|

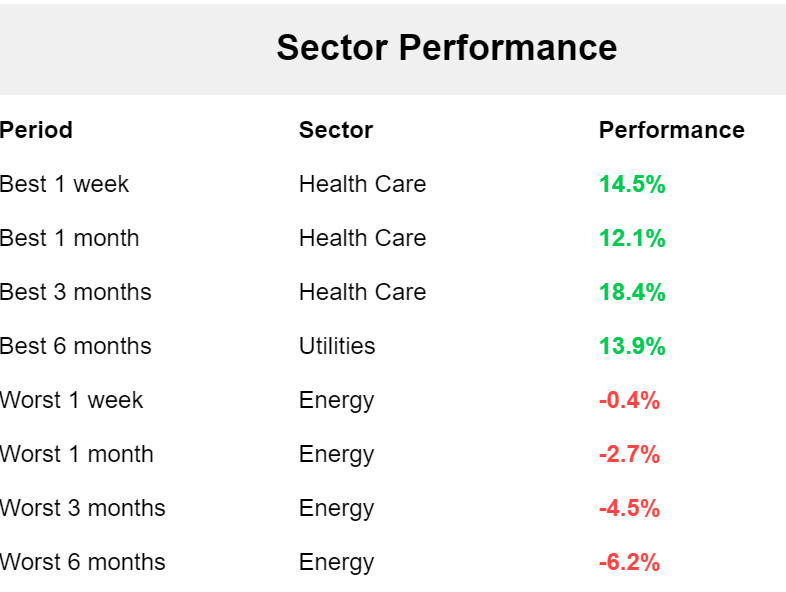

Welcome to a new month traders! We finished off the month strong! We've been on a nice run lately. Check out our results below. We've had a stellar few weeks. It's a nice feeling. It wasn't that long ago that we had three losing days in a row. That's a whole different feeling. Emotions are such a big part of trading. Bullish bias is still in place. Markets are still hanging around their ATH's. 83% of S&P 500 stocks are above their 50-day average 73.6% of S&P 500 Stocks are within 10% of their 52-week Highs... This is the highest level since July 2021 December S&P 500 E-Mini futures (ESZ24) are down -0.13%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.06% this morning as investors awaited the latest reading on U.S. job openings, comments from Federal Reserve officials, and an earnings report from the world’s largest shoemaker Nike. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Apple (AAPL) rose over +2% and was the top percentage gainer on the Dow after JPMorgan Chase noted that lead times for the latest iPhone indicate that initially slower demand for Pro models was “starting to correct.” Also, CVS Health (CVS) gained more than +2% after the Wall Street Journal reported that hedge fund Glenview Capital Management is scheduled to meet with CVS Health’s top executives to suggest operational improvements. In addition, FedEx (FDX) advanced over +2%, and United Parcel Service (UPS) rose more than +1% after Stifel stated that the companies are the “most obvious beneficiaries” of extended disruption due to an impending port workers’ strike. On the bearish side, Boeing (BA) fell over -2% and was the top percentage loser on the Dow after the machinists union announced that negotiations to resolve the strike with the company had collapsed, with no further talks scheduled. Also, chip stocks came under pressure as Treasury yields climbed, with Micron Technology (MU) slumping more than -3% and On Semiconductor (ON) falling over -2%. Economic data released on Monday showed that the Chicago PMI unexpectedly edged up to 46.6 in September, stronger than expectations of 46.1. Fed Chair Jerome Powell said Monday that the central bank will reduce interest rates “over time” while reiterating that the overall economy continues to be on solid footing. Powell also reaffirmed his belief that inflation will keep moving toward the central bank’s 2% target, adding that current economic conditions “set the table” for a continued easing of price pressures. At the same time, he noted that the U.S. did not yet have the data necessary to make a decision regarding the November meeting. Also, Atlanta Fed President Raphael Bostic stated he would be open to another half-percentage-point interest rate cut at the November meeting if forthcoming data indicate job growth is slowing more rapidly than anticipated. “A surprise to the weak side .... would pull me much further into really needing another dramatic move,” Bostic said in an interview with Reuters. Meanwhile, U.S. rate futures have priced in a 64.7% chance of a 25 basis point rate cut and a 35.3% chance of a 50 basis point rate cut at the conclusion of the Fed’s November meeting. On the earnings front, notable companies like Nike (NKE), Paychex (PAYX), and McCormick & Co. (MKC) are set to report their quarterly figures today. On the economic data front, all eyes are focused on the U.S. JOLTs Job Openings data, which is set to be released in a couple of hours. Economists, on average, forecast that the August JOLTs Job Openings will stand at 7.640M, compared to July’s figure of 7.673M. Also, investors will focus on the U.S. ISM Manufacturing PMI, which stood at 47.2 in August. Economists foresee the September figure to be 47.6. The U.S. S&P Global Manufacturing PMI will come in today. Economists expect September’s figure to be 47.0, compared to 47.9 in August. U.S. Construction Spending data will be reported today as well. Economists foresee this figure to stand at +0.2% m/m in August, compared to the previous number of -0.3% m/m. In addition, market participants will be looking toward speeches from Atlanta Fed President Raphael Bostic, Fed Governor Lisa Cook, Boston Fed President Susan Collins, and Richmond Fed President Thomas Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.750%, down -1.57%. Trade docket for today: /ES (theta fairy), /MNQ,QQQ scalps, /NG, /ZC, FDX, LW/NWL, MRK/MRNA, SPY, 2 new pairs trades, 0DTE's NKE, LW. Let's look at intra-day 0DTE levels: /ES; 5822 is the first resistance with 5830 being the big one. It's our ATH. 5797 is first support and 5788 the next which is also the PoC on the 2hr. chart. /NQ: 20331 is the first resistance and 20438 is the next. Support is 20213 which is PoC on 2hr. chart with 20159 as the next. Bitcoin: BTC has had a nice run but looks to be rolling over a bit. 65117 is current resistance with 63045 is support. Let's have a great day folks! See you in the trading room.

0 Comments

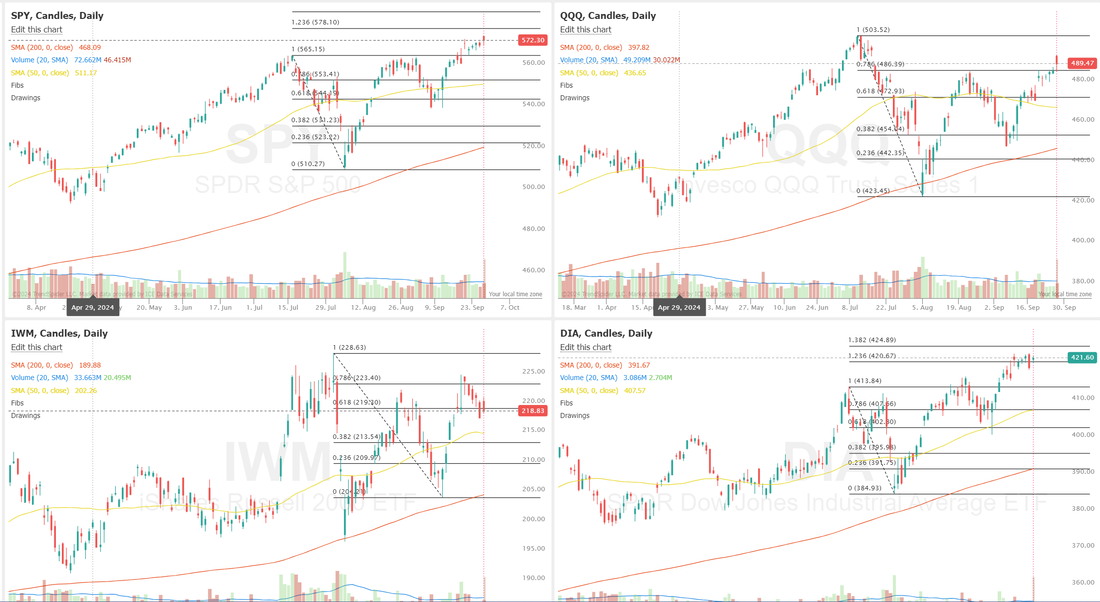

Welcome back traders! A new week and the last trading day of Sept. The wifes already breaking out the Halloween stuff. We had an excellent day Friday. Our event contracts played a big roll in that. Once again, our NDX trades offered the most potential and also the most risk. We had an E.C. NDX trade on that would pay our almost a 300% return if it hit. That allowed us to sit in our other NDX trades until the close. It became a sacrifice to the greater good. See our results below: The markets have had a nice, long run. They are starting to look tired here. Rolling over from a buy mode to an ever so slight sell mode. You can see the trend (bullish) and the length (almost three weeks) of an uptrend but, you can also see it starting to fade. Let's take a look at some of the statistics. The SPY remained the leader this week, surging above a rising 8 EMA and setting yet another new all-time high before closing just lower at $571.47 (+0.61%). Traders will be closely monitoring the $565 level on any pullback, as this former resistance throughout the summer could now serve as support if momentum weakens next week. After weeks of anticipation, QQQ finally managed to fill the July gap but immediately got rejected and closed the week at $486.75 (+0.89%). While the price is powering higher above the 8 EMA, bulls should watch the $489 area closely, as it has served as key resistance since early summer. If the index is to reach new all-time highs soon, it will need to dig in here. Despite a rough start to the week, IWM found support at the 8 EMA, closing just below the large volume nodes and ending the week at $220.33 (-0.59%). Now, the $225 level comes into focus. Having acted as strong resistance since early July, this is the key level the index needs to break through to continue its push higher. Let's look at the expected moves this week: We've got some solid I.V. to work with this week. In fact, we've got a Theta fairy working right now that we put on Sunday evening. I'm not sure how many more we'll get this week but it looks somewhat promising. December S&P 500 E-Mini futures (ESZ24) are down -0.29%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.31% this morning as market participants looked ahead to remarks from Federal Reserve Chair Jerome Powell and other Fed officials as well as a fresh batch of U.S. labor market data, with a particular focus on Friday’s nonfarm payrolls report. In Friday’s trading session, Wall Street’s major averages closed mixed. HP Inc. (HPQ) slumped nearly -4% after Bank of America downgraded the stock to Neutral from Buy. Also, chip stocks lost ground, with Marvell Technology (MRVL) sliding more than -3% to lead losers in the Nasdaq 100 and Applied Materials (AMAT) dropping over -2%. In addition, Costco Wholesale (COST) fell more than -1% after the company reported weaker-than-expected Q4 revenue. On the bullish side, Wynn Resorts (WYNN) climbed over +7% and was the top percentage gainer on the S&P 500 after Morgan Stanley upgraded the stock to Overweight from Equal Weight with a price target of $104. Data from the U.S. Department of Commerce released on Friday showed that the core PCE price index, a key inflation gauge monitored by the Fed, came in at +0.1% m/m and +2.7% y/y in August, compared to expectations of +0.2% m/m and +2.7% y/y. Also, U.S. August personal spending rose +0.2% m/m, weaker than expectations of +0.3% m/m, while August personal income grew +0.2% m/m, weaker than expectations of +0.4% m/m. In addition, the University of Michigan U.S. consumer sentiment index was revised upward to a 5-month high of 70.1 in September, stronger than expectations of 69.0. “Add [Friday’s] PCE price index to the list of economic data landing in a sweet spot,” said Chris Larkin, managing director, trading and investing, at E*Trade. “Inflation continues to keep its head down, and while economic growth may be slowing, there’s no indication it’s falling off a cliff.” St. Louis Fed President Alberto Musalem stated on Friday that the U.S. central bank should reduce interest rates “gradually” following what he described as the “strong and clear message” of a half-point interest rate cut, which he endorsed. “For me, it’s about easing off the brake at this stage. It’s about making policy gradually less restrictive,” Musalem said in an interview with the Financial Times. If the economy or the labor market deteriorates more than anticipated, he noted, “a faster pace of rate reductions might be appropriate.” U.S. rate futures have priced in a 58.5% chance of a 25 basis point rate cut and a 41.5% probability of a 50 basis point rate cut at the next central bank meeting in November. In the coming week, the U.S. Nonfarm Payrolls report for September will be the main highlight. Also, market participants will be eyeing a spate of other economic data releases, including U.S. JOLTs Job Openings, S&P Global Manufacturing PMI, Construction Spending, ISM Manufacturing PMI, ADP Nonfarm Employment Change, Crude Oil Inventories, Initial Jobless Claims, S&P Global Composite PMI, S&P Global Services PMI, Factory Orders, ISM Non-Manufacturing PMI, Average Hourly Earnings, and the Unemployment Rate. Meanwhile, Fed Chairman Jerome Powell is set to deliver a speech at the annual meeting of the National Association for Business Economics in Nashville later today. A host of other Fed officials will also be making appearances throughout the week, including Bowman, Bostic, Cook, Collins, Barkin, and Williams. Several notable companies like Nike (NKE), Carnival (CCL), Paychex (PAYX), McCormick & Company (MKC), and Levi Strauss (LEVI) are slated to release their quarterly results this week. Today, investors will focus on the U.S. Chicago PMI, which is set to be released in a couple of hours. Economists forecast that the Chicago PMI will stand at 46.1 in September, matching last month’s value. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.785%, up +0.89%. My bias or lean today is bearish. I think its about time we start to build on this rollover momentum from Friday. Trade docket for today: /ES (Theta fairy), /MNQ,QQQ scalping. IWM, BB?, FSLR, WYNN, UPST, ORCL, CRM, PYPL, SHOP, SPY/QQQ, 0DTE's I look forward to seeing you all in the live trading room!

Welcome back traders. We've had a really stellar week so far. Yesterday was amazing for us. It wasn't easy. We had both our put side and call side threatened on our NDX trades but we navigated it well. Is was another "excellent" day for us will all our day trades producing profit and my net liq up almost $6,000 dollars. Our Nat gas and Corn trade are positioned to really generate some income over the next month. Here's a look at our results. Markets are still working the bullish bias. While the bullishness persists, I continue to look to establish a short, cash flow setup for the DIA in both our model portfolio and the A.T.M. program. It's looking a little toppy. December S&P 500 E-Mini futures (ESZ24) are trending down -0.04% this morning as investors braced for the release of the Federal Reserve’s first-line inflation gauge, which will offer further insights into the trajectory of U.S. interest rates. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Micron Technology (MU) surged over +14% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the memory chipmaker posted upbeat Q4 results and provided a strong Q1 revenue forecast. Also, Southwest Airlines (LUV) climbed more than +5% after the carrier lifted its Q3 revenue-per-capacity guidance and unveiled a new $2.5 billion stock buyback program. In addition, Accenture (ACN) gained over +5% after the company reported better-than-expected Q4 results and issued above-consensus Q1 revenue guidance. On the bearish side, Super Micro Computer (SMCI) tumbled over -12% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the Wall Street Journal reported the U.S. Justice Department is investigating the company. The U.S. Commerce Department said Thursday that the Q2 GDP growth estimate remained at +3.0% (q/q annualized) in its final print, in line with expectations. Also, U.S. August durable goods orders were unchanged m/m, better than the -2.8% m/m expected, while core durable goods orders rose +0.5% m/m, stronger than expectations of +0.1% m/m. In addition, U.S. pending home sales rose +0.6% m/m in August, weaker than expectations of +0.9% m/m. Finally, the number of Americans filing for initial jobless claims in the past week unexpectedly fell -4K to a 4-month low of 218K, compared with 224K expected. “If there’s a problem in the labor market, it’s not showing up in the weekly jobless claims data. Numbers like this will likely keep soft-landing hopes alive and well,” said Chris Larkin at E*Trade from Morgan Stanley. Fed Governor Lisa Cook stated Thursday that she “wholeheartedly” backed the central bank’s decision last week to reduce interest rates by a half percentage point, pointing to a cooling labor market and easing inflation. “In thinking about the path of policy moving forward, I will be looking carefully at incoming data, the evolving outlook, and the balance of risks,” Cook said. Meanwhile, U.S. rate futures have priced in a 49.2% chance of a 25 basis point rate cut and a 50.8% probability of a 50 basis point rate cut at the November FOMC meeting. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.7% y/y in August, compared to the previous figures of +0.2% m/m and +2.6% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists forecast August Personal Spending to be at +0.3% m/m and August Personal Income to come in at +0.4% m/m, compared to the July numbers of +0.5% m/m and +0.3% m/m, respectively. U.S. Wholesale Inventories preliminary data will come in today. Economists anticipate the August figure to be +0.2% m/m, matching the +0.2% m/m recorded in July. The U.S. Michigan Consumer Sentiment Index will be reported today as well. Economists estimate this figure to arrive at 69.0 in September, compared to 67.9 in August. In addition, market participants will be looking toward a speech from Fed Governor Michelle Bowman. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.783%, down -0.32%. My bias or lean today is more neutral. Once again, we've got bullish price action thats looking more and more like its running out of steam. Super low volume with less and less buyers showing up. Trade docket for today: /MNQ and QQQ for scalping. BB, COSt, CRM, FDX, NEM, IWM?, ORCL, PYPL, QQQ/SPY, SHOP, UPST, 0DTE's. Let's take a look at the intra-day levels for 0DTE's. /ES: The market appears to be flattening out. 5814 is first resistance with 5821 following and 5830 being the big one. This is the ATH. 5800 is first support with 5790 then 5771 the big one. It's PoC on 2hr. chart. /NQ: Nasdaq is still lagging the SP500 in terms of performance. 20419 is first resistance with 20468 next. 20536 is the recent high and a push above that would be very bullish. 20231 is the main support level target. Its the 50 period M.A. on the 2 hr. chart. Below that we could see a decent sized retrace. BTC: Bitcoin has been on a very nice run this whole month. 66,000 is the key upside resistance level with 64752 as support. Let's finish strong today, going into the weekend!

Welcome to Thursday! Our weeks been pretty good and yesterday continued that trend. We had another "excellent" day with both our day trades making money AND our net liq was up. That was a bit of a surprise as our Nat gas trade hurt us yesterday after helping us on Weds. A couple of notes about yesterday. We rolled some of our SPX puts to today. Those obviously look great this morning with futures up. Our NDX event contract made us 220% ROI but has a 1,100% potential. These setups can be fantastic every once in a while. They are a valuable addition to our 0DTE's. If you're not trading them with us I invite you to come check them out. No cost to open an account and you can start trading with $20 dollars. Come give it a go! Here's a look at our day yesterday. It was pretty darn solid. Futures are popping today with MU earnings helping to the upside. We have an MU earnings trade working and that should cash flow perfectly for us today. December Nasdaq 100 E-Mini futures (NQZ24) are trending up +1.33% this morning as market participants cheered forecast-beating quarterly results and guidance from semiconductor giant Micron, while also awaiting a flurry of U.S. economic data and remarks from Federal Reserve officials. Micron Technology (MU) surged over +15% in pre-market trading after the memory chipmaker reported stronger-than-expected Q4 results and provided above-consensus Q1 guidance. In yesterday’s trading session, Wall Street’s major indices closed mixed. Global Payments (GPN) slumped over -6% and was the top percentage loser on the S&P 500 after BTIG, William Blair, and Seaport Research downgraded the stock. Also, KB Home (KBH) slid more than -5% after the homebuilder reported weaker-than-expected Q3 EPS. In addition, General Motors (GM) fell over -4% after Morgan Stanley downgraded the stock to Underweight from Equal Weight with a price target of $42. On the bullish side, Vistra (VST) climbed about +6% and was the top percentage gainer on the S&P 500 after Morgan Stanley raised its price target on the stock to $132 from $110. Also, chip stocks advanced, with Intel (INTC) rising over +3% to lead gainers in the Dow and Nvidia (NVDA) gaining more than +2%. Economic data released on Wednesday showed that U.S. new home sales fell -4.7% m/m to 716K in August, a smaller decline than expectations of 699K. Fed Governor Adriana Kugler stated on Wednesday that she “strongly supported” the U.S. central bank’s decision last week, noting that it would be appropriate to implement additional rate cuts if inflation continues to ease as anticipated. “The labor market remains resilient, but the FOMC now needs to balance its focus so we can continue making progress on disinflation while avoiding unnecessary pain and weakness in the economy as disinflation continues in the right trajectory,” Kugler said. U.S. rate futures have priced in a 39.3% chance of a 25 basis point rate cut and a 60.7% chance of a 50 basis point rate cut at November’s monetary policy meeting. Meanwhile, Fed Chair Jerome Powell is scheduled to deliver pre-recorded opening remarks at the 2024 U.S. Treasury Market Conference later in the day. Also, a slew of other Fed officials will speak today, including Collins, Bowman, Williams, Kugler, Cook, and Kashkari. On the earnings front, notable companies like Costco Wholesale (COST), Accenture (ACN), Jabil Circuit (JBL), and CarMax (KMX) are slated to release their quarterly results today. On the economic data front, all eyes are on the Commerce Department’s final estimate of gross domestic product, which is set to be released in a couple of hours. Economists, on average, forecast that U.S. GDP will stand at +3.0% q/q in the second quarter, compared to the first-quarter figure of +1.4% q/q. Also, investors will focus on U.S. Durable Goods Orders data, which came in at +9.9% m/m in July. Economists foresee the August figure to be -2.8% m/m. U.S. Core Durable Goods Orders data will be reported today. Economists estimate this figure to come in at +0.1% m/m in August, compared to the previous number of -0.2% m/m. U.S. Pending Home Sales data will come in today. Economists expect the August figure to be +0.9% m/m, compared to the previous figure of -5.5% m/m. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 224K, compared to last week’s number of 219K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.776%, down -0.24%. Technicals are now pinned to the upside with bullishness. Price action continues to support the bullish bias. Charlie once again putting up some interesting data. US Small Caps are up 7% over the last 10 trading days while US Large Caps are down 4%. The 11% spread is the largest 10-day Small Cap outperformance ever. $IWM $SPY This could be an interesting setup for a pairs trade. Trade docket for today: /MCL, /MNQ and QQQ scalping, FSLR, IWM, MU, SPY?, GLD/NEM, ORCL? COST, BB 0DTE's. My bias and lean today has to be bullish. The futures are just up too much to be anything else. Let's see if we can find some intra-day 0DTE levels: /ES; Futures are pumping today! Two key levels for me. 5865 is the resistance level and 5806 is the support. Between those levels is just meaningless chop for me. /NQ; The Nasdaq is doing everything it can to catch up to the other indicies. The push higher is impressive. The moves are big enough now that I'm looking at levels on a one day chart vs. the normal 2-4 hr. chart. The next big resistance area is at 20677 with support at 20029. BTC: Bitcoin has been firming up quite nicely. I've got a binary trade on BTC that is will NOT hit a new ATH this year. It's got a 110% ROI potential. Chech out our binary trade link. these are some of the funnest trades we do. Key levels for me today. 65,831 is resistance and 62,839 is support. Let's have a great day. I'll see you all in the trading room!

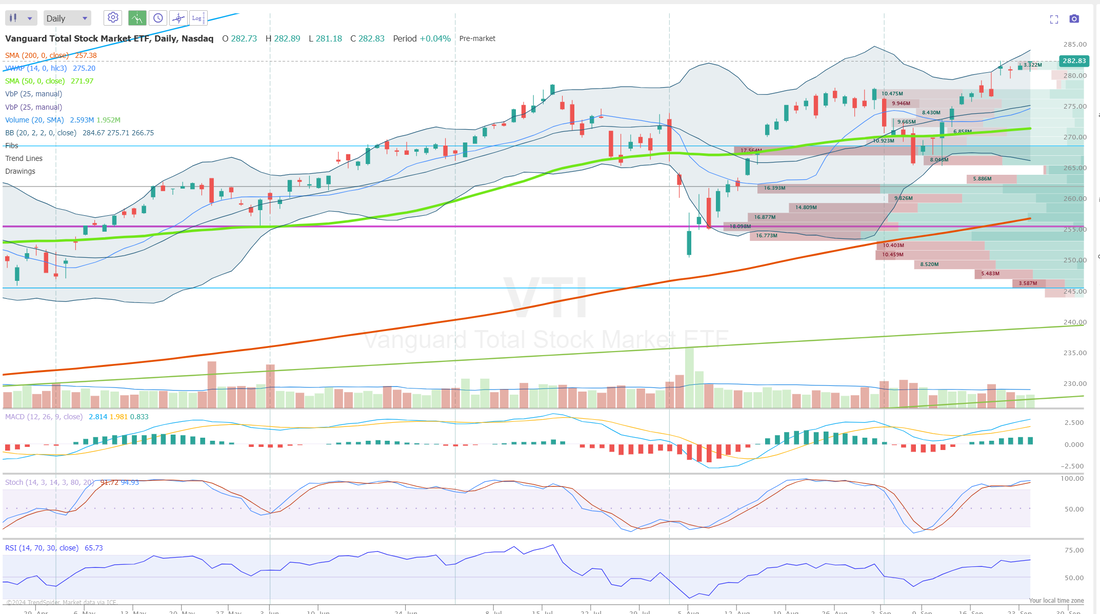

Welcome back traders. Midweek already! We has an 'excellent" day yesterday. We made some great profits on our day trades and our net liq was up. Here's a snapshot of our results. Markets are still tilting bullish However, we are looking to start a bearish hedge soon in our ATM program. Keep your eye on the VTI. It certainly looks top heavy. Once we get some sell signals we'll get a bearish setup working. Markets have been strong but the IWM seems to want to retrace and the QQQ's are still lagging behind. December S&P 500 E-Mini futures (ESZ24) are trending down -0.02% this morning, taking a breather after the benchmark index finished with its 41st record close this year, while investors looked ahead to remarks from a Federal Reserve official as well as an earnings report from semiconductor giant Micron. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green, with the benchmark S&P 500 and blue-chip Dow notching new all-time highs and the tech-heavy Nasdaq 100 posting a 2-1/4 month high. Nvidia (NVDA) climbed about +4% following a report from Barron’s that the company’s chief executive officer, Jensen Huang, was done selling his shares. Also, stocks exposed to China surged after Beijing announced a slew of stimulus measures, with JD.com (JD) soaring more than +13% and PDD Holdings (PDD) advancing over +11% to lead gainers in the Nasdaq 100. In addition, Uber Technologies (UBER) rose more than +3% after Raymond James resumed coverage of the stock with a Strong Buy rating and a price target of $90. On the bearish side, Visa (V) slumped over -5% and was the top percentage loser on the Dow after the U.S. Justice Department filed a lawsuit against the company, alleging that it illegally monopolized the U.S. debit card market. Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index unexpectedly fell to 98.7 in September, missing the 103.9 consensus and marking the biggest drop since August 2021. Also, the U.S. July S&P/CS HPI Composite - 20 n.s.a. eased to +5.9% y/y from +6.5% y/y in June, in line with expectations. In addition, the U.S. Richmond Fed manufacturing survey unexpectedly fell to a 4-1/3 year low of -21 in September, weaker than expectations of -13. “We got a little bit of cold water with the consumer confidence number [yesterday morning] that might add to concerns the Fed may have been a little late,” said Michael James, senior vice president of equity trading at Wedbush Securities. Meanwhile, Fed Governor Michelle Bowman stated Tuesday that the central bank should reduce interest rates at a “measured” pace, noting that inflationary risks persist and the labor market has not shown significant weakening. “Turning to the risks to achieving our dual mandate, I continue to see greater risks to price stability, especially while the labor market continues to be near estimates of full employment,” Bowman said. U.S. rate futures have priced in a 41.8% probability of a 25 basis point rate cut and a 58.2% chance of a 50 basis point rate cut at the next FOMC meeting in November. On the earnings front, notable companies like Micron Technology (MU), Cintas (CTAS), and Jefferies Financial (JEF) are set to report their quarterly figures today. On the economic data front, investors will focus on U.S. New Home Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that August New Home Sales will stand at 699K, compared to the previous figure of 739K. U.S. Building Permits data will also be released today. Economists expect the August figure to be 1.475M, compared to 1.406M in July. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -1.300M, compared to last week’s value of -1.630M. In addition, market participants will be anticipating a speech from Fed Governor Adriana Kugler. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.750%, up +0.32%. My bias or lean today in more neutral. Signals are are still bullish but we look "toppy" here and the volume yesterday was horrible. S&P 500 IS AS EXPENSIVE AS DURING THE DOT-COM BUBBLE 90% of the market sectors have their P/E ratios in the top 25% historically. This is in line with levels seen during the Dot-Com Bubble and before the 2022 bear market. Long-term expected returns are not promising now. I believe the next top will be formed with a classic bearish divergence. This indicates a rally for the SPX of approximately 5.5%, with a top between @ 6,015/30, according to a projection from current RSI(14) levels. If confirmed, a 17% pullback is likely. Dow Jones $DJI has broken through the 125 year resistance trendline. In 1929 it broke through for 1 month before beginning its -90% collapse over the next 3 years None of this implies the markets are getting ready to crash and I'm not prediciting anything! It's just important to look at valuations from time to time and understand we are getting into that "priced to perfection" area. Be prepared. Trade docket for today: Big day with our Nat gas trade. /NG. Working scalps agian starting with /MNQ futures and then moving into QQQ's. I'll look to add some more cash flow to our /ZC corn trade. KBH earnings trade should be profitable for us today. MU earnings and, of course, our seven potential 0DTE's. Let's take a look at some key intra-day levels for 0DTE's. /ES: There's a couple critical levels. 5794 on the upside is close but also substantial resistance. 5800 would be the next resistance level. These are big levels. A break above would be very bullish. 5778 is first support with 5771 being the next. It's also the PoC on the 2 hr. chart. /NQ: 20183 is the first resistance. The Nasdaq has been the laggard in this rally. It needs to break some of these resistance levels to come join the bullish party. 20215 is the big one. This has been a tough level for bulls. A break above would really solidify this rally. 20066 is first support with 20042 being the PoC on the 2hr. chart. A break below that is full on bearish mode for me. Bitcoin has had a nice run. I've got a trade on in our binary brokerage that pays 110% ROI if BTC does NOT finish at an ATH by the end of they year. I don't think it will but if it does my BTC, ETH, POLK would love it. If it doesn't, 110% ROI would help. Levels for BTC today are 65000 on the resistance side and 62750 on the support side. Let's "trade to trade well" folks and let the chips fall where they may! Have a great day.

Welcome back traders! A little technical challenge so todays blog will be short. I'l put up our intra-day levels in the trading room. We had a stellar day yesterday. Not an "excellent" day though. Our net liq was hurt with the push in Nat gas but everything we traded intra-day worked. See our results below. December S&P 500 E-Mini futures (ESZ24) are up +0.21%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.30% this morning as global risk sentiment got a boost after Beijing announced one of its most aggressive economic stimulus packages since the pandemic. In yesterday’s trading session, Wall Street’s major indexes closed in the green. Tesla (TSLA) climbed nearly +5% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after Barclays said it expects the company’s Q3 deliveries to exceed consensus estimates, which could drive continued stock strength. Also, Intel (INTC) advanced more than +3% and was the top percentage gainer on the Dow after Bloomberg reported that Apollo Global Management had offered to make a multibillion-dollar investment in the chipmaker. In addition, Walmart (WMT) gained over +1% after Melius Research LLC initiated coverage of the stock with a Buy rating and a price target of $95. On the bearish side, Regeneron Pharmaceuticals (REGN) slid more than -4% and was the top percentage loser on the S&P 500 and Nasdaq 100 after a federal judge in West Virginia rejected the company’s motion for a temporary injunction against Amgen, which recently received FDA approval for the biosimilar eye drug Pavblu. Economic data released on Monday showed that the U.S. S&P Global manufacturing PMI unexpectedly fell to 47.0 in September, weaker than expectations of 48.6 and the steepest pace of contraction in 15 months. Also, the U.S. September S&P Global services PMI fell to 55.4, better than expectations of 55.3. “This is a somewhat inconclusive report, and therefore it shouldn’t alter Fed expectations dramatically,” said Adam Crisafulli at Vital Knowledge. “The flash PMIs do suggest the U.S. economy is on reasonably sound footing, especially compared to Europe.” Chicago Fed President Austan Goolsbee stated on Monday that interest rates need to be reduced “significantly” to protect the U.S. labor market and bolster the economy. “As we’ve gained confidence that we are on the path back to 2%, it’s appropriate to increase our focus on the other side of the Fed’s mandate - to think about risks to employment,” Goolsbee said. “That likely means many more rate cuts over the next year.” Also, Minneapolis Fed President Neel Kashkari said that he anticipates lowering interest rates by smaller, quarter-point moves at each of the central bank’s two remaining meetings this year. “As we go forward, I expect, on balance, we will probably take smaller steps unless the data changes materially,” Kashkari said. Meanwhile, U.S. rate futures have priced in a 49.1% probability of a 25 basis point rate cut and a 50.9% chance of a 50 basis point rate cut at the November FOMC meeting. Today, all eyes are focused on the U.S. Conference Board’s Consumer Confidence Index, set to be released in a couple of hours. Economists, on average, forecast that the September CB Consumer Confidence index will stand at 103.9, compared to last month’s figure of 103.3. Also, investors will focus on the U.S. S&P/CS HPI Composite - 20 n.s.a., which arrived at +6.5% y/y in June. Economists foresee the July figure to be +5.9% y/y. The U.S. Richmond Manufacturing Index will be reported today as well. Economists estimate this figure to come in at -13 in September, compared to the previous value of -19. In addition, market participants will be anticipating a speech from Fed Governor Michelle Bowman. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.791%, up +1.38%. Trade docket for today: /MNQ, QQQ scalps, /NG, /ZC?, AZO?, IWM, KBH, SPY/QQQ 3DTE, 0DTE's. My lean or bias today continues to be bullish: See you all in the trading room! Let's try to replicate our success from yesterday!

Good Monday morning traders! I hope your weekend was great. We got out of the house and did some Mtn. biking and hiking. It's always nice to get out and recharge the batteries. Don't let trading wear you down. It can be all consuming. We had an fantastic Friday. See our results below: It was an amazing day. It's rare that everything we touch works but that was the case Friday. Let's take a look at whats coming this week: Despite hitting new all-time highs, the SPY was the weakest performer in percentage terms, finding resistance at the upper Bollinger Band and closing the week at $568.25 (+1.10%). Notably, the last two reversals were signaled by bearish crosses in overbought territory on the Stochastic Oscillator, a pattern that’s reemerging now. The QQQ benefited from the FOMC excitement this week, reaching a new monthly high and closing at $482.44 (+1.49%). However, like the SPY, it’s now showing signs of a potential reversal, with a bearish Stochastic cross forming as the price stalls just below the upper Bollinger Band With their sensitivity to interest rates, the stocks in IWM stand to benefit the most from this week’s rate cut—and the market took notice. The index posted the largest percentage gain, closing the week at $221.57 (+2.18%). A bearish cross of the Stochastics appears imminent while the price is facing resistance at the upper Bollinger Band. Technicals are overstretched to the upside but they continue to flash buy signals Let's take a look at the expected moves this week: I.V. is back to a more "normal" level. This may put an end to our Theta fairy's for a bit. December S&P 500 E-Mini futures (ESZ24) are up +0.19%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.25% this morning as market participants looked ahead to speeches from Federal Reserve officials, earnings reports from several notable companies, and the release of the Fed’s favorite inflation gauge later in the week. In Friday’s trading session, Wall Street’s major averages ended mixed. FedEx (FDX) plunged over -15% and was the top percentage loser on the S&P 500 after the delivery services giant reported weaker-than-expected Q1 adjusted EPS and cut its full-year guidance. Also, semiconductor stocks lost ground, with ON Semiconductor (ON) slumping more than -5% and GlobalFoundries (GFS) falling nearly -4%. In addition, Lennar (LEN) slid over -5% after the company reported weaker-than-expected Q3 net new orders and offered soft Q4 gross margin guidance. On the bullish side, Nike (NKE) climbed more than +6% and was the top percentage gainer on the Dow after announcing that Elliot Hill will return as President and Chief Executive Officer, effective October 14th. Also, Intel (INTC) gained over +3% after the Wall Street Journal reported that Qualcomm approached the chipmaker about a potential takeover. “The market is still trying to recalibrate because, yes, there were some market participants that may have expected 50 basis points but a lot of people didn't,” said Sid Vaidya, U.S. chief wealth strategist at TD Wealth in New York. Fed Governor Christopher Waller stated Friday that favorable inflation data, rather than concerns about the labor market, persuaded him to back policymakers’ decision to reduce interest rates by a half percentage point at the September FOMC meeting. “What’s got me a little more concerned is inflation is running softer than I thought,” Waller said in an interview on CNBC. Waller noted that he would likely support quarter-point reductions at the next two Fed policy meetings, in November and December, if the economy evolves as he anticipates. “If labor market data worsens, or if the inflation data continues to come in softer than everybody was expecting, then you can see going at a faster pace,” he said. At the same time, Fed Governor Michelle Bowman said that lowering interest rates by 50 basis points could risk signaling that the central bank was declaring victory over inflation prematurely. “The committee’s larger policy action could be interpreted as a premature declaration of victory on our price stability mandate,” Bowman said in a statement released Friday. “I believe that moving at a measured pace toward a more neutral policy stance will ensure further progress in bringing inflation down to our 2% target.” U.S. rate futures have priced in a 48.5% chance of a 25 basis point rate cut and a 51.5% chance of a 50 basis point rate cut at the conclusion of the Fed’s November meeting. In the coming week, the August reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight. Also, investors will be monitoring a spate of other economic data releases, including U.S. GDP (third estimate), CB Consumer Confidence Index, S&P/CS HPI Composite - 20 n.s.a., Richmond Manufacturing Index, Building Permits, New Home Sales, Crude Oil Inventories, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Pending Home Sales, Goods Trade Balance (preliminary), Personal Income, Personal Spending, Wholesale Inventories (preliminary), and Michigan Consumer Sentiment Index. Meanwhile, Fed Chair Jerome Powell is set to deliver pre-recorded opening remarks at Thursday’s 2024 U.S. Treasury Market Conference hosted by the Federal Reserve Bank of New York, marking his first comments since last week’s press conference. A host of other Fed officials will also be making appearances throughout the week, including Bostic, Goolsbee, Kashkari, Bowman, Kugler, Collins, Williams, Cook, and Barr. Several notable companies like Micron Technology (MU), Costco Wholesale (COST), Accenture (ACN), BlackBerry (BB), and AutoZone (AZO) are scheduled to release their quarterly results this week. Today, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, set to be released in a couple of hours. Economists, on average, forecast that the September manufacturing PMI will come in at 48.6, compared to last month’s value of 47.9. Also, investors will focus on the U.S. S&P Global Services PMI, which stood at 55.7 in August. Economists foresee the preliminary September figure to be 55.3. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.747%, up +0.52%. My lean or bias today is slightly bullish. We are entering overbought territory but the technicals are still holding to that bullish bent. Trade docket for today: Back to a full slate after the FOMC past week. /ES (Theta fairy), /MNQ scalping, /ZC, MRK/MRNA pair, AZO, FDX, IWM, /ZN, FSLS, WYNN, UPST, ORCL, CCL, CRM, PLTR, PYPL, SHOP. NOTE: Our earnings plays this week are looking at KBH, MU, COSt, BB, AZO. Let's take a look at our intra-day levels for 0DTE setups. /ES; Resistance is at 5782 with support at 5753. /NQ: The /NQ levels are a bit more "solid" and established, meaning that if these levels break it could be a bigger potential driver for market moves. 20,164 is resistance and 19,949 is support. BTC: Bitcoin has finally had a nice run. It's correlation to equities is amazing. It's been pitched over and over as a non-equity correlated underlying. That certainly hasn't been the case lately. The two key levels today are 64,259 as resistance and 62,432 on the support side. Let's have a great day folks! It's interesting how powerful the mental aspect of trading is. It was great mentally for me to get out this past weekend and enjoy the outdoors....not thinking about trading. Having a strong performance on Fridays is always good. Not just for the wallet but mentally as well. It's a nice topper to the week. Starting our days with a $100 profit in our pocket from a Theta fairy is huge. It doesn't make us rich but mentally its a great way to start the day. Starting the week with a profitable Monday is powerful as well. See you all in the trading room shortly!

Welcome to Friday folks. Well...what a day yesterday. Those types of openings are so rare. Some setups are more apparent than others and yesterday was a pretty high conviction day for me. We had another "excellent" day with our day trades making money and our net liq up nicely on the day. Our results are below. Note: The scalping looks good but the covers are for Monday so they aren't realized yet and not included in the totals and we have two earnings plays from yesterday that aren't realized yet either. Markets are in full blown buy mode after yesterdays monster gains Most of the major indices have pushed to new ATH's with the QQQ's still lagging a bit. Trade docket for today: I don't think we'll do much with the /MNQ scalp. I may add a bit to it for Monday's exp. /ZC (corn) cover is done today! That should be a nice win. FDX and LEN earnings plays will be worked today. IWM, QQQ's should be a big winner for us today. We'll look to add to the put side. All 0DTE's again. September S&P 500 E-Mini futures (ESU24) are down -0.29%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.45% this morning as disappointing earnings results from global economic bellwether FedEx dampened optimism surrounding the outlook for interest rates, while investors geared up for the so-called triple-witching event later in the day. FedEx (FDX) plunged over -13% in pre-market trading after the delivery services giant reported weaker-than-expected Q1 adjusted EPS and cut its full-year guidance. In yesterday’s trading session, Wall Street’s major indexes closed higher, with the benchmark S&P 500 and blue-chip Dow notching new all-time highs and the tech-heavy Nasdaq 100 rising to a 2-month high. Darden Restaurants (DRI) surged over +8% and was the top percentage gainer on the S&P 500 as the announcement of a delivery partnership between its Olive Garden restaurant chain and Uber overshadowed weaker-than-expected Q1 results. Also, megacap technology stocks rallied, with Tesla (TSLA) climbing more than +7% to lead gainers in the Nasdaq 100 and Apple (AAPL) advancing over +3%. In addition, chip stocks gained ground, with Advanced Micro Devices (AMD) and Applied Materials (AMAT) rising more than +5%. On the bearish side, Steelcase (SCS) slumped over -5% after the company reported weaker-than-expected Q2 revenue and provided below-consensus Q3 revenue guidance. “Despite some volatility after the Fed’s rate cut, the S&P 500’s bullish trend remains intact,” said Fawad Razaqzada at City Index and Forex.com. “The Fed’s decision to deliver a 50-basis point rate cut was largely welcomed by investors. The move was seen as a bold but necessary step to ease economic concerns without sending panic signals reminiscent of the 2008 financial crisis.” Economic data released on Thursday showed that the U.S. Philadelphia Fed manufacturing index rose to 1.7 in September, stronger than expectations of -0.8. Also, the number of Americans filing for initial jobless claims in the past week fell -12K to a 4-month low of 219K, stronger than expectations of 230K. In addition, the U.S. leading indicator index fell -0.2% m/m in August, a smaller decline than expectations of -0.3% m/m. At the same time, U.S. existing home sales fell -2.5% m/m to a 10-month low of 3.86M in August, weaker than expectations of 3.92M. U.S. rate futures have priced in a 59.1% chance of a 25 basis point rate cut and a 40.9% chance of a 50 basis point rate cut at the next central bank meeting in November. Meanwhile, Wall Street is preparing for a quarterly event known as triple witching, during which derivatives contracts linked to equities, index options, and futures expire, prompting traders collectively to either roll over their current positions or initiate new ones. About $5.1 trillion worth of options tied to individual stocks, indexes, and exchange-traded funds are set to expire today, according to an estimate from derivatives analytical firm Asym 500. “Triple-witching will likely inject more volatility into the market - we just don’t know which direction,” said Matt Thompson, co-portfolio manager at Little Harbor Advisors. The U.S. economic data slate is empty on Friday. However, investors will likely focus on a speech from Philadelphia Fed President Patrick Harker. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.708%, down -0.03%. Let's take a look at the intra-day 0DTE levels: /ES: New ATH's on the /ES. Key level for bulls today is to break above yesterdays high. That's the focus for today. /NQ: Same focus on /NQ. Watch for a breakout above yesterdays highs for the next trigger. BTC: Bitcoin had a run yesterday, along with equities. We've had a $4,000 dollar push up over the last few weeks. It may be getting a little tired here. 64,067 is resistanceand 62,885 is support. Let's have a great finish to the week folks. I hope you have a great weekend!

Welcome back traders! We had an 'excellent" day yesterday with FOMC. I need to define "excellent" and use that term with more consistency. We measure two key metrics each day. Our Net liq, or account value and whether its going up or down and our day trades. With the Theta Fairy and Scalping it can be nine different trades including all our 0DTE's with our event contracts. Sometimes our day trades can fail to generate a profit but our net liq goes up because of our model portfolio holdings. Likewise, sometimes our day trades make money but our net liq is down on the day because our holdings in the model portfolio go down. Yesterday we had a green number on our net liq. Our accts. went up in value AND, our day trades made money. That's the qualifier for an "excellent" day. FOMC is an interesting day. As traders we KNOW that it's going to offer up the opportunity to make money. It's just up to us as traders to capitalize on what that market gives us. It's not an easy day to trade. It wasn't too messy for us. We could have done better. We could have done worse. Here's a look at our day: Let's look at the markets as we start Thursday after the FOMC day. Technicals are pinned bullish now. Futures are soaring as I type! Looking at the futures we've got the /ES back up to ATH's and DIA (/YM) as well. Trade docket for today: /MNQ scalping, IWM, MU, FDX, LEN, FDS, QQQ, DG/WMT pair, GS/RJF pair, LW/NWL pair, MRK/UNH pair, 0DTE's. My bias or lean today is begrudgingly bullish. I say begrudgingly because the futures are currently pinned to the upside. Obviously bullish but how much more upside do we have today? September S&P 500 E-Mini futures (ESU24) are up +1.48%, and September Nasdaq 100 E-Mini futures (NQU24) are up +2.03% this morning on expectations the Federal Reserve’s half-percentage-point rate cut will steer the U.S. economy toward a “soft landing,” while investors awaited a new round of U.S. economic data and an earnings report from delivery services giant FedEx. The Federal Reserve cut its benchmark interest rate by a half percentage point yesterday, marking its first rate reduction in over four years. The Federal Open Market Committee voted 11 to 1 to reduce the federal funds rate to a range of 4.75% to 5.00% after maintaining it at its highest level in two decades for over a year. In their statement, policymakers indicated they will contemplate “additional adjustments” to rates depending on “incoming data, the evolving outlook, and the balance of risks.” At the same time, Fed Chair Jerome Powell warned not to presume that the half-point move establishes a pace that policymakers will maintain. “This decision reflects our growing confidence that with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2%,” Powell said in a press conference. Projections released after the Fed’s two-day meeting revealed that a slim majority, 10 out of 19 policymakers, supported cutting rates by at least an additional half-point during the two remaining 2024 meetings. Also, Fed officials penciled in an additional percentage point of cuts in 2025, according to their median forecast. “The markets got what they wanted - a big first cut by the Fed. Now we’ll see if they remain satisfied,” said Chris Larkin at E*Trade from Morgan Stanley. “The Fed has a well-deserved reputation for not rushing, so there’s the potential for some disappointment if it’s seen to be moving too slowly, especially if economic data continues to soften. But today they delivered.” In yesterday’s trading session, Wall Street’s major indices ended in the red. ResMed (RMD) slumped over -5% and was the top percentage loser on the S&P 500 after Wolfe Research downgraded the stock to Underperform from Peer Perform with a price target of $180. Also, chip stocks lost ground, with Intel (INTC) sliding more than -3% to lead losers in the Dow and Nasdaq 100 and Nvidia (NVDA) falling nearly -2%. On the bullish side, U.S. Steel (X) advanced over +1% after a U.S. security panel granted Nippon Steel permission to refile its plans to acquire the company for $14.1 billion. In addition, Intuitive Machines (LUNR) surged more than +38% after announcing that it was awarded a NASA contract worth up to $4.82 billion for providing communication and navigation services for near-space missions. Economic data released on Wednesday showed that U.S. building permits, a proxy for future construction, rose +4.9% m/m to a 5-month high of 1.475M in August, stronger than expectations of 1.410M. Also, U.S. August housing starts rose +9.6% m/m to a 4-month high of 1.356M, stronger than expectations of 1.310M. Meanwhile, U.S. rate futures have priced in a 62.9% chance of a 25 basis point rate cut and a 37.1% chance of a 50 basis point rate cut at the next central bank meeting in November. On the earnings front, notable companies like FedEx (FDX), Lennar (LEN), and Darden Restaurants (DRI) are slated to release their quarterly results today. Today, all eyes are focused on the U.S. Philadelphia Fed manufacturing index, set to be released in a couple of hours. Economists, on average, forecast that the September Philadelphia Fed manufacturing index will come in at -0.8, compared to last month’s value of -7.0. Also, investors will focus on U.S. Initial Jobless Claims data. Economists predict this figure will hold steady at 230K, consistent with last week’s number. U.S. Existing Home Sales data will be released today. Economists foresee this figure to stand at 3.92M in August, compared to 3.95M in July. The U.S. Conference Board Leading Index will be reported today as well. Economists expect the August figure to be -0.3% m/m, compared to the previous number of -0.6% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.707%, up +0.38%. Let's take a look at levels today: /ES; Two key levels for me today. 5747 as resistance and 5696 as support. Above is bullish. Below is bearish. /NQ: Two key levels for me in the /NQ as well. 19,856 is resistance and 19659 is support. Above is bullish. Below is bearish. BTC: Bitcoin is popping with equities. 64,402 is resistance. 62,093 is support. We have a heavy trade docket today but it will be a half day for me. I'm headed to a local traders mastermind today just down the road from me at 11:00 am MST so we'll get everything done quickly this morning! Not every day will be "excellent" but let's give is another try!! See you in the trading room!

Good morning all! Welcome to FOMC day! Todays usually a great day for us, opportunity wise. We do a lot of sitting on our hands until Powell speaks and the Algos start doing their thing. I would imagine today will be no different. Yesterdays trading was actually pretty good as far as damage control went. My net liq was us $75 dollars at the end of the day. I'll take it as a victory as we had several trades that needed work. See our results below: Our trade docket for today: Scalping. We've still got our short /MNQ position and I'll look to cover that again today. We should have an opportunity during Powells speech to scalp the QQQ's so be ready for those. Corn (/ZC) looks ready to roll on the cover. IWM needs to be worked. QQQ's will need to be worked again and, or course, all our 0DTE's. No directional bias or support/resistance areas today. The Algos are going to take us where they take us so we'll just remain flexible and sit on our cash until we see an opportunity today. September S&P 500 E-Mini futures (ESU24) are up +0.10%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.09% this morning as caution prevailed ahead of the Federal Reserve’s interest rate decision, with investors split on the size of a potential rate cut. In yesterday’s trading session, Wall Street’s major averages closed little changed. Moderna (MRNA) advanced over +4% and was the top percentage gainer on the Nasdaq 100 after announcing that Health Canada approved its updated COVID-19 vaccine, SPIKEVAX KP.2 variant, for preventing COVID-19 in individuals six months of age and older. Also, Intel (INTC) rose more than +2% and was the top percentage gainer on the Dow after the chipmaker announced a multibillion-dollar agreement to make custom artificial intelligence chips for Amazon’s cloud computing division while also revealing plans to turn its Intel Foundry into a separate subsidiary. In addition, Hewlett Packard Enterprise (HPE) climbed over +5% after BofA upgraded the stock to Buy from Neutral with a price target of $24. On the bearish side, Accenture (ACN) fell more than -4% and was the top percentage loser on the S&P 500 after Bloomberg News reported that the IT and consulting services provider plans to push back most of its staff promotions by six months. Economic data released on Tuesday showed that U.S. retail sales edged up +0.1% m/m in August, defying expectations for a -0.2% m/m decline. At the same time, U.S. August core retail sales, which exclude motor vehicles and parts, crept up +0.1% m/m, weaker than expectations of +0.2% m/m. In addition, U.S. industrial production climbed +0.8% m/m in August, stronger than expectations of +0.2% m/m. “Another Goldilocks number,” said David Russell at TradeStation. “Retail sales are strong enough to keep us out of recession, but not strong enough to stop rate cuts.” Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. While the Fed is widely expected to implement its first interest rate cut since 2020, market participants are debating whether a quarter-point reduction will be deemed sufficient for an economy showing signs of slowing or if policymakers will opt for a half-point cut instead. Investor attention will also be on the central bank’s quarterly “dot plot” in its Summary of Economic Projections and Chair Jerome Powell’s post-decision press conference. Meanwhile, U.S. rate futures have priced in a 37.0% chance of a 25 basis point rate cut and a 63.0% chance of a 50 basis point rate cut later today. A survey conducted by 22V Research revealed that market reaction expectations to the Fed decision hinge on the bets regarding the size of the cut. Investors who expect a 25 basis point reduction are divided on whether that cut would trigger a “risk-on” or “risk-off” reaction. At the same time, those wagering on a 50 basis point cut believe a smaller Fed move would be “risk-off.” On the economic data front, investors will focus on the U.S. Building Permits (preliminary) and Housing Starts figures, scheduled for release in a couple of hours. Economists forecast August Building Permits to be 1.410M and August Housing Starts to be 1.310M, compared to the previous numbers of 1.406M and 1.238M, respectively. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -0.100M, compared to last week’s value of 0.833M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.667%, up +0.64%. Once again, the plan for us today is to sit on our hands until Powell starts speaking then pounce!!

See you all in the live trading room. |

Archives

November 2024

AuthorScott Stewart likes trading, motocross and spending time with his family. |