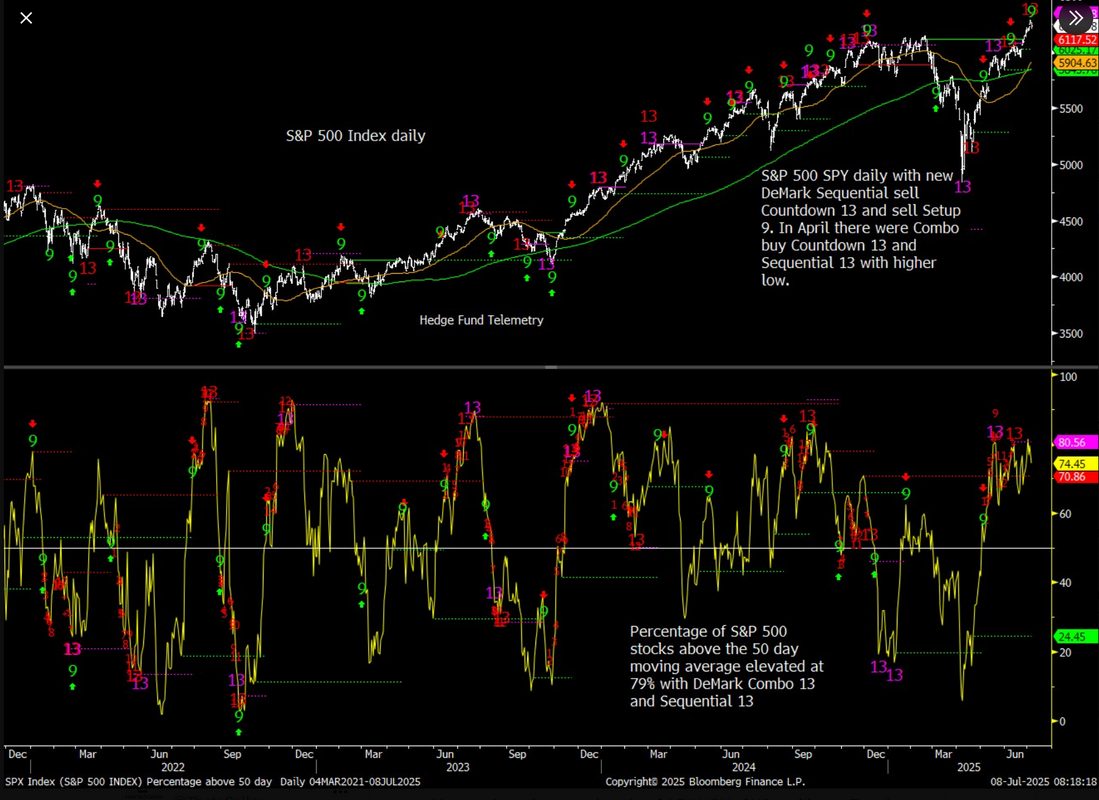

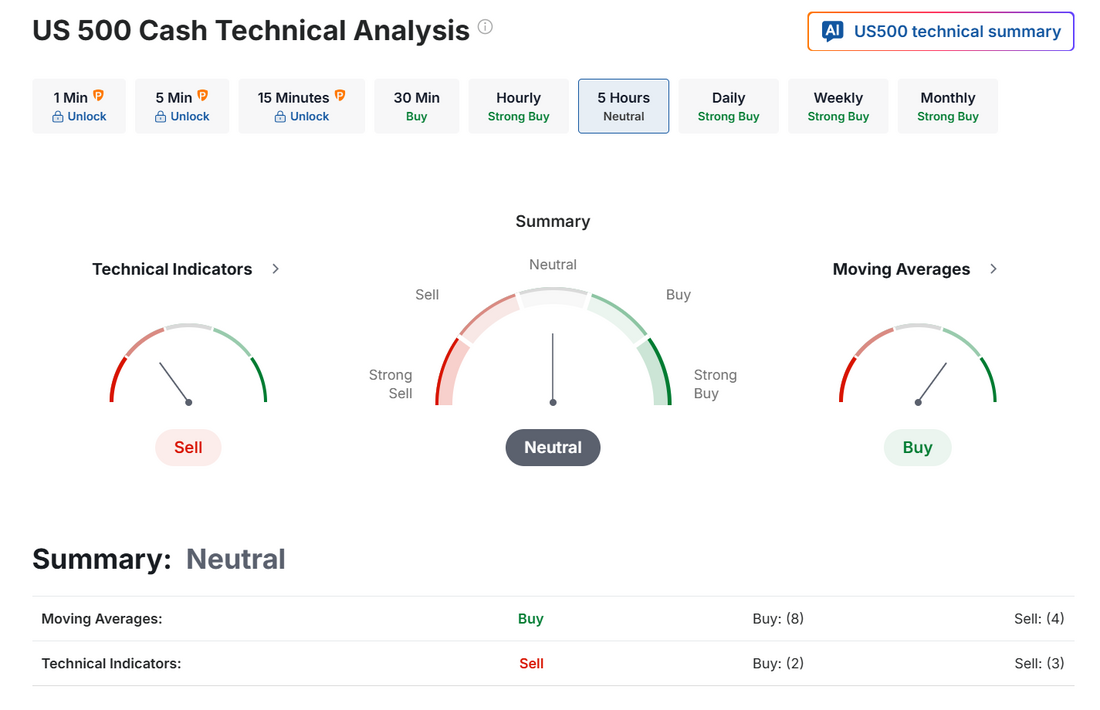

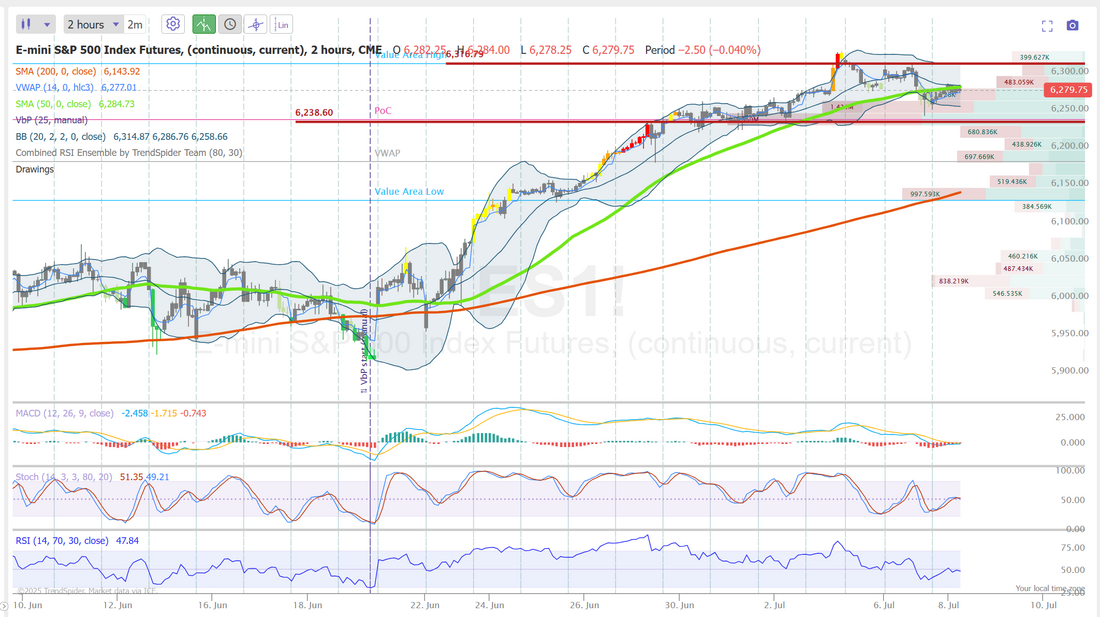

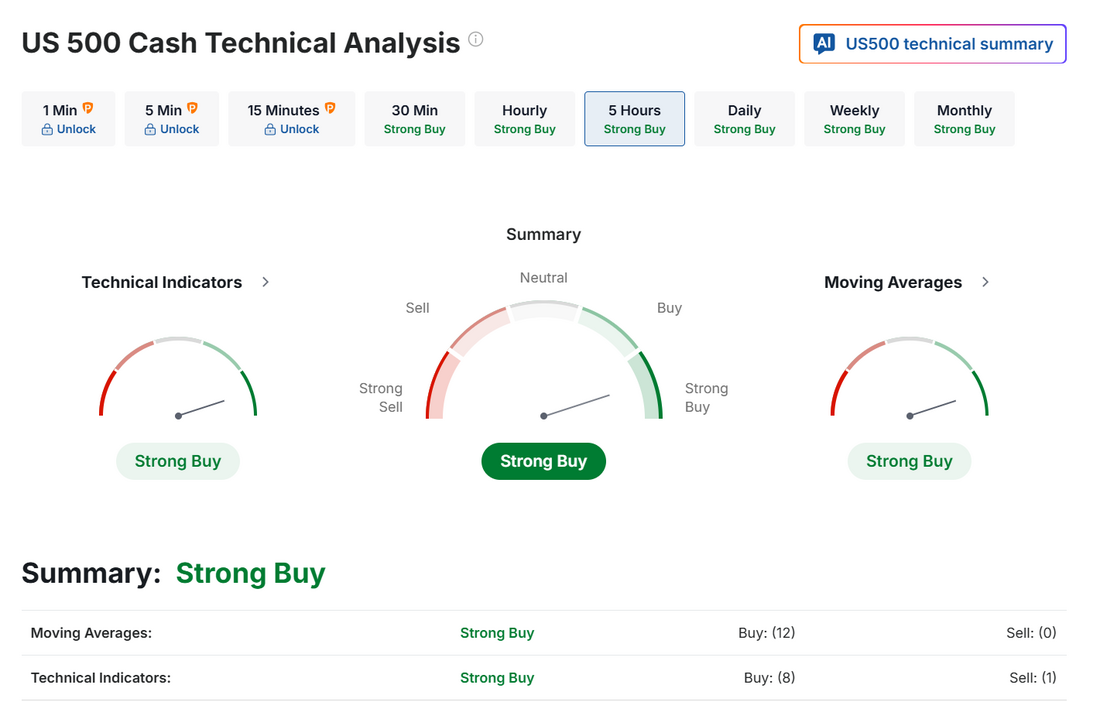

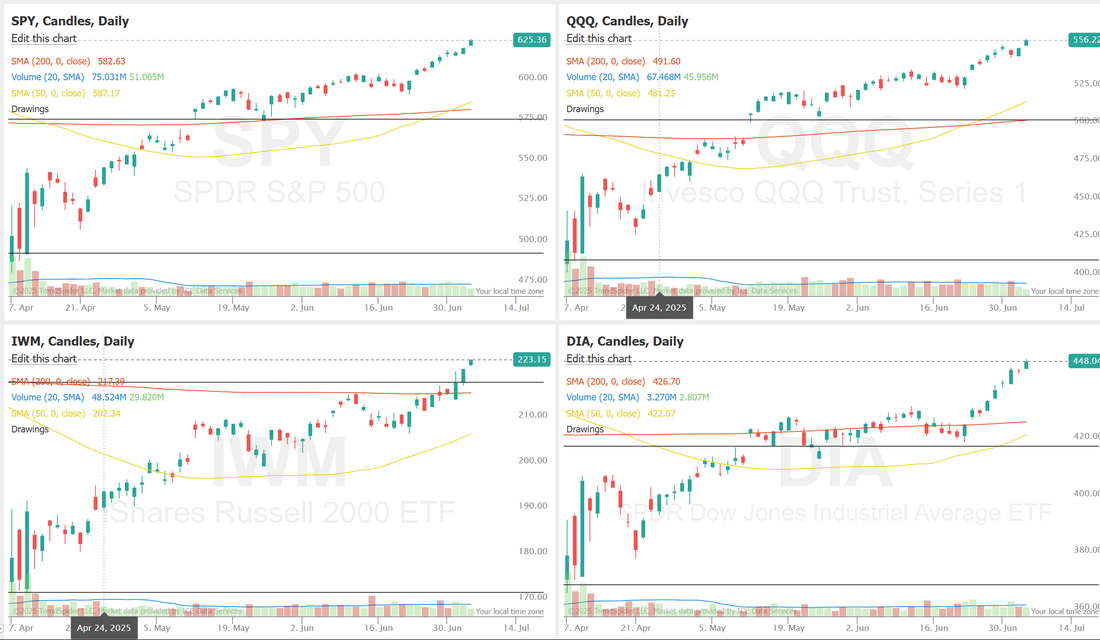

Every dollar countsWe have a daily income goal of $1,000 dollars profit. We also follow the idea of Gestalt which means you use a diversified approach with multiple setups, knowing the likelihood that some will not work. As our day get started we see trades come in with $24 profit, $60 profit, etc. It seems meaningless but at the end of the day, it all adds up. That has been our case for the last few days. No real big home runs. Just plucking away and at the end of the day it adds up. Here's a look at our results from yesterday. Our /ES trade was an easy winner for us yesterday. We have a similar setup going into today. See below: I'm pretty proud of this setup...if I do say so. Market's today are no different then they've been for weeks. Take a look at the /ES. This is a 2hr. chart going back to the start of the month. We've been stuck in a consolidation zone between 6342 and 6251. At some point we'll break out but who knows when? We are coming into the morning session with positive gamma. The Quant score keeps us in bullish mode It seems more and more likely we are primed for a retrace. Key levels for /ES. eptember S&P 500 E-Mini futures (ESU25) are up +0.05%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.13% this morning, pointing to a muted open on Wall Street after yesterday’s volatile session, with attention now turning to U.S. retail sales data and an earnings report from streaming giant Netflix. U.S. President Donald Trump said in an interview aired on Real America’s Voice on Wednesday that the U.S. is very close to finalizing a trade deal with India, while a deal with Europe is also possible, though it is too early to determine whether an agreement can be reached with Canada. Earlier on Wednesday, President Trump stated that he would send letters to over 150 countries informing them of tariff rates, with the imposed levies potentially set at 10% or 15%. “We’ll have well over 150 countries that we’re just going to send a notice of payment out, and the notice of payment is going to say what the tariff” rate will be, Trump told reporters. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the green. Global Payments (GPN) climbed over +6% and was the top percentage gainer on the S&P 500 after the Financial Times reported that activist hedge fund Elliott Management had built a “sizeable” stake in the payments processing company. Also, Johnson & Johnson (JNJ) advanced more than +6% and was the top percentage gainer on the Dow after the drug and medical device maker posted better-than-expected Q2 results and raised its full-year guidance. In addition, Arm Holdings (ARM) rose over +4% and was the top percentage gainer on the Nasdaq 100 after BNP Paribas Exane upgraded the stock to Outperform from Neutral with a $210 price target. On the bearish side, ASML Holding N.V. (ASML) slid more than -8% and was the top percentage loser on the Nasdaq 100 after the Dutch supplier of chip-making equipment said it could no longer guarantee growth in 2026 due to rising uncertainty stemming from President Trump’s tariffs. Economic data released on Wednesday showed that the U.S. producer price index for final demand came in at unchanged m/m and +2.3% y/y in June, weaker than expectations of +0.2% m/m and +2.5% y/y. Also, the core PPI, which excludes volatile food and energy costs, was unchanged m/m and rose +2.6% y/y in June, weaker than expectations of +0.2% m/m and +2.7% y/y. In addition, U.S. June industrial production rose +0.3% m/m, stronger than expectations of +0.1% m/m, while manufacturing production rose +0.1% m/m, stronger than expectations of no change m/m. “Disinflation remains, but the Fed will be undeterred in keeping rates steady until September. As long as the labor market remains strong and resilient, rates aren’t likely to move meaningfully lower, and that’s a good thing,” said Jamie Cox at Harris Financial Group. New York Fed President John Williams said on Wednesday that he anticipates tariffs will have a bigger impact on inflation in the coming months, making the Fed’s current restrictive stance “entirely appropriate.” Meanwhile, the Fed said Wednesday in its Beige Book survey of regional business contacts that U.S. economic activity “increased slightly” between late May and early July. “That represented an improvement over the previous report, in which half of districts reported at least slight declines in activity,” according to the Beige Book. Still, the report said that “uncertainty remained elevated, contributing to ongoing caution by businesses.” The report also said that all 12 regions of the country saw price increases, with businesses facing “modest to pronounced input cost pressures related to tariffs.” U.S. rate futures have priced in a 97.4% chance of no rate change and a 2.6% chance of a 25 basis point rate cut at the conclusion of the Fed’s July meeting. Second-quarter corporate earnings season is gathering pace, and investors look forward to new reports from prominent companies today, including Netflix (NFLX), GE Aerospace (GE), Abbott Labs (ABT), and PepsiCo (PEP). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +2.8% increase in quarterly earnings for Q2 compared to the previous year, marking the smallest rise in two years. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that Retail Sales will show a +0.1% m/m rise in June following a -0.9% m/m decline in May. Investors will also focus on U.S. Core Retail Sales data, which came in at -0.3% m/m in May. Economists expect the June figure to be +0.3% m/m. The U.S. Philadelphia Fed Manufacturing Index will be reported today. Economists foresee the Philly Fed manufacturing index standing at -1.2 in July, compared to last month’s value of -4.0. U.S. Export and Import Price Indexes will come in today. Economists anticipate the export price index to be unchanged m/m and the import price index to rise +0.3% m/m in June, compared to the previous figures of -0.9% m/m and unchanged m/m, respectively. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 233K, compared to last week’s number of 227K. In addition, market participants will be anticipating speeches from Fed Governors Adriana Kugler, Lisa Cook, and Christopher Waller, along with San Francisco Fed President Mary Daly. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.469%, up +0.34%. My lean or bias today is neutral again. Most of our technicals are still leaning bullish with positive gamma as well but the market is looking tired. Unless we get a catalyst today it may be more of the same. Trade docket today: I'll continue to use the /MNQ for scalping . We already have the bulk of our /ES 0DTE working. /GC 0DTE is already started and may need more work. ASML could be ready for a take profit. JNJ? NFLX earnings. LULU, QQQ 0DTE, SPX 0DTE?, NDX 0DTE. I look forward to seeing you all in the live trading room shortly!

0 Comments

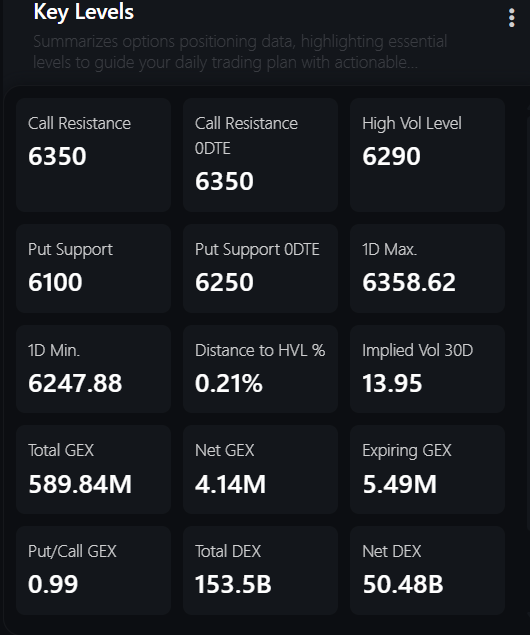

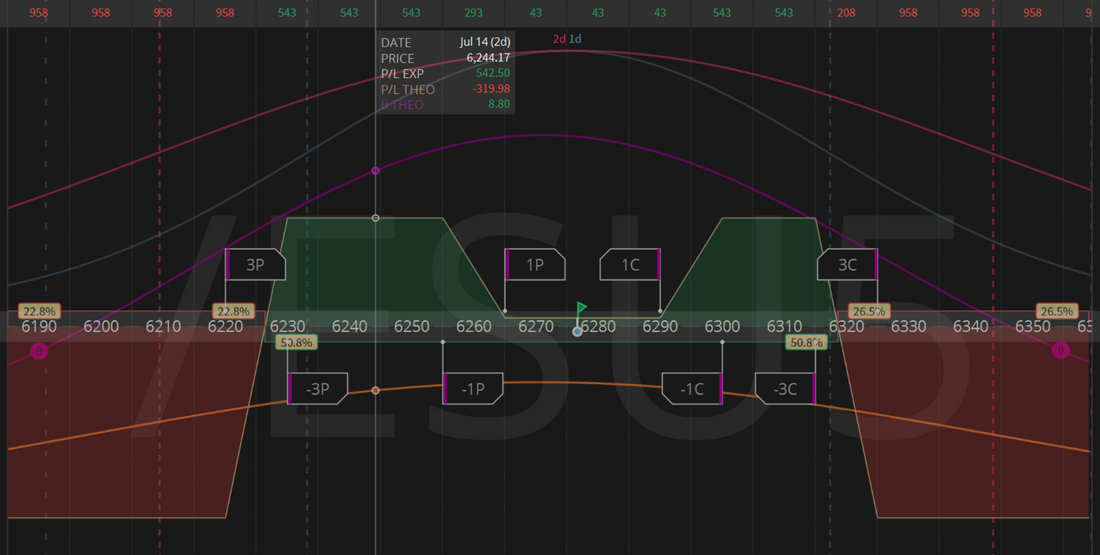

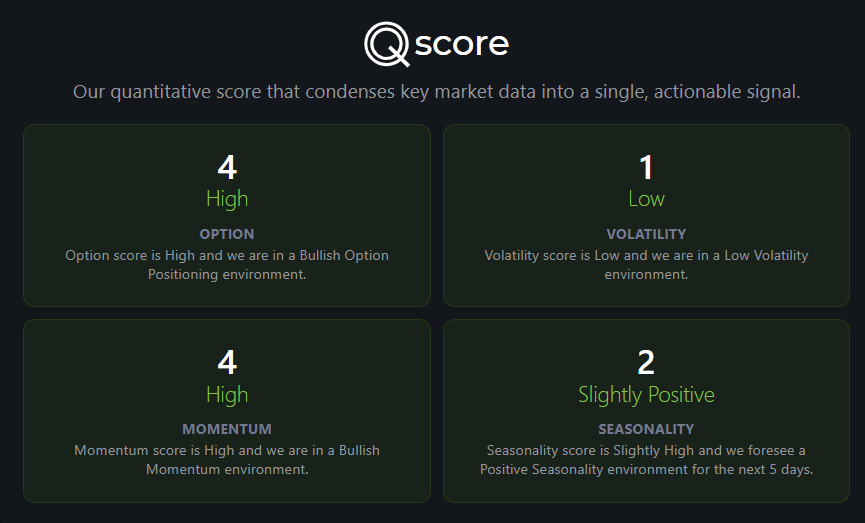

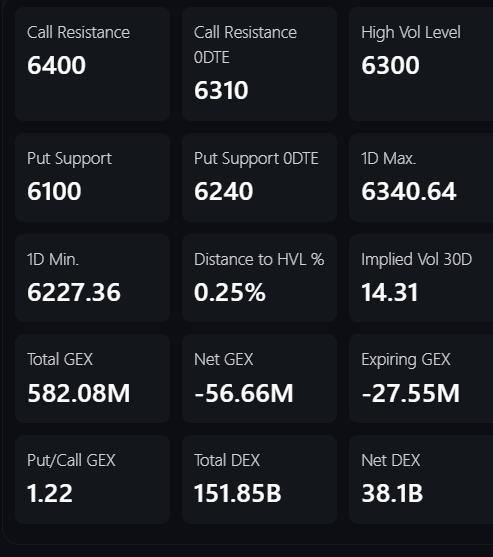

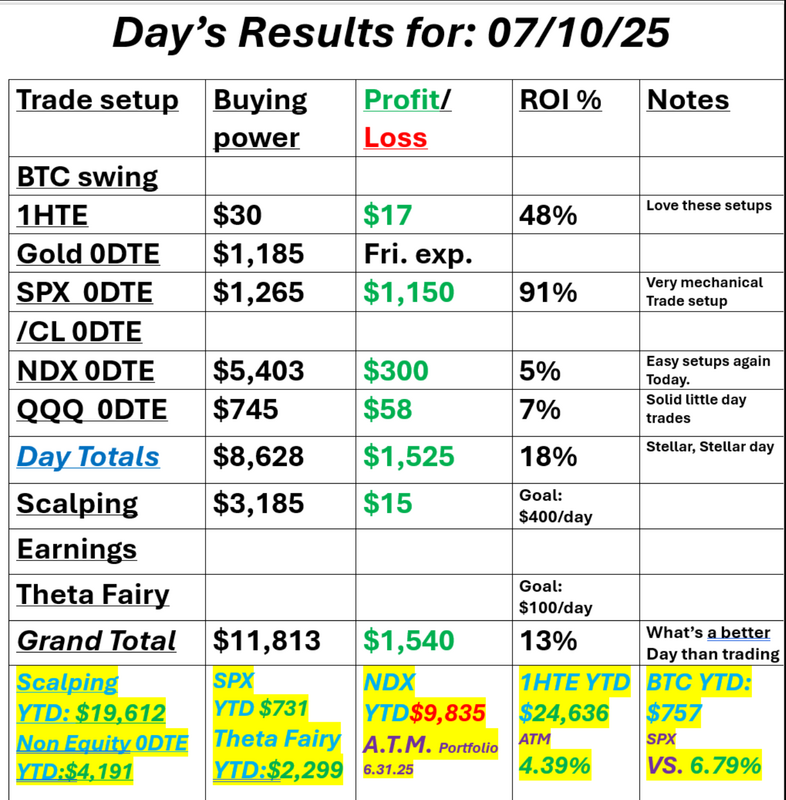

Do you use a "data driven approach"?I watched Powell's testimony yesterday and it was mentioned several times, by reporters and himself that he makes decisions and takes action based solely on data. They establish a mandate. What it is they want to achieve. Then they simply react to the data that comes in. This is how we should trade. We talk a lot about working to achieve stoic equanimity. That place where all emotion is removed from your trading. You're just reacting to the data. For us as day traders there are dozens of indicators, levels and order flow tools we use to attempt to accomplish this but some of the key ones are our support/resistance levels (levels are key to us...hence the name of this blog). We look at levels via support resistance, Fibonacci levels and GEX levels. I'll start including our GEX levels into our intra-day level analysis starting today. I've held off adding these because some traders get confused on GEX and DEX and how to use them. I'm going to be doing a training today on this in our live trading room. Join us if you can. Our results from yesterday were stellar. The profit noted in the QQQ is higher than actual as our put side finished slightly in the money but nevertheless, it was an excellent day for us. Let's take a look at the markets. Drawdown day! Two days ago the futures were down and my bias was bullish. Yesterday the futures were higher and my bias was bearish. I was right on both days. I don't need to be right. We can still make money if I'm wrong but, holy smokes!... it sure helps to be right! It makes it a lot easier. Is this the start of a roll over? Way too early to tell, if you ask me. No question we are "toppy" here though. Futures are starting us off with a slight sell signal this morning. We've yet to see PPI numbers and that could change everything. September S&P 500 E-Mini futures (ESU25) are trending down -0.09% this morning as investors digest the latest tariff headlines, while also awaiting crucial U.S. producer inflation data, quarterly reports from more big banks, and remarks from Federal Reserve officials. U.S. President Donald Trump signaled on Tuesday that tariffs on pharmaceuticals could be implemented by the end of the month, with similar measures on semiconductors possibly following. “Probably at the end of the month, and we’re going to start off with a low tariff and give the pharmaceutical companies a year or so to build, and then we’re going to make it a very high tariff,” he told reporters. Trump also stated that letters informing smaller countries of their U.S. tariff rates would be sent out soon, adding that his administration would likely impose a tariff of “a little over 10%” on those nations. In addition, the president predicted that he could finalize “two or three” trade agreements with countries before his so-called reciprocal tariffs take effect on August 1st, noting that a deal with India was among the most likely. In yesterday’s trading session, Wall Street’s major indexes closed mixed. State Street (STT) slumped over -7% and was the top percentage loser on the S&P 500 after Q2 results showed the company didn’t reduce expenses as much as analysts had expected and reported a decline in net interest income. Also, Wells Fargo (WFC) slid more than -5% after the San Francisco lender cut its full-year net interest income guidance. In addition, Newmont (NEM) dropped over -5% following the resignation of Chief Financial Officer Karyn Ovelmen. On the bullish side, Advanced Micro Devices (AMD) climbed more than +6%, and Nvidia (NVDA) rose over +4% to lead gainers in the Dow after the companies said they will resume some chip sales to China. The U.S. Bureau of Labor Statistics report released on Tuesday showed that consumer prices rose +0.3% m/m in June, in line with expectations. On an annual basis, headline inflation picked up to +2.7% in June from +2.4% in May, slightly stronger than expectations of +2.6%. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.2% m/m and +2.9% y/y in June, weaker than expectations of +0.3% m/m and +3.0% y/y. In addition, the Empire State manufacturing index unexpectedly rose to 5.50 in July, stronger than expectations of -8.30. “The big question for the inflation picture is tariffs. It’s taking some time for tariffs to show up in the data, but it’s highly likely that a tariff-driven inflation reckoning is coming,” said Skyler Weinand at Regan Capital. “The Fed will want to watch the next several inflation and jobs reports before it makes any moves on rates.” Richmond Fed President Tom Barkin said on Tuesday that the latest inflation data showed signs of building price pressures, and that more were on the way. Barkin added that it remains unclear how much of the tariffs companies could pass along to consumers, who may struggle to absorb additional price increases. Also, Boston Fed President Susan Collins said she still believes the central bank can afford to be patient when considering interest rate cuts. “Continued overall solid economic conditions enable the Fed to take the time to carefully assess the wide range of incoming data,” Collins said. Meanwhile, U.S. rate futures have priced in a 97.4% chance of no rate change and a 2.6% chance of a 25 basis point rate cut at July’s monetary policy meeting. After the latest inflation data, traders priced in lower odds that the Fed will cut rates more than once this year, with the chances of a September move now viewed as only slightly above 50%. Second-quarter corporate earnings season picks up steam, with investors awaiting reports today from major U.S. banks such as Bank of America (BAC), Morgan Stanley (MS), and Goldman Sachs (GS) as well as notable companies like Johnson & Johnson (JNJ), Progressive (PGR), and United Airlines Holdings (UAL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +2.8% increase in quarterly earnings for Q2 compared to the previous year, marking the smallest rise in two years. On the economic data front, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. June PPI will stand at +0.2% m/m and +2.5% y/y, compared to the previous figures of +0.1% m/m and +2.6% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect June figures to be +0.2% m/m and +2.7% y/y, compared to May’s numbers of +0.1% m/m and +3.0% y/y. U.S. Industrial Production and Manufacturing Production data will be reported today. Economists anticipate Industrial Production to rise +0.1% m/m and Manufacturing Production to be unchanged m/m in June, compared to the May figures of -0.2% m/m and +0.1% m/m, respectively. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -1.800M, compared to last week’s value of 7.070M. In addition, market participants will be looking toward speeches from Richmond Fed President Tom Barkin, Cleveland Fed President Beth Hammack, Fed Governor Michael Barr, and New York Fed President John Williams. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.478%, down -0.29%. My lean or bias right now is more neutral. PPI may change that and give us some directional bias. We have one of my favorite setups already on coming into this morning session. This is a trade that benefits from a decent sized move, either up or down but has no "valley of death" like so many of these setups have. I've got about $950 of buying power used for a max profit potential of around $500. We'll likely continue to add to this trade as the day progresses. As I mentioned, my bias is neutral to start off the day: Trade docket for today: /ES 0DTE, /MNQ scalp again, /GC 0DTE, ASML, JNJ, UAL, AA, GE earnings setups, 1HTE BTC IF I can get Kalshi to work (having issues there) QQQ 0DTE and SPX 0DTE. Also, never rule out a late day NDX entry. Let's take a look at the intra-day levels on /ES. 6300, 6311,6337 are resistance with 6262, 6242 working as support. The Q score (or quantitative score) still looks bullish. Key levels to watch today. I look forward to our training today on GEX and DEX. I'll see you all shortly, in the live trading room! If you want to use the quantitative data feed I use for GEX levels you can get a 20% discount now. click here.

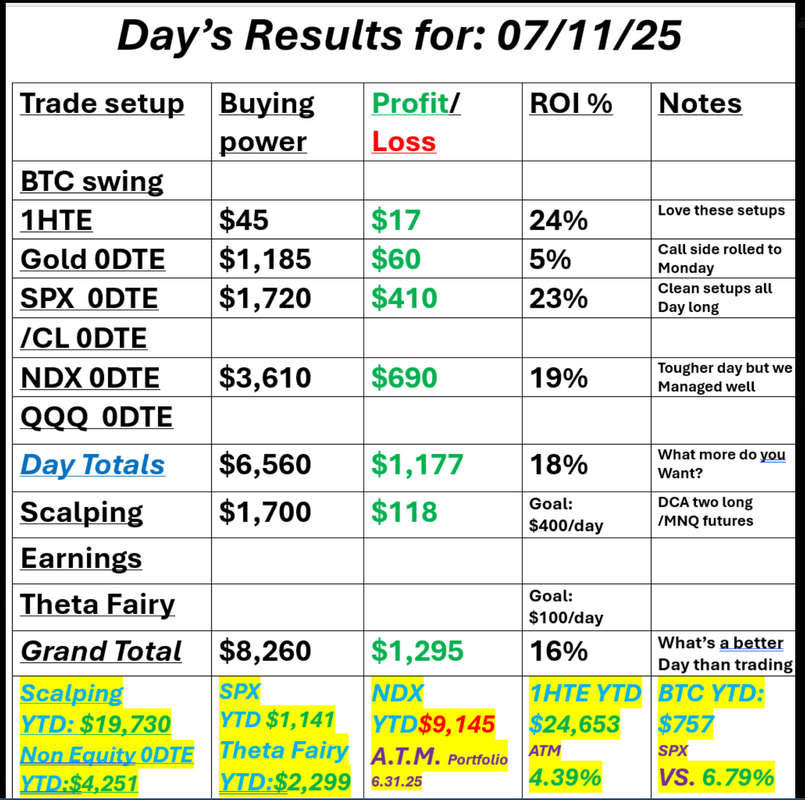

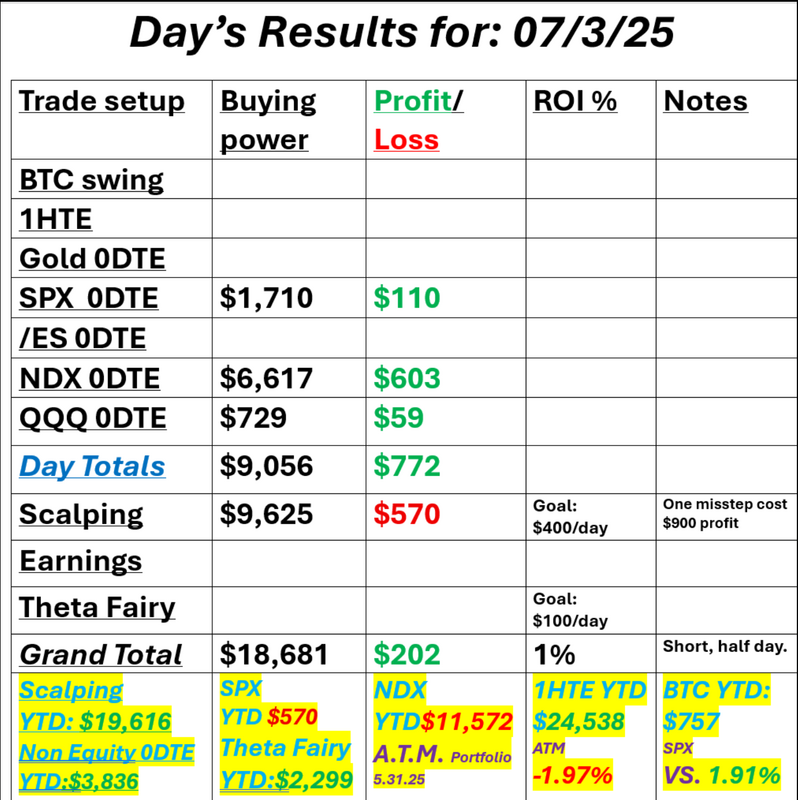

Take what you can getI was watching the futures before the open yesterday and just had a feeling it wasn't going to be an action filled day. Unfortunately I was right. I did have a bullish bias and we did get a little push up. I left some profit on the table on SPX but otherwise, we really got everything we could out of the day. Take a look at our day below: Let's take a look at the market this morning. We got a push up on the futures with the NVDA news. CPI is incoming. We are already short /MNQ in the scalping room. I'm looking for a retrace today from these highs. We just continue to tread water up here at the ATH zone. September S&P 500 E-Mini futures (ESU25) are up +0.39%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.56% this morning as sentiment got a boost after Nvidia said it would restart sales of some AI chips to China, while investors awaited the release of key U.S. inflation data and earnings reports from some of the biggest U.S. banks. Nvidia (NVDA) gained over +5% in pre-market trading after the chip maker said it plans to resume sales of its H20 AI chip in China following assurances from Washington that export licenses would be granted. Other chip stocks also advanced in pre-market trading, with Advanced Micro Devices (AMD), Marvell Technology (MRVL), and Arm Holdings (ARM) up more than +2%. In yesterday’s trading session, Wall Street’s main stock indexes closed higher. Autodesk (ADSK) climbed over +5% and was among the top percentage gainers on the S&P 500 after the company said in a filing with the Securities and Exchange Commission that it is prioritizing organic growth with “targeted and tuck-in acquisitions,” signaling it has likely dropped its bid for PTC. Also, AppLovin (APP) surged more than +6% and was the top percentage gainer on the Nasdaq 100 after Citi reiterated that the stock remains a “Top Pick” heading into the company’s Q2 report on August 6th. In addition, Fastenal (FAST) rose over +4% after the company posted better-than-expected Q2 results. On the bearish side, Waters (WAT) tumbled more than -13% and was the top percentage loser on the S&P 500 after the company announced it was acquiring Becton Dickinson’s Biosciences & Diagnostic Solutions business in a Reverse Morris Trust transaction valued at $17.5 billion. Cleveland Fed President Beth Hammack said on Monday that she wants to see further declines in inflation before supporting an interest rate cut. “We’re not there yet on the inflation side of the mandate. I think it’s important that we wait and see how all the new policies that have been put forward are going to impact inflation,” she said in an interview with Fox Business Network. U.S. rate futures have priced in a 95.3% probability of no rate change and a 4.7% chance of a 25 basis point rate cut at the July FOMC meeting. Meanwhile, the second-quarter corporate earnings season gets underway, with some of the biggest U.S. banks, including JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C), slated to report their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +2.8% increase in quarterly earnings for Q2 compared to the previous year, marking the smallest rise in two years. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. The report will be closely scrutinized for any indications of whether tariffs are already driving up prices and what implications this could have for U.S. interest rates. Economists, on average, forecast that the U.S. June CPI will come in at +0.3% m/m and +2.6% y/y, compared to the previous numbers of +0.1% m/m and +2.4% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.0% y/y in June, compared to the May figures of +0.1% m/m and +2.8% y/y. “Inflation pressures have remained muted so far, but tariffs will eventually feed through pushing prints higher and creating some discomfort for the Fed,” said Seema Shah at Principal Asset Management. A survey conducted by 22V Research revealed that 42% of investors expect a “risk-on” market reaction to the CPI report, while 29% anticipate a “mixed” response and another 29% foresee a “risk-off” response. Moreover, the survey showed that 67% of investors believe the core CPI is on a Fed-friendly glide path. The Empire State Manufacturing Index will also be released today. Economists anticipate the Empire State manufacturing index to be -8.30 in July, compared to last month’s value of -16.00. In addition, market participants will parse comments today from Fed Vice Chair for Supervision Michelle Bowman, Fed Governor Michael Barr, Richmond Fed President Tom Barkin, and Boston Fed President Susan Collins. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.418%, down -0.25%. Trade docket today: We are currently working a 1HTE on BTC. We've got a working put side entry on our Gold 0DTE. We'll Scale our QQQ 0DTE some more today. We have JNJ and ASML earnings trades. In scalping we are currently short, looking for a futures pullback today. We'll also work to get an SPX and hopefully an NDX 0DTE on as well. Let's take a look at my intra-day levels on /ES. Finally we have a change! 6356 is new resistance with 6300 now working as support. I look forward to seeing you all in the live trading room shortly. I'm hopefully we'll get some movement today that could yield up some good setups.

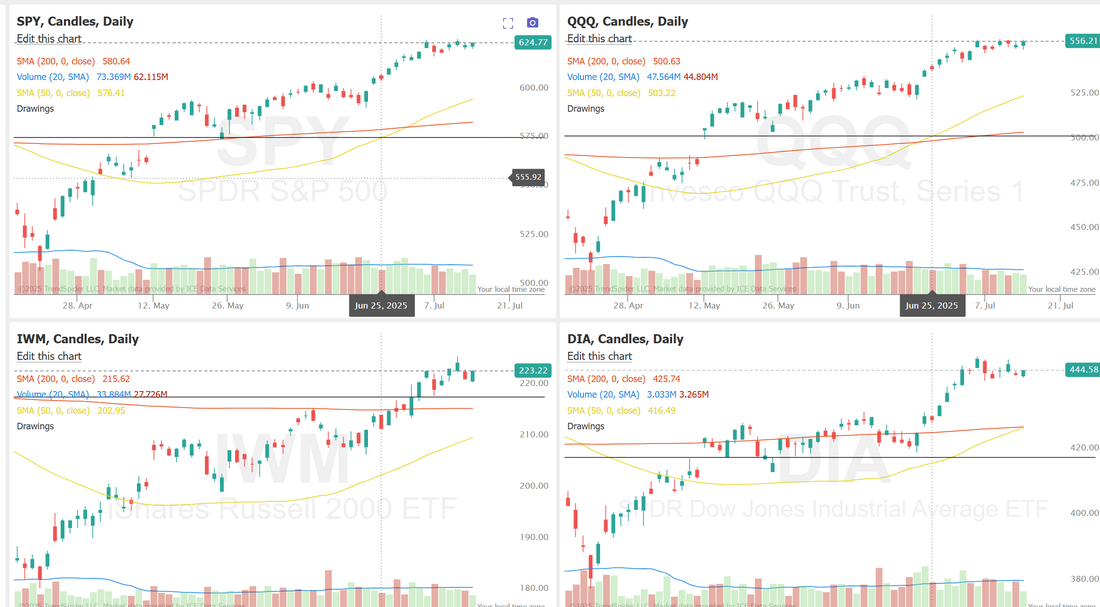

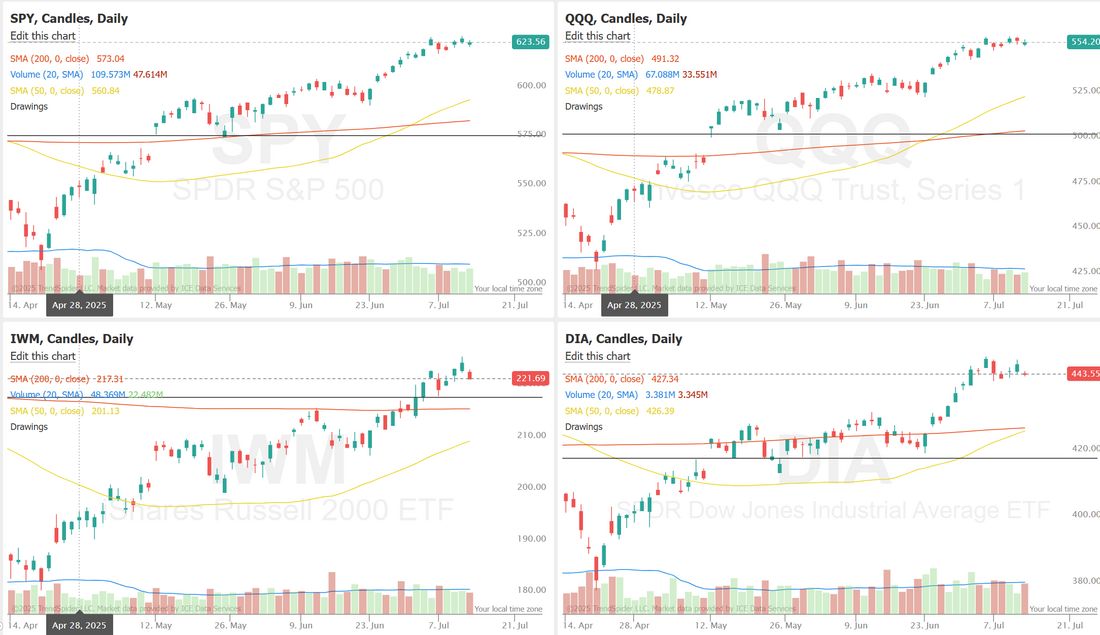

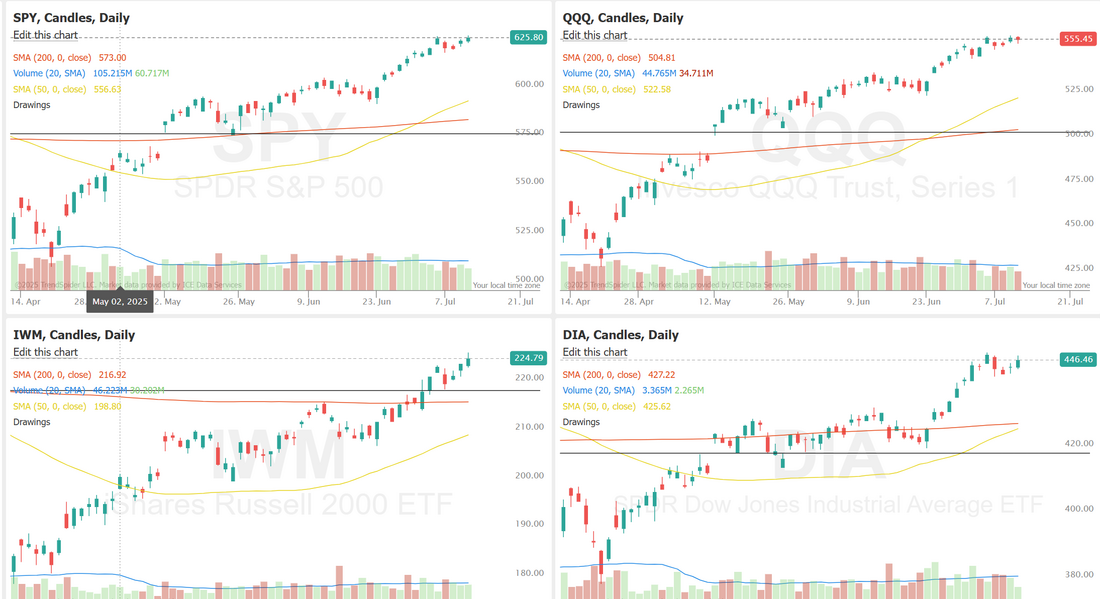

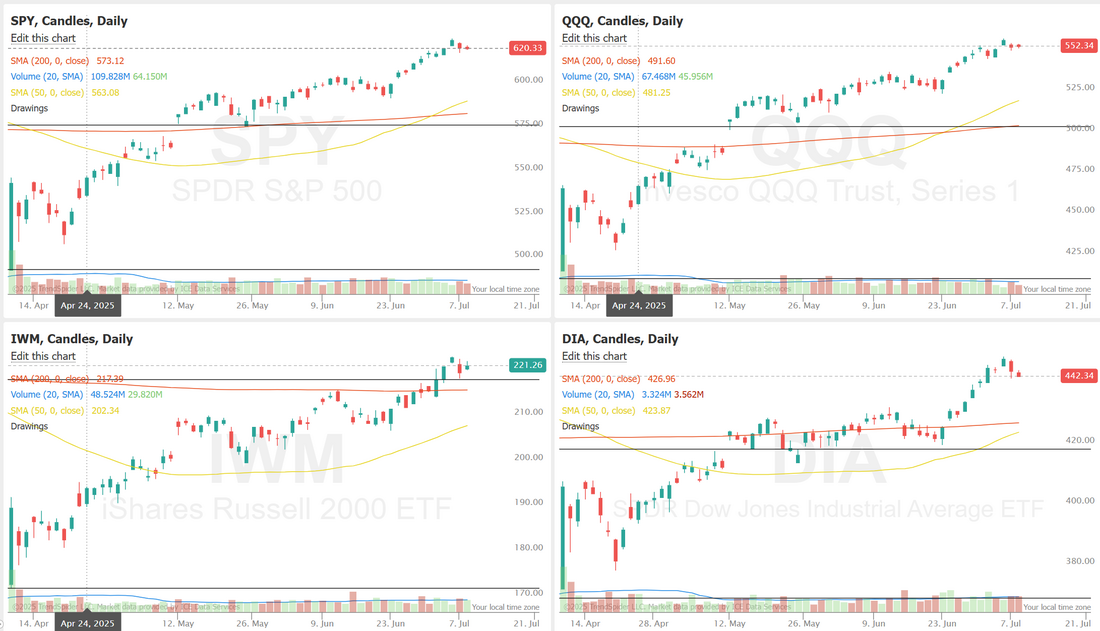

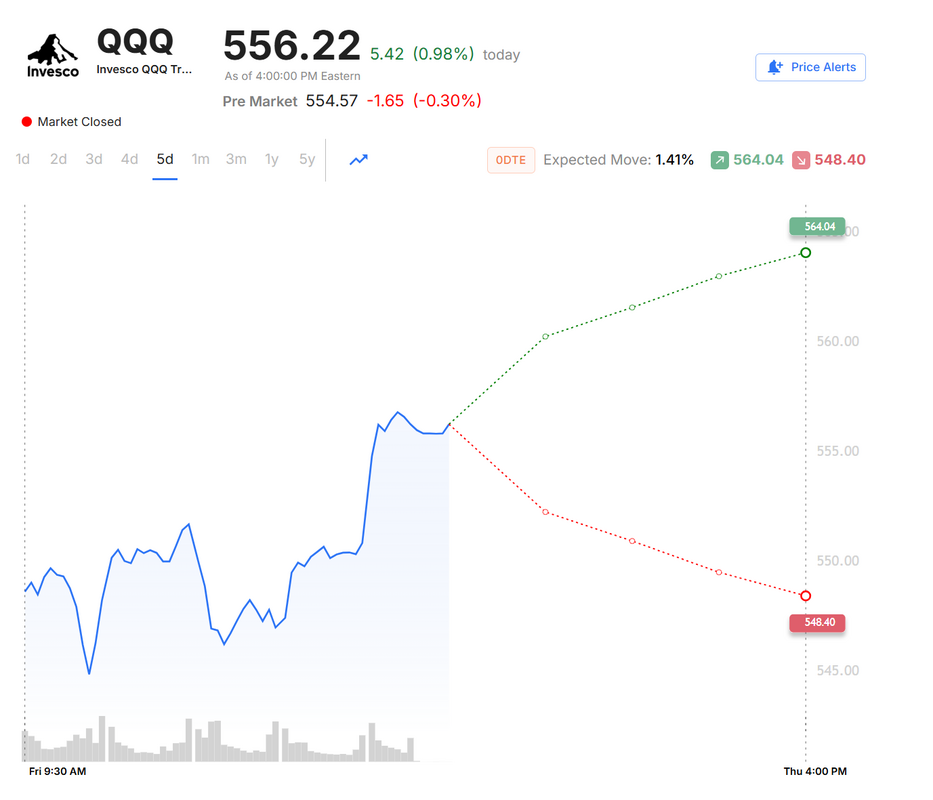

CPI and PPI weekMore inflation data and tariff news this week. We had an exceptional result from last week. Take a look at our day from Friday. We traded all day, right up to the close. September S&P 500 E-Mini futures (ESU25) are down -0.29%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.30% this morning, pointing to a lower open on Wall Street after U.S. President Donald Trump escalated his trade war. President Trump said in letters shared on his social media platform on Saturday that the U.S. will impose a 30% tariff on goods imported from both the European Union and Mexico beginning August 1st. Mr. Trump also said that if the EU or Mexico retaliated by increasing tariffs on the U.S., the U.S. would add that figure to the 30% rate. In response, European Commission President Ursula von der Leyen said on Saturday that the EU was prepared to retaliate to defend its interests. “We will take all necessary steps to safeguard EU interests, including the adoption of proportionate countermeasures if required,” she said. However, the EU said on Sunday it would extend its suspension of countermeasures to U.S. tariffs until early August and maintain efforts to reach a negotiated settlement. White House economic adviser Kevin Hassett said on Sunday that Trump had seen some trade deal offers and believes they need to be improved, adding that without that, he would move forward with the proposed tariffs on Mexico, the EU, and other countries. “Well, these tariffs are real if the President doesn’t get a deal that he thinks is good enough,” Hassett told ABC’s This Week program. “But you know, conversations are ongoing, and we’ll see where the dust settles.” Adding to the negative sentiment, Trump and his allies intensified their criticism of Federal Reserve Chair Jerome Powell’s handling of the costly renovation of the Fed’s headquarters. Some administration officials are working to build a case to remove Powell from the Fed’s Board of Governors. This week, investors look ahead to the release of key U.S. inflation data, comments from Fed officials, and the start of the second-quarter earnings season. In Friday’s trading session, Wall Street’s major equity averages ended in the red. Albemarle (ALB) slid over -4% and was among the top percentage losers on the S&P 500 after UBS downgraded the stock to Sell from Neutral with a price target of $57. Also, airline stocks retreated, with American Airlines Group (AAL) falling more than -5% and United Airlines Holdings (UAL) dropping over -4%. In addition, Capricor Therapeutics (CAPR) plummeted about -33% after the U.S. Food and Drug Administration declined to approve the company’s cell therapy for a heart condition. On the bullish side, most members of the Magnificent Seven stocks advanced, with Alphabet (GOOGL) and Amazon.com (AMZN) rising more than +1%. “The stock market is looking lower due to President Trump’s more hawkish stance on tariffs. With the market overbought and very expensive, the market is getting ripe for some sort of a pullback,” said Matt Maley at Miller Tabak. Second-quarter corporate earnings season kicks off this week, with big banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C) set to release their earnings reports on Tuesday, followed by Bank of America (BAC), Morgan Stanley (MS), and Goldman Sachs (GS) on Wednesday. Netflix (NFLX), PepsiCo (PEP), Abbott Labs (ABT), Johnson & Johnson (JNJ), American Express (AXP), and 3M (MMM) are among other major names scheduled to deliver quarterly updates during the week. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +2.8% increase in quarterly earnings for Q2 compared to the previous year, marking the smallest rise in two years. On the economic data front, the U.S. consumer inflation report for June will be the main highlight this week. The report will be closely scrutinized for any indications of whether tariffs are already driving up prices and what implications this could have for U.S. interest rates. Investors will also keep an eye on June wholesale inflation data, which will offer insight into pipeline inflationary pressures. Other noteworthy data releases include U.S. Retail Sales, Core Retail Sales, Industrial Production, Manufacturing Production, the Empire State Manufacturing Index, the Export Price Index, the Import Price Index, Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, Building Permits (preliminary), Housing Starts, and the University of Michigan’s Consumer Sentiment Index (preliminary). Also, market participants will hear perspectives from a slew of Fed officials, including Waller, Bowman, Barr, Barkin, Collins, Logan, Williams, Kugler, Daly, and Cook, throughout the week. In addition, the Fed will release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. Meanwhile, RBC Capital Markets strategists pushed back their forecast for the Fed to resume easing to December from September, citing the need for more time to evaluate inflation and labor market conditions. U.S. rate futures have priced in a 93.3% chance of no rate change and a 6.7% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. The U.S. economic data slate is empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.423%, down -0.05%. Let's take a look at the market. We've got a slight sell signal to start us off this week. It's not very strong but I'll take it. We've been hoping for some bearish price action so hopefully we can get some this week. Are we rolling over? It's too early to tell. We can only hope! SPY ended the week nearly unchanged at $623.62 (-0.28%) as markets lacked a clear catalyst to drive momentum. A golden cross, highlighted by the Golden/Death Cross Candle Painter on July 1st, has kept the index hovering near its all-time high. However, with key inflation data set to be released next week, bulls will need to hold their ground to maintain momentum. With key tech earnings approaching, QQQ held steady and closed the week at $554.20 (-0.36%). QQQ’s golden cross, which occurred about a week ahead of the S&P 500, reflects stronger momentum in the tech sector. However, with QQQ trading higher above its 50-day and 200-day SMA support levels, there is more room for a pullback if earnings disappoint or market volatility increases. Small-caps were flat this week and underperformed their large-cap peers, with the IWM closing at $221.70 (-0.65%). Even so, the IWM has outperformed in recent weeks and may be setting up for a golden cross of it’s own. Since small-caps tend to benefit the most from lower rates, bullish momentum could continue if the market’s expectations for rate cuts by year-end hold up. Expected move for the week on SPX is only slightly better than 1%. That's to be expected. The market was completely flat last week and continues to be stuck in a tight consolidation zone. We really need a break to the downside to get any I.V. back in the market. My lean or bias today is slightly bullish. Futures were down and got hit pretty good Sunday night. We put on a long /MNQ scalp at that point and have covered it with an /NQ spread. It's hard to say if we get to green today on the indices but we've already recovered half of Sunday nights selloff. I'll likely start off my day with some bullish setups.  Trade docket: One quick mention here on our ATM portfolio. We continue to gain more and more buying power as our large Tesla position gets closer to unwinding. Managing BP can be as important as the trades you do. We've added several new positions to the portfolio today and hopefully can add several more later this week. For our trading room today: Gold 0DTE. Looking to unwind that trade today. We'll look to add our next tranche to our Copper trade. QTTB once again, we'll look at it and see if we want to book profits, adjust or hold. SPX 0DTE, LULU, JNJ earnings trade, NDX 0DTE, QQQ 0DTE. Let's take a look at intra-day levels on /ES. They haven't changed much, largely because the market didn't really move last week. 6317 continues to be resistance with 6239 working as support. I'm excited to do another training session today on all of the following:

I'll see you all in the live trading room shortly!

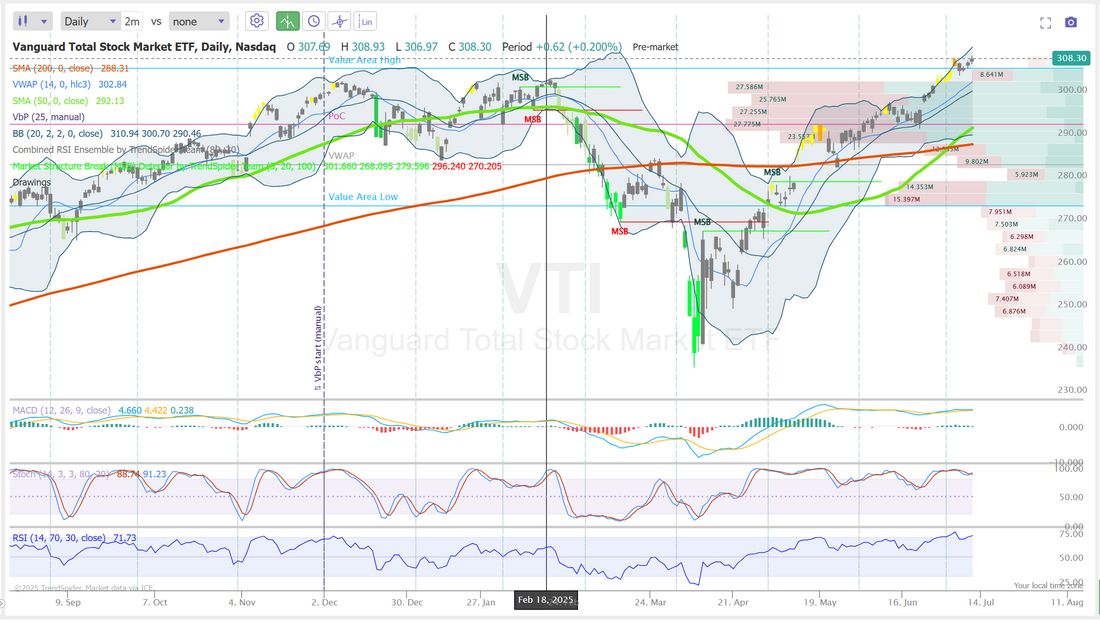

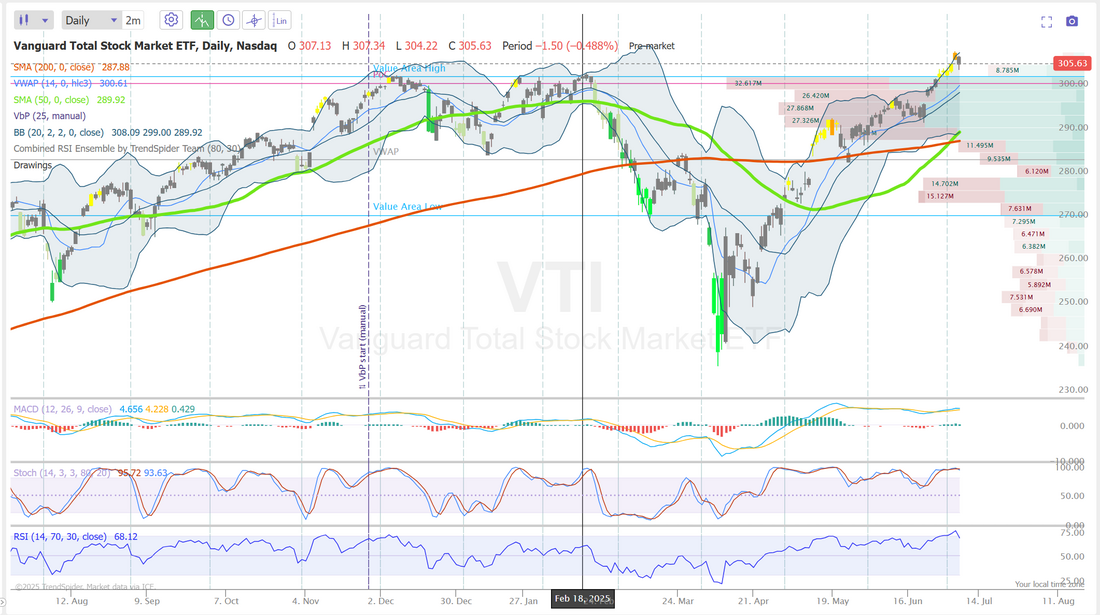

Are you a full-time professional trader?We had a good discussion yesterday in our live trading room about what level of effort we put into our trading. One thing we've learned in life is that those that treat something as a hobby are less proficient than those that treat it as a profession. Those that look at it as "part-time" do worse than those that view it as "full-time" work. The key here is that it's all about how you view it, not how much money you have or how much time you can devote. Many will say, "I only have a tiny amount of capital" or "I have a full time job and little time to commit to trading". None of this precludes us from viewing ourselves and conducting ourselves in a professional manner. We all need to decide, each day, how much effort we are willing to give to something. Trading is one of the most rewarding things I've done in my life but it take commitment. I've spent time living in Hawaii, getting up at 3:00 A.M. every day to start my trading. I've traded from hospital beds. I've annoyed my family to no ends continually pulling the family car over on road trips to "make just one more trade". I get up at 4:00 A.M. every day to do my research. I'm keenly aware that I'm not the smartest person in the room. I'm keenly aware that there are many traders much better versed than I. I succeed because of effort...not skill or I.Q. Each night, as we go to bed we need to look ourselves in the mirror and ask if we did everything we could to be successful. It's hard...but it's worth it. Put in the work. Trading IS work. We had a really nice day yesterday. Here's a look at our results. September S&P 500 E-Mini futures (ESU25) are trending down -0.62% this morning as sentiment took a hit after U.S. President Donald Trump ratcheted up trade tensions yet again. Late Thursday, President Trump announced a 35% tariff on Canadian imports, set to take effect on August 1st. However, the White House said goods complying with the U.S.-Mexico-Canada Agreement would continue to be exempt. Also, Mr. Trump said the European Union could receive a letter on tariff rates by Friday, casting doubt on the progress of trade negotiations between Washington and the bloc. In addition, Trump said he plans to raise blanket levies to 15%-20% on most trading partners that have not yet been given proposed tariff rates. “We’re just going to say all of the remaining countries are going to pay, whether it’s 20% or 15%,” he told NBC News. The International Monetary Fund said Thursday it is keeping a close watch on the latest U.S. tariff announcements, cautioning that global economic uncertainty remains high. It called on countries to engage constructively to maintain a stable trade environment. In yesterday’s trading session, Wall Street’s major indices closed higher, with the S&P 500 notching a new all-time high. Delta Air Lines (DAL) surged about +12% and was among the top percentage gainers on the S&P 500 after the carrier posted better-than-expected Q2 results and reinstated its 2025 profit guidance. Also, Advanced Micro Devices (AMD) rose more than +4% after HSBC upgraded the stock to Buy from Hold with a $200 price target. In addition, MP Materials (MP) jumped over +50% after announcing a public-private partnership with the U.S. Department of Defense aimed at speeding up the build-out of the nation’s rare earth magnet supply chain. On the bearish side, Helen of Troy (HELE) plummeted more than -22% after the company behind brands including Hydro Flask and Braun Thermometers posted downbeat FQ1 results. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week unexpectedly fell -5K to an 8-week low of 227K, compared with the 236K expected. St. Louis Fed President Alberto Musalem said on Thursday that while he sees upside risks to inflation, it is still too early to determine whether tariffs will have a persistent impact on prices. “It’s going to take time for the tariffs to settle. There’s a scenario where we could be in Q4 this year, or Q1 or Q2 of next year, where tariffs are still working themselves into the economy,” he said. At the same time, San Francisco Fed President Mary Daly said she continues to see two interest rate cuts as likely this year and believes there is a higher likelihood that the inflationary impact of tariffs may be more subdued than expected. “There’s zero chance we’ll have tariff clarity by Aug. 1, which makes a July rate cut impossible,” said Tom Essaye of The Sevens Report. “The practical impact of this consistently delayed tariff policy is to reduce the chances of a September rate cut, which could leave rates higher for longer and increase the chances of an economic slowdown.” Meanwhile, U.S. rate futures have priced in a 93.3% probability of no rate change and a 6.7% chance of a 25 basis point rate cut at the next central bank meeting in July. The U.S. economic data slate is empty on Friday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.389%, up +0.73%. Let's take a look at the markets this morning. We are holding on to an every so slight, buy signal....still. We keep hitting new ATH's but we also seem to be running out of gas...if that makes sense. We keep waiting for a new catalyst that will relaunch the bullish move or cause a reversal. The VTI is just stuck here. No real buy or sell signals...yet. We've recently triggered a Golden cross in the indices. This is about as bullish a signal as we can get. Do the bulls still have enough buying power to keep the push going? Trade docket for today: QTTB. We've been quietly cash flowing this position with covered calls for a while now. Yesterday it came alive. That may present an interesting opportunity today to either take profit or possibly add more. /MNQ scalp. I've added to our long position this morning on the dip. We'll keep working this all day today. Gold 0DTE. We started this yesterday and set aside more buying power to continue to work it today. SPX 0DTE. Possibly a NDX 0DTE later in the day and 1HTE on Bitcoin. Let's take a look at the intra-day levels I'll be using today for our /ES setup. We have an interesting start to today. Futures are down this morning on tariff concerns (stop me if you've heard this before) but the structure shows some support and technicals on the 2 hr. chart are looking to rebound. Could we build back some upside movement this morning? That's the way I'm setup right now with our scalping trade. We find ourselves smack dab in the middle of my trading range this morning with 6317 still working as my resistance level an 6238 my support. I think we may have a decent shot at getting some movement today so I'll continue to hold my long scalp until we see what trend develops. My lean or bias today is slightly bullish. I think we have a decent chance to rebound off the lows of the futures market this morning. I'll see you all in the live trading room shortly! We've had an amazing week so far. Let's try to not screw it up today! LOL

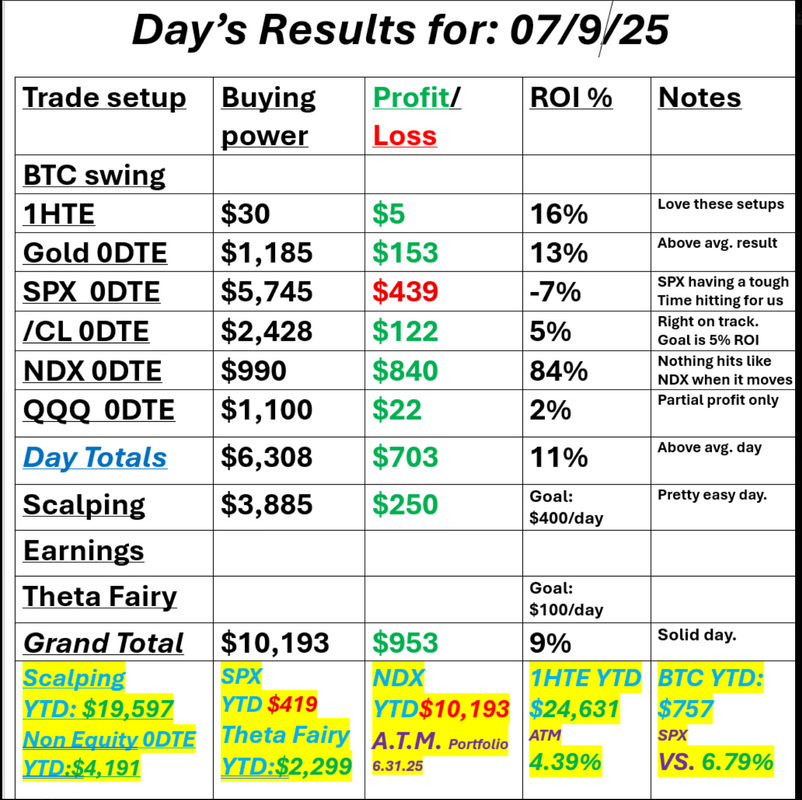

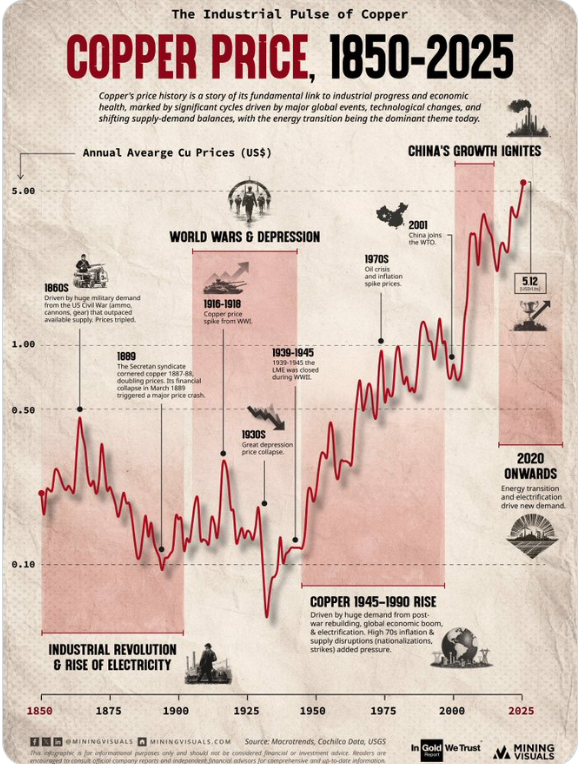

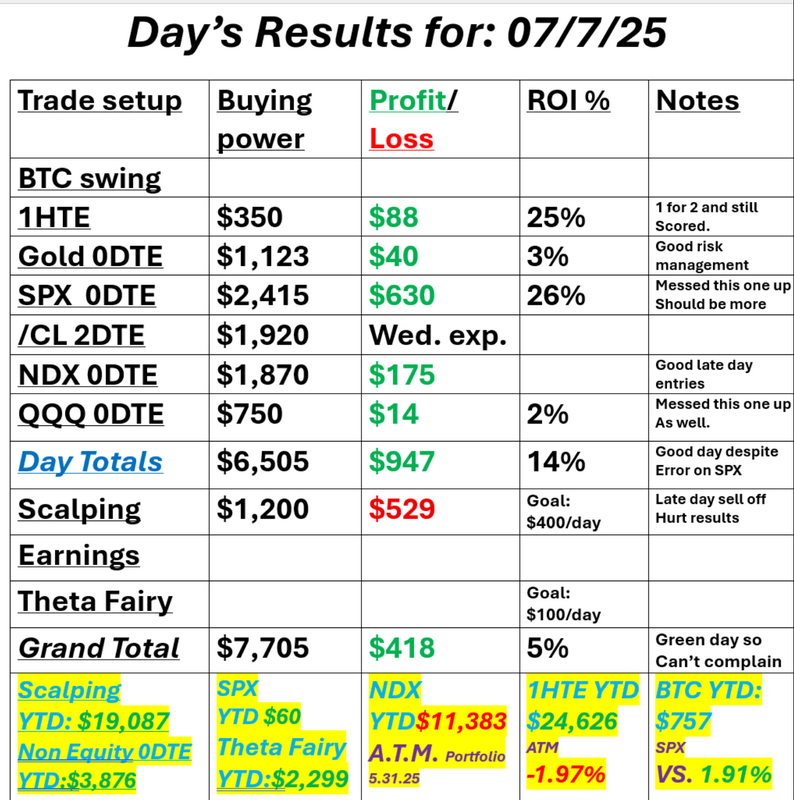

Copper is in play!If you traded with us yesterday we started our first entry into copper. It's a just a little 60% ROI potential trade! Crazy times for sure. We'll be working more positions into this trade over the next three weeks. Come join us! Our day yesterday was great. We still have trouble getting SPX into the green but our well diversified daily strategies continue to produce. See our results below: September S&P 500 E-Mini futures (ESU25) are down -0.12%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.09% this morning, pointing to a muted open on Wall Street amid uncertainty over U.S. President Donald Trump’s trade policies, while investors await U.S. jobless data and remarks from Federal Reserve officials. President Trump on Wednesday announced 50% tariffs on Brazilian goods, the highest rate announced so far, and confirmed via social media that 50% tariffs on copper products would take effect from August 1st. Trump also stated he would impose a 30% tariff on Algeria, Libya, Iraq, and Sri Lanka, along with 25% duties on goods from Brunei and Moldova, and a 20% rate on products from the Philippines. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the green. The Magnificent Seven stocks advanced, with Nvidia (NVDA) and Microsoft (MSFT) rising over +1%. Also, AES Corp. (AES) surged more than +19% and was the top percentage gainer on the S&P 500 after Bloomberg reported that the renewable power company was exploring options, including a possible sale, amid takeover interest. In addition, Boeing (BA) climbed over +3% and was the top percentage gainer on the Dow after delivering 60 aircraft in June, marking its highest monthly total in 18 months. On the bearish side, Aehr Test Systems (AEHR) plunged more than -12% after the company posted weaker-than-expected FQ4 revenue and said it wasn’t “reinstating specific guidance beyond what we have already stated” amid tariff-related uncertainty. Economic data released on Wednesday showed that U.S. Wholesale Inventories fell -0.3% m/m in May, in line with the preliminary reading. The minutes of the Federal Open Market Committee’s June 17-18 meeting, released Wednesday, showed that officials remained divided on how tariffs would impact inflation. “While a few participants noted that tariffs would lead to a one-time increase in prices and would not affect longer-term inflation expectations, most participants noted the risk that tariffs could have more persistent effects on inflation,” according to the FOMC minutes. Policymakers cited “considerable uncertainty” regarding the timing, magnitude, and duration of the tariffs’ possible impact on inflation. Still, most policymakers judged that “some reduction” in the Fed’s policy rate would probably be appropriate this year. Meanwhile, President Trump on Wednesday posted on social media that the Fed’s rate is “at least 3 points too high,” while repeating his demand for lower rates to ease the burden of servicing the national debt. “Optimism is growing that the Federal Reserve could begin cutting interest rates as early as September, particularly if upcoming data shows inflation is softening,” said Fawad Razaqzada at City Index. “But this is not a given as Trump’s policies could ramp up inflation in the coming months, which would lessen the need to loosen policy aggressively.” U.S. rate futures have priced in a 93.3% chance of no rate change and a 6.7% chance of a 25 basis point rate cut at the conclusion of the Fed’s July meeting. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 236K, compared to last week’s number of 233K. Also, market participants will parse comments today from St. Louis Fed President Alberto Musalem, Fed Governor Christopher Waller, and San Francisco Fed President Mary Daly. In addition, investors will monitor earnings reports from several notable companies, with Delta Air Lines (DAL), Conagra Brands (CAG), and Levi Strauss (LEVI) scheduled to report their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.349%, up +0.21%. My bias or lean yesterday was neutral. That was accurate for most of the day, until some bulls showed up late in the day. I'd look for more of the same today. We don't have a lot of upward catalysts. Trade docket today: /MNQ scalping, QQQ 0DTE, /GC 1DTE, /CL 1DTE, SPX 0DTE, NDX 0DTE, 1HTE BTC trades. Short and sweet blog today. All my levels are the same today as they were yesterday. No changes in our approach today vs. yesterday. See you all in the live trading room. Let's do it all again today!

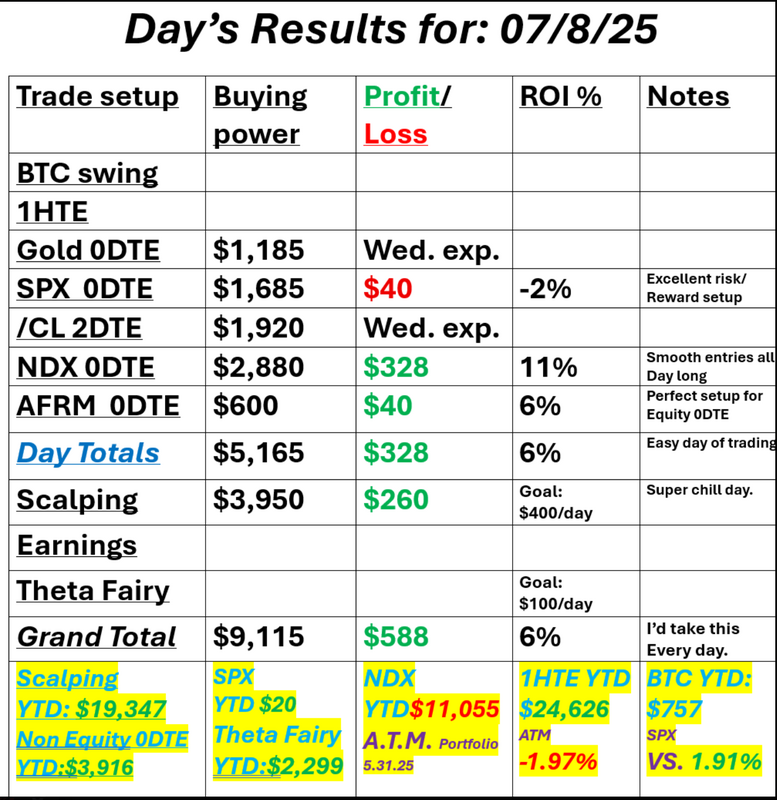

Smaller profit goal=More Consistency=More profit?Good morning traders! We had as close to a perfect day yesterday that we could possibly get. No, it wasn't our biggest profit day...by far. We have a daily profit goal of $1,000 dollars and we attempt to achieve that with 10-15K of capital. As amazing (or far fetched) as that sounds, there is rarely a day that the trades we build DON'T have that potential. Does it work everyday? Of course not, but the potential to make $1,000 a day is very real. Yesterday we made $588 profit. Much less than the $1,000 goal so why would I say it was a perfect day? The biggest our risk got yesterday with all our trades was approx. $200 dollars. It was a very easy day and the risk/reward was great. Our SPX lost $40 dollars but had over $500 profit potential and it was a trade that would have made money if the market went crazy...had a big move, shooting up or crashing down. I think these are perfect setups for this type of market. Have a position on that profits if a big move (either up or down) happens. This get's me to the title of today's blog. It only makes sense that if you lower your profit goals your consistency should increase. If your win rate increases your overall profit should increase as well. Yes! By lowering your profit goal you could actually find yourself making more. Would you give up the (very real) chance we have every day of making $1,000+ profit if you knew you could make $588 every day, guaranteed? I would. Here's a look at our day: King Copper in playLikely you heard Trump is looking to apply a 50% tariff on copper. Copper has retreated a bit this morning but it popped 10% yesterday and, I believe, it's created an interesting setup that creates some "edge" for a sharp trader. Be sure to tune into the zoom feed today as I discuss what that setup may look like. Let's take a look at the market. Technicals are still holding in buy mode. My lean or bias yesterday was neutral and that's exactly what we got. I'm leaning the same way today. We have oil inventory numbers and FOMC minutes but not much else to move the market. Some type of Tariff news seems likely which lately has been more negative then positive, albeit the market doesn't really seem to care that much anymore. The roll over hasn't taken shape...yet, but it does look like the bears are trying. September S&P 500 E-Mini futures (ESU25) are trending up +0.16% this morning as investors look past U.S. President Donald Trump’s latest tariff threats and await the Federal Reserve’s June meeting minutes. Just days after the U.S. started sending letters to trading partners announcing reciprocal tariffs under a new August 1st deadline, sector-specific duties have returned to the spotlight. President Trump on Tuesday announced a large 50% tariff on copper that could take effect by August 1st or earlier. Mr. Trump also proposed a tariff of up to 200% on pharmaceutical products but noted that companies would have up to a year and a half to prepare. He said that semiconductor tariffs are also under consideration. President Trump signaled that additional tariff details could be unveiled on Wednesday, with tariff letters possibly being sent to as many as seven countries this morning. “We will be releasing a minimum of 7 Countries having to do with trade, tomorrow morning, with an additional number of Countries being released in the afternoon,” Trump said on Truth Social late Tuesday. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Fair Isaac (FICO) slumped over -8% and was the top percentage loser on the S&P 500 after Federal Housing Finance Agency Director Bill Pulte announced on social media that Fannie Mae and Freddie Mac will permit lenders to use the VantageScore 4.0 credit scoring model. Also, Datadog (DDOG) slid more than -4% and was the top percentage loser on the Nasdaq 100 after Guggenheim downgraded the stock to Sell from Neutral with a $105 price target. In addition, solar stocks plunged after the White House said it would “rapidly eliminate the market distortions and costs imposed on taxpayers by so-called ‘green’ energy subsidies,” with Sunrun (RUN) tumbling over -11% and First Solar (FSLR) falling more than -6%. On the bullish side, chip stocks advanced, with Intel (INTC) climbing over +7% to lead gainers in the Nasdaq 100 and GlobalFoundries (GFS) rising more than +6%. Economic data released on Tuesday showed that U.S. consumer credit rose $5.10 billion in May, weaker than expectations of $10.40 billion. Today, market watchers will parse the Fed’s minutes from the June 17-18 meeting for any additional clues on potential interest rate cuts. While there have been recent signs of divisions leaning toward a more dovish stance, PMI and jobs data have indicated economic resilience, supporting the delay of interest rate cuts until later in the year. Meanwhile, U.S. rate futures have priced in a 95.3% probability of no rate change and a 4.7% chance of a 25 basis point rate cut at July’s monetary policy meeting. On the economic data front, investors will focus on U.S. Wholesale Inventories data, which is set to be released in a couple of hours. Economists expect the final May figure to be -0.2% m/m, compared to +0.2% m/m in April. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -1.700M, compared to last week’s value of 3.845M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.394%, down -0.50%. Trade docket today: Copper! using /HG. Scalping continues with /MNQ, /NQ setup. /CL 0DTE, /GC 0DTE, QQQ 0DTE, SPX 0DTE, NDX 0DTE? QTTB? 1HTE BTC trades. With yesterday being a completely flat day my intra-day levels for /ES are the same. On the daily chart we are pretty neutral. The indicators as sooooo close to giving us a full blown sell signal, however, the bulls don't need to do much today to keep the bullish bias in place. On the 2hr. chart I continue to monitor 6316 as resistance and value area high and 6238 as support and PoC. It's tough to be anything but neutral until we break out of this consolidation range. 175 year history of Copper Is this really where you want to be long? Those with long only IRA's and 401K's are just asking to lose money. I look forward to seeing you all in the live trading room shortly. Let's see if we can put a copper trade together that we feel gives us an "edge".

Retail investors driving the marketIt's always interesting to see who an what drives market moves. This current push higher is almost all retail. That's not tremendously comforting if you want the bull market to keep going. Mom-and-pop investors bought ~$4 BILLION of US equities on Tuesday, the biggest daily amount since mid-April. Over the 5 trading days ending, retail purchased $15B of stocks, according to Goldman. We had a profitable day yesterday despite two unforced errors on my part. That probably cost us $320 of potential profit. I'll work to do better today. Here's a look at our day: Let's take a look at the market. Technicals have flipped neutral to start us off. SPX has now hit 7 new ATH's this year. Is the highly anticipated rollover finally starting? Taking a look at the VTI again. Yesterday brought very faint sell signals all across the board. Today may very well be the day that we get a confirmation one way of the other. Any weakness or red today will confirm the weak sell signals we currently have. Any strength may be enough to put the bulls back on track. I'm looking for a neutral day today. Futures are higher, as I type but we'll need some catalyst today if the bulls want to continue any higher. Trade docket today: AFRM week long trade. /MNQ, /NQ scalp, Gold 1DTE, LULU, QTTB, SPX 0DTE and NDX 0DTE. Let's take a look at the intra-day levels on /ES. My two key levels for today as the same as yesterday. 6316 is the resistance zone and Value area high. 6238 is support and also PoC on the 2 hr. chart. I look forward to another day of trading together in the live trading room! See you shortly.

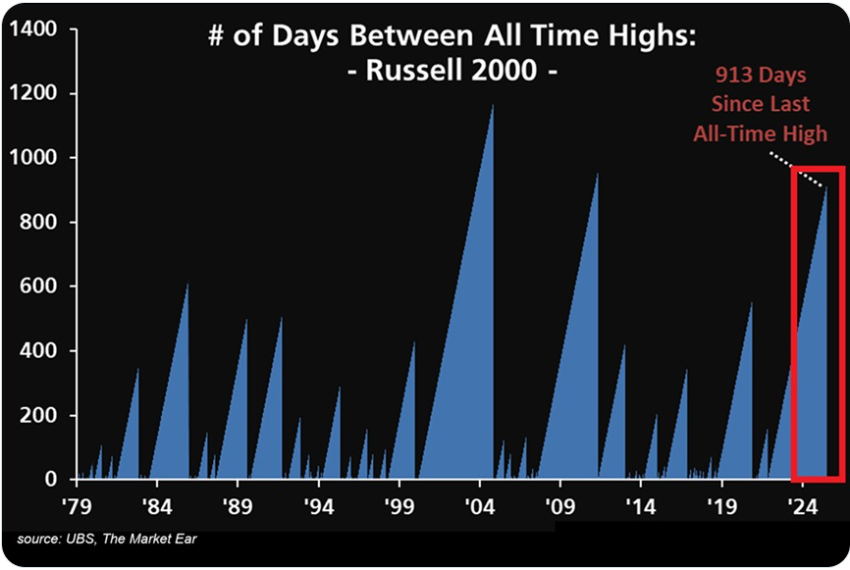

July 9th trade deadline loomsI hope everyone had a great 4Th of July. It's always good to get a break for the screens and market and take some personal time. We are back at it today with a full week ahead of us. Their are no real earnings trades to watch this week and economic news is tampered down from last weeks deluge. We do have the trade deadline looming and I'm sure we'll get some announcements of deals and no deals in the next couple days. Markets continue to trend bullish and continue to look overstretched (to me at least). Here's a look at our shortened days results from last Thurs. I gave up an additional $900 profit by not rolling our calendar 0DTE portion of our QQQ scalp out but that's hindsight for you. Let's take a look at the market. Buy mode is still hanging in there. All the major indices continue to sit at ATH'S. This is the 7th ATH for SPX this year. VTI is always my go to for total market view and it sure looks stretched and poised for a downturn here. We will be building cash for a bearish zebra setup in our ATM portfolio this week. September S&P 500 E-Mini futures (ESU25) are down -0.34%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.53% this morning, starting the week on a downbeat note as uncertainty surrounding U.S. tariffs remains elevated ahead of the July 9th deadline to complete trade negotiations. U.S. President Donald Trump announced on his Truth Social platform that “tariff letters and/or deals” would be delivered to global trading partners starting at 12 p.m. Eastern Time on Monday. President Trump has stated that new tariff rates could span from 10% to 70%. U.S. officials have signaled August 1st as the effective date for higher tariffs. Trump also threatened an additional 10% levy on nations aligned with BRICS, which includes Brazil, Russia, India, and China. “Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy,” he said. In Thursday’s trading session, Wall Street’s major equity averages ended higher. Most members of the Magnificent Seven stocks advanced, with Microsoft (MSFT) and Nvidia (NVDA) rising over +1%. Also, Datadog (DDOG) surged more than +14% and was the top percentage gainer on the Nasdaq 100 after S&P Dow Jones Indices announced that the stock would be added to the S&P 500 index on July 9th. In addition, Cadence Design Systems (CDNS) climbed over +5%, and Synopsys (SNPS) gained more than +4% after the U.S. lifted export restrictions on chip design software to China. On the bearish side, homebuilder stocks slumped after the benchmark 10-year T-note yield jumped, with Lennar (LEN) sliding over -4% to lead losers in the S&P 500 and DR Horton (DHI) falling more than -2%. The U.S. Labor Department’s report on Thursday showed that nonfarm payrolls rose 147K in June, stronger than expectations of 111K. Also, U.S. June average hourly earnings rose +0.2% m/m and +3.7% y/y, weaker than expectations of +0.3% m/m and +3.9% y/y. In addition, the U.S. unemployment rate unexpectedly fell to 4.1% in June, stronger than expectations of 4.3%. Finally, the U.S. ISM services index rose to 50.8 in June, in line with expectations. “The solid June jobs report confirms that the labor market remains resolute and slams the door shut on a July rate cut,” said Jeff Schulze at ClearBridge Investments. Atlanta Fed President Raphael Bostic on Thursday urged patience amid economic policy uncertainty and said that a wait-and-see stance could help avoid the need to reverse course on interest rates. “I believe a period characterized by such widespread uncertainty is no time for significant shifts in monetary policy,” Bostic said. U.S. rate futures have priced in a 93.6% chance of no rate change and a 6.4% chance of a 25 basis point rate cut at the July FOMC meeting. Meanwhile, the U.S. House of Representatives passed President Trump’s “One Big, Beautiful Bill” on Thursday with a 218-214 vote, and Trump signed it into law on the White House South Lawn on Friday afternoon. The highlight of this week is the July 9th deadline, when the 90-day reprieve from President Trump’s so-called “reciprocal” tariffs ends. Trump is anticipated to announce a slew of trade agreements ahead of the tariff deadline. “We’re going to be very busy over the next 72 hours,” Treasury Secretary Scott Bessent said Sunday on CNN’s State of the Union, referencing the time remaining before the deadline. Bessent also indicated that certain nations without finalized deals could be granted a three-week extension to negotiate, with the tariffs set to take effect on August 1st. The U.S. economic calendar lightens up considerably following last week’s wave of economic data releases. Investors will monitor U.S. Consumer Credit, Crude Oil Inventories, and Initial Jobless Claims data this week. Also, market watchers will parse the Fed’s minutes from the June 17-18 meeting, scheduled for release on Wednesday, for any additional clues on potential interest rate cuts. While there have been recent signs of divisions leaning toward a more dovish stance, PMI and jobs data have indicated economic resilience, supporting the delay of interest rate cuts until later in the year. In addition, market participants will hear perspectives from Fed Governor Christopher Waller, San Francisco Fed President Mary Daly, and St. Louis Fed President Alberto Musalem throughout the week. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.353%, up +0.86%. The SPY hit another all-time high this week, closing at $624.97 (+1.67%) with zero signs of bearish momentum. Zooming out and looking at the quarterly chart, we see a massive Q2 2025 candle with the SPY bouncing off its 2021 resistance, which is now acting as support. With the MACD continuing to push and a new quarterly candle gap, bulls remain in full control. Even as tech heavyweights like Tesla and Meta stumbled, QQQ surged to fresh all-time highs, closing at $555.75 (+5.50%). The quarterly 8/21 EMA cloud, which has been green for more than a decade, once again acted as a springboard, with Q2’s brief dip into the cloud quickly bought up. With no clear resistance overhead, traders are watching for potential resistance levels to form as this momentum plays out. Small-caps roared higher this week, with the IWM closing at $223.08 (+5.35%) as the Russell 2000 continues to defend its 2022 lows. With rate cut bets fueling rotation and the quarterly MACD flirting with a bullish cross, traders are eyeing a potential breakout to all-time highs that could finally bring small-caps in line with their large-cap counterparts. Expected moves for the week are still stuck around the 1% range for SPX. We need some more I.V. to get back to better risk/reward ratios. NDX is not much better. Trade docket for today is busy. /MNQ scalping. Gold 0DTE, Oil 2DTE, QQQ 0DTE, SPX 0DTE, Two new pairs trades with GOGO, MGNI short and EHAB and ADMA long. BITO 4DTE and 1HTE BTC trades. The Russell 2000 index has gone 913 trading days without hitting an all-time high, the longest streak in 14 years. This also marks the 3rd-longest stretch in history. The index is currently trading ~10% below its November 2021 peak. While the Nasdaq 100 and S&P 500 have reached multiple record highs in 2025, small caps continue to lag. Year-to-date, the Russell 2000 is flat, significantly underperforming the S&P 500 and Nasdaq, which are up 5.9% and 7.8%, respectively. Meanwhile, 46% of companies in the index are currently unprofitable, near the highest share on record. Small caps are getting smaller. I look forward to seeing you all in the live trading room shortly! We've got a lot to work on today.

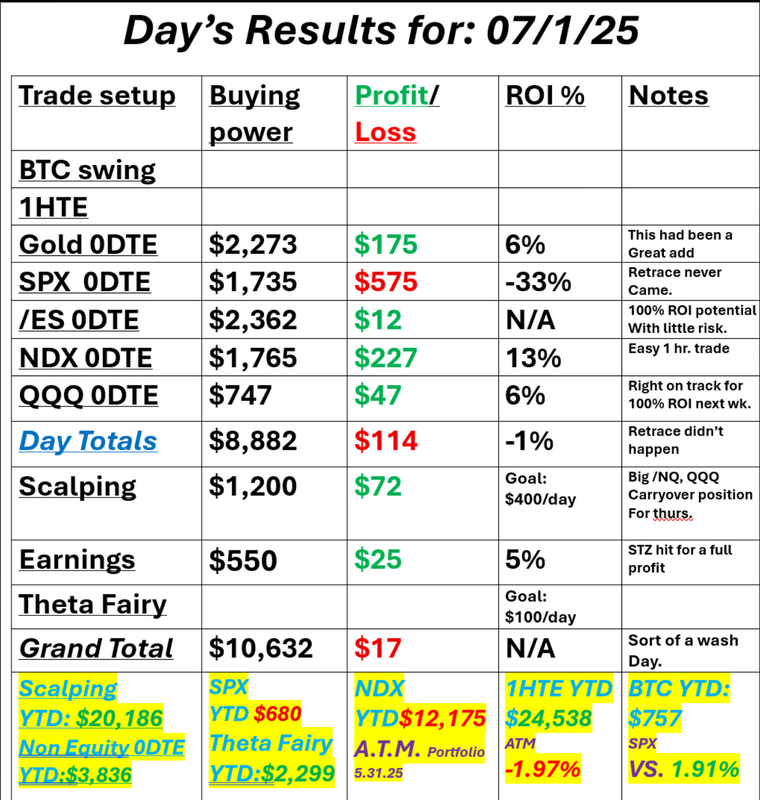

Happy independence day!Welcome back to a holiday shortened trading session today. The 4th of July holiday is a big thing to Americans and I can say, as an American who has lived in different countries and extensively traveled the entire globe, There is no more free place to live in the world. Do we have problems? Yes, and that will always be the case but I'm grateful for the freedoms we have. We had an "O.K." day yesterday. No, we didn't make any money but we had some great potential that just didn't hit. I was looking for a retrace yesterday and it just never came. Take a look at my day yesterday: We've got a shortened trading session today so we'll concentrate our focus to our scalps that we rolled from yesterday. We have a QQQ put position on that we'll turn into a debit spread to get some capital back and we have a big /NQ hedge against it. It these both hit we'll have a $1000+ profit day which is all we ask for. September S&P 500 E-Mini futures (ESU25) are up +0.03%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.08% this morning as investors sit on their hands ahead of the all-important U.S. payrolls report that will offer fresh insight into the labor market and the path of interest rates. Investors are also keeping an eye out for any updates on trade deals. Reuters reported that U.S. and India trade negotiators were working on Wednesday to secure a tariff-reducing deal ahead of the July 9th deadline, though disagreements over U.S. dairy and agriculture remained unsettled. Also, European Union trade chief Maros Sefcovic is set to meet with his counterparts today in Washington as the bloc scrambles to reach a deal before the July 9th deadline. U.S. President Donald Trump’s massive tax and spending bill remains in focus as well. The Republican-controlled U.S. House of Representatives on Thursday advanced President Trump’s tax bill, a procedural step that paves the way for potential passage of the legislation in a vote expected later in the day. Once the bill clears the House again, it will head to Trump’s desk, where he has long awaited the opportunity to sign it into law. The U.S. stock markets will close early at 1 p.m. Eastern Time today and remain closed on Friday for the Independence Day holiday. In yesterday’s trading session, Wall Street’s major indices closed mixed. Tesla (TSLA) advanced over +4% after the electric vehicle company reported better-than-feared Q2 deliveries. Also, chip stocks gained ground, with NXP Semiconductors N.V. (NXPI) and ON Semiconductor (ON) rising more than +4%. In addition, Nike (NKE) climbed over +4% and was the top percentage gainer on the Dow after President Trump said the U.S. reached a trade deal with Vietnam. On the bearish side, Centene (CNC) plummeted more than -40% and was the top percentage loser on the S&P 500 after the health insurer withdrew its full-year profit guidance. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls unexpectedly fell -33K in June, weaker than expectations of +99K and the first decline in 2-1/4 years. “The ADP report increased the odds of a downside surprise in Thursday’s nonfarm payroll release,” said Jeff Roach at LPL Research. “Investor jitters could be a catalyst for a drop in yields [today] if the jobs report is weaker than expected. I expect a weaker-than-consensus report, increasing the odds the Fed cuts three times this year.” Traders increased bets on at least two rate cuts this year following the weak ADP data, with the first expected in September. Meanwhile, U.S. rate futures have priced in a 74.7% chance of no rate change and a 25.3% chance of a 25 basis point rate cut at the conclusion of the Fed’s July meeting. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that June Nonfarm Payrolls will come in at 111K, compared to the May figure of 139K. A survey conducted by 22V Research revealed that investors are paying closer attention to the key jobs report than usual this time and are anticipating a weaker print. Among the respondents, 44% expect the data to be “mixed/negligible,” 41% anticipate a “risk-off” reaction, and only 15% expect a “risk-on” response. Investors will also focus on U.S. Average Hourly Earnings data. Economists expect June figures to be +0.3% m/m and +3.9% y/y, compared to the previous numbers of +0.4% m/m and +3.9% y/y. The U.S. Unemployment Rate will be reported today. Economists forecast that this figure will creep up a tick to 4.3% in June from 4.2% in the prior month. The U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI will be closely monitored today. Economists expect the June ISM services index to be 50.8 and the S&P Global services PMI to be 53.1, compared to the previous values of 49.9 and 53.7, respectively. U.S. Factory Orders data will come in today. Economists foresee the May figure jumping +8.1% m/m, compared to -3.7% m/m in April. U.S. Trade Balance data will be released today. Economists anticipate the trade deficit will widen to -$69.90B in May from -$61.60B in April. U.S. Initial Jobless Claims data will be released today as well. Economists expect this figure to be 240K, compared to last week’s number of 236K. In addition, market participants will be looking toward a speech from Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.256%, down -0.79%. Trade docket today is concentrated today with just a half day. We'll work another QQQ 0DTE. We may have the potential for a take profit on GNE and PGCE. We'll put on a very small SPX 0DTE butterfly or something similar with little risk. Our big focus for today is our QQQ scalp with /NQ hedge. That trade alone could get us our $1,000+ profit goal today. Trading volume should be light today. We don't need levels or much technical guidance today with our focus and approach today. We will have a zoom live feed for the few hours we are trading today so I'll see you all there!

|

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |