|

Welcome back traders! We had an O.K. day yesterday. Most of our 0DTE's turned out well but my net liq ended down, just slightly on the day. There were too many hot spots in the model portfolio to overcome. It looks like we've got a good start to the day with our futures positions. Here's our results from yesterday. JNJ, BAC and UNH won't be know until the cash open. Markets are still bullish: My bias is bullish...again. Everything points that way...until it doesn't. December S&P 500 E-Mini futures (ESZ24) are trending down -0.03% this morning as investors looked ahead to quarterly reports from more big banks while also awaiting remarks from Federal Reserve officials. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green, with the benchmark S&P 500 and blue-chip Dow notching new all-time highs and the tech-heavy Nasdaq 100 posting a 2-3/4 month high. Vistra Corp. (VST) climbed over +5% and was the top percentage gainer on the S&P 500 after Exane BNP Paribas initiated coverage of the stock with an Outperform rating and a price target of $231. Also, chip stocks gained ground, with Arm (ARM) rising more than +6% to lead gainers in the Nasdaq 100 and Marvell Technology (MRVL) advancing nearly +5%. In addition, Apple (AAPL) rose over +1% and was the top percentage gainer on the Dow after Evercore ISI added the stock to its “Tactical Outperform” list ahead of earnings. On the bearish side, Caterpillar (CAT) fell more than -2% and was the top percentage loser on the Dow after Morgan Stanley downgraded the stock to Underweight from Equal Weight with a price target of $332. Minneapolis Fed President Neel Kashkari stated Monday that “further modest reductions” in the federal funds rate appear likely to be appropriate in the coming quarters. “Ultimately, the path ahead for policy will be driven by the actual economic, inflation, and labor market data,” Kashkari said. Also, Fed Governor Christopher Waller stated that recent economic data indicate policymakers can approach subsequent rate cuts with less urgency than they did at their last month’s meeting. “I view the totality of the data as saying monetary policy should proceed with more caution on the pace of rate cuts than was needed at the September meeting,” Waller said. Meanwhile, U.S. rate futures have priced in an 86.8% chance of a 25 basis point rate cut and a 13.2% chance of no rate change at the conclusion of the Fed’s November meeting. On the earnings front, major U.S. banks such as Bank of America (BAC), Goldman Sachs (GS), and Citigroup (C) are scheduled to release their quarterly results today. UnitedHealth (UNH), Johnson & Johnson (JNJ), Charles Schwab (SCHW), and United Airlines (UAL) are other prominent companies set to deliver their quarterly updates today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. “The third quarter earnings season has begun, and while expectations have tempered since earlier in the year, the corporate sector remains strong, with ample buffers given elevated profit margins and strong balance sheets,” said Principal Asset Management. On the economic data front, investors will likely focus on the NY Empire State manufacturing index, which is set to be released in a couple of hours. Economists, on average, forecast that the October NY Empire State manufacturing index will stand at 3.40, compared to last month’s value of 11.50. In addition, market participants will be anticipating speeches from San Francisco Fed President Mary Daly, Fed Governor Adriana Kugler, and Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.072%, down -1.29%. Trade docket could be busy today: /MCL, /MNQ, /ETH, /BTC, /NG, /ZC, BAC, FANG, ORCL, QQQ, DJT, JNJ, UNH, CCI?, DIA, ASML, ABT, UAL. Let's take a look at intra-day levels: /ES: A couple simple levels as we continue to push to new ATH's. 5918 is current resistance. A push above that keeps the bulls happy. 5880 is support. Bears need to get back down below this to work towards a change of direction. We are push on the upper Bollinger band on the daily chart. RSI and Stoch are pushed to the overbought range as well. /NQ: 20679 is resistance and 20563 is support. Tight ranges for today. Looks like a break out is due. BTC: Bitcoin had an insane run yesterday of 4,000 points! It's settled for now and has a resistance of 66,753 and support of 65,000. We'll see if we can get a better setup today. Nothing worked yesterday. Let's have a great day folks!

0 Comments

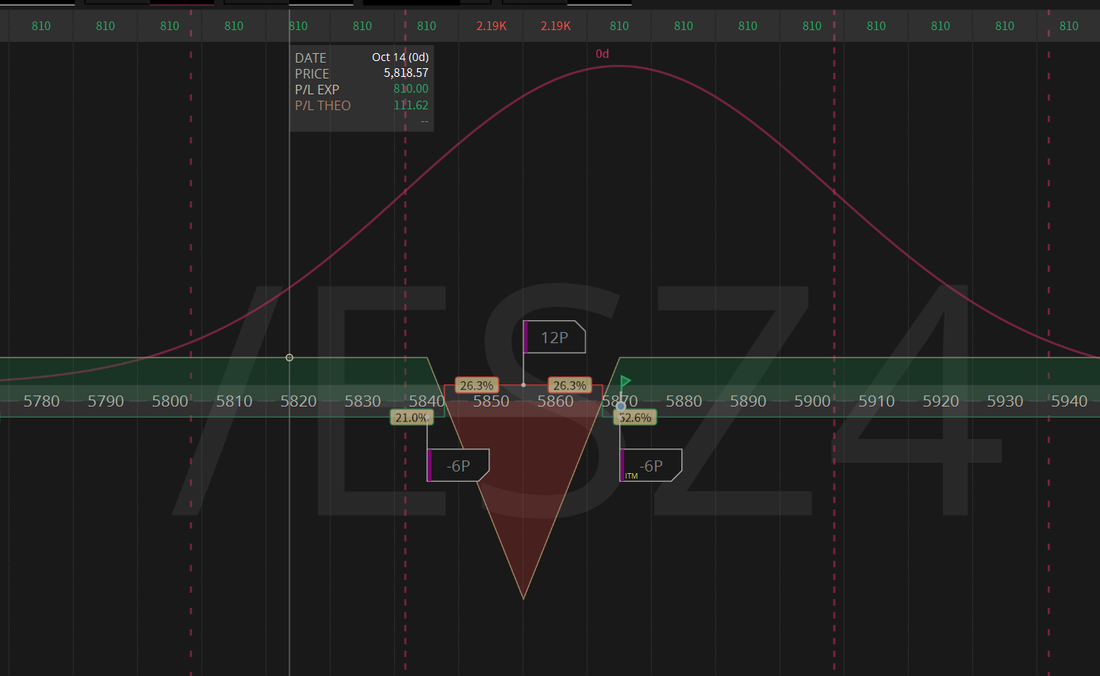

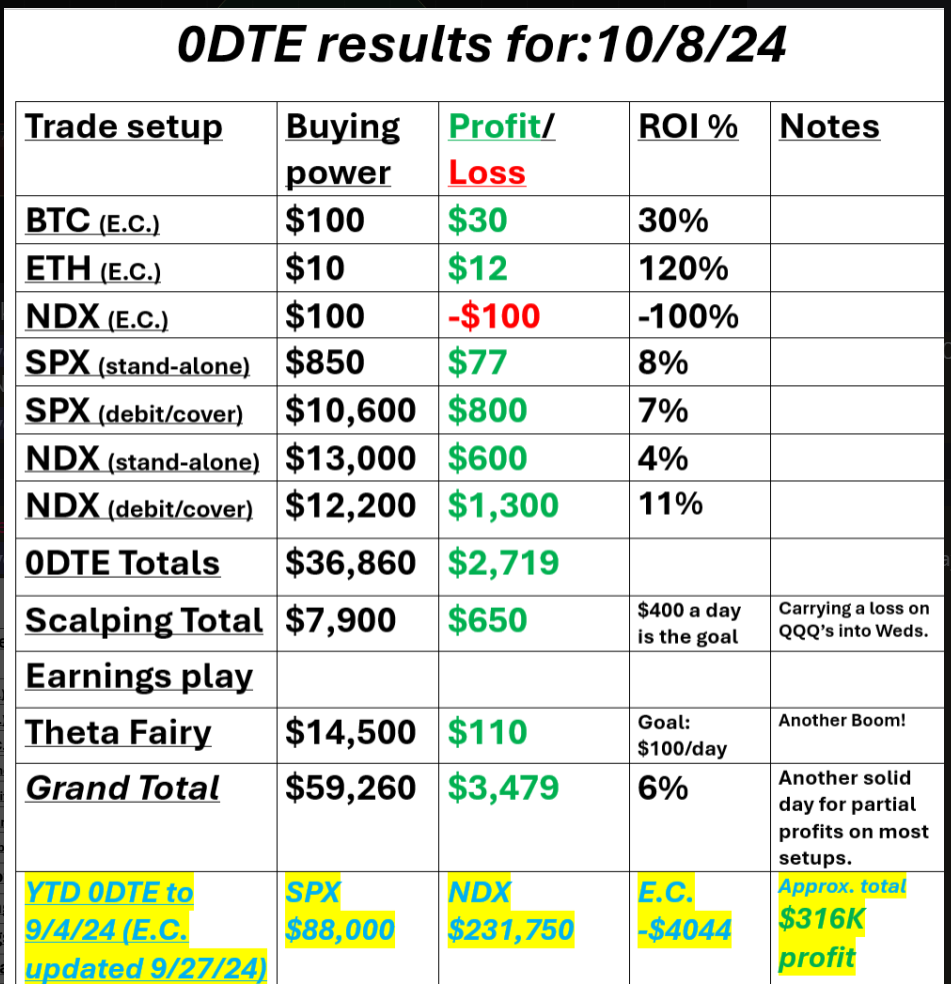

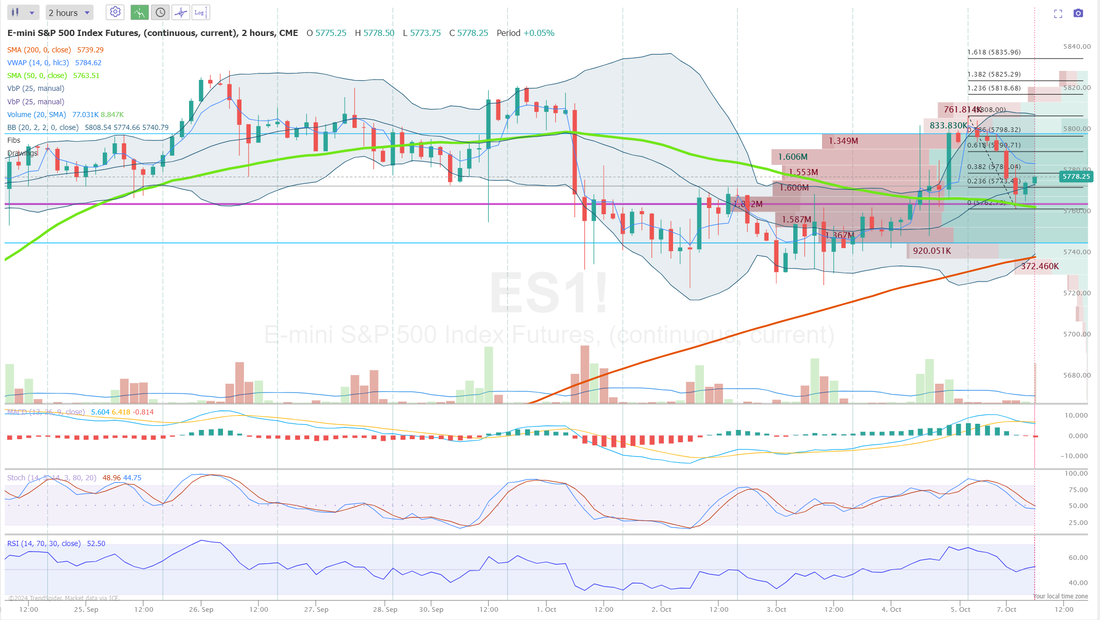

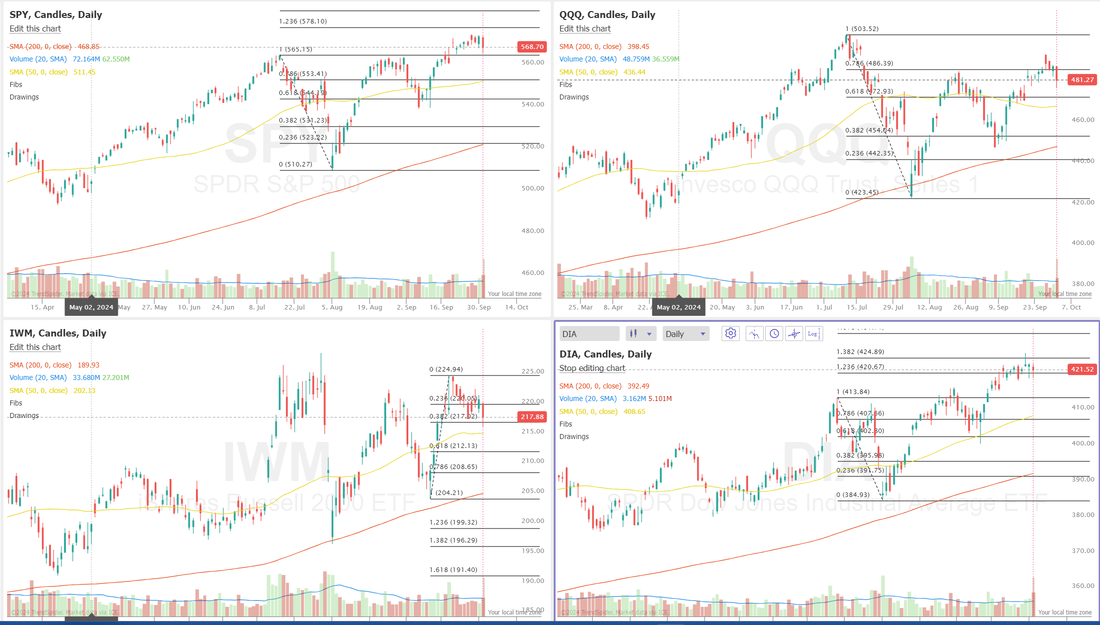

Good morning traders! Welcome back to a new week of trading. We had an incredible day on Friday. See our results below: We've had an incredible run over the last month. It's been well above average. I've tried to keep our three day losing streak from over a month ago in mind and front and center of our trading room. Runs like this never last. We know losses are a part of this game but, it's been nice to have such a profitable run. I've been drawing $1,500-$2,000 of profits out each day to fund some heavy bills I have coming in. It's been nice to be able to do that. We've been "trading scared" for the last few days...taking small profit captures and resetting the trade. It's created more work for us but also allowed us to continue our win streak. Let's take a look at the markets as we start this new week: Buy mode continues to start us off. SPY and DIA are pushing to new highs. IWM is playing catch up and QQQ's continue to channel. I'm waiting on the break out for it. We have a couple interesting setups to start off our day. #1. is our SPX debit cover. The SPX's been strong the last 5 trading days. We keep rolling the cover up and out on this bullish play. We are building a nice potential payout on this. #2. Our /ES Theta fairy replacement for today: This 4K trade has an $800 or 20% profit potential. December S&P 500 E-Mini futures (ESZ24) are up +0.16%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.23% this morning as market participants looked ahead to earnings reports from a stellar lineup of companies, key economic data releases, and comments from Federal Reserve officials. In Friday’s trading session, Wall Street’s major averages closed higher, with the benchmark S&P 500 and blue-chip Dow notching new all-time highs. Fastenal (FAST) surged over +9% and was the top percentage gainer on the Nasdaq 100 after the company reported stronger-than-expected Q3 results. Also, JPMorgan Chase (JPM) advanced more than +4% and was the top percentage gainer on the Dow after the biggest U.S. bank by assets posted upbeat Q3 results and raised its full-year net interest income forecast. In addition, Wells Fargo & Co. (WFC) climbed over +5% after reporting better-than-expected Q3 EPS. On the bearish side, Tesla (TSLA) slid more than -8% and was the top percentage loser on the S&P 500 and Nasdaq 100 after unveiling a prototype of its much-anticipated “Cybercab” robotaxi, which analysts said was “light on details.” Economic data released on Friday showed that the U.S. producer price index for final demand came in at 0.0% m/m and +1.8% y/y in September, compared to expectations of +0.1% m/m and +1.6% y/y. Also, core PPI, which excludes volatile food and energy costs, rose +0.2% m/m and +2.8% y/y in September, compared to expectations of +0.2% m/m and +2.7% y/y. In addition, the University of Michigan’s U.S. October consumer sentiment index unexpectedly fell to 68.9, weaker than expectations of 70.9. Dallas Fed President Lorie Logan reiterated on Friday that interest rates should be lowered gradually to a more normal level. While Logan described the economy as “strong and stable,” she also highlighted “meaningful” risks on the horizon. “It’s really important to look ahead as we chart this path toward neutral, and that we do so in a very gradual way to balance the risks that we have,” Logan said. Meanwhile, U.S. rate futures have priced in an 88.2% probability of a 25 basis point rate cut and an 11.8% chance of no rate change at the November FOMC meeting. Earnings season heats up this week, with results expected from several more big banks, including Goldman Sachs (GS), Bank of America (BAC), Morgan Stanley (MS), and Citigroup (C). Also, notable companies, including Netflix (NFLX), UnitedHealth (UNH), Johnson & Johnson (JNJ), United Airlines (UAL), Abbott Laboratories (ABT), Alcoa (AA), Procter & Gamble (PG), and American Express (AXP), are set to post quarterly results this week. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.2% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. “We expect earnings season to be solid, including the big banks,” said Michael Landsberg, chief investment officer at Landsberg Bennett Private Wealth Management. “Credit card delinquencies are still very low and increased economic activity should drive bank revenues.” Investors will also be monitoring a spate of economic data releases this week, including U.S. Retail Sales, Core Retail Sales, the NY Empire State Manufacturing Index, the Export Price Index, the Import Price Index, Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, Industrial Production, Manufacturing Production, Business Inventories, Crude Oil Inventories, Building Permits (preliminary), and Housing Starts. In addition, several Fed officials will be making appearances throughout the week, including Waller, Kashkari, Daly, Kugler, Bostic, and Goolsbee. The U.S. economic data slate is mainly empty on Monday. U.S. bond markets are closed today in observance of the Columbus Day holiday. This week, the SPY closed at a record high of $579.58 (+1.17%), showcasing strength that mirrors a powerful setup from June. The Bollinger Band Width indicator is at its lowest level since that period, with the price consolidating just above a rising 20-day SMA—a technical alignment that previously preceded a 5% rally. QQQ led the indexes this week, closing just shy of its all-time high at $493.36 (+1.24%). Similar to SPY, the Bollinger Bands have tightened to levels unseen since June, and with the price holding steadily above a rising 20-day SMA, this index seems to be setting up for a powerful breakout. IWM closed at $219.15 (+0.96%) after a solid push on Friday, setting the stage for a potentially powerful move next week. Like the SPY and QQQ, IWM’s Bollinger Bands are the tightest they’ve been since the summer, and with the price reclaiming its position above the rising 20-day SMA, this index looks primed for a continuation higher. Let's take a look at the expected moves this week: Range is fairly muted this week. A break out of the QQQ's from it's rangebound zone would help pump that number up. Trend watch is all to the upside: Sector performance shows utilities (the safe haven) getting the most love. My bias to start this week is bullish. That's where all the indicators are pointing. Our trade docket for today: /HG (copper), /ES (inverted Butterfly/ Theta fairy replacement), /MNQ, /NG, QQQ scalping, /MCL, DIA, SPY/QQQ 4DTE, /NG, 0DTE's. Let's take a look at the intra-day 0DTE levels I'm watching. /ES: Sitting at the lofty ATH level. It certainly looks like it wants to keep going. 5900 is my key upward resistance level. 5855 is the key support level. Anything between these two levels is just chop. /NQ: Not quite as stong as the /ES. 20565 is my resistance line with 20426 as support. BTC: Bitcoiin had a strong run to the upside over the weekend. A continuation move above current resistance at 66,000 would be very bullish. Belfow 60623 would be bearish. Our net liq is already off to a good start with all our futures positions helping out. Let's go get it today folks!

Welcome to Friday! The week went by quick for me. I've got nothing planned for the weekend which means I'll probably be put to work around the house by the boss! CPI came and went. The market shrugged off the bad numbers. Will PPI make any difference today? We'll see shortly. We had a decent day yesterday. The NDX debit cover really stepped up and saved the day. Scalping was a loss for me and we rolled the SPX debit cover calls, once again. See our results below: Markets are clinging to the bullish bias. I would have thought the hot CPI would have done more damage to the indices but they held up well. Bonds and the IWM are saying something very different from the FED. Everything else is pushing those ATH's. Just a couple things I've been looking at that may be beneficial to your trading: Small retail traders are "all in" on this market. This usually creates the top in the markets. This is not a forecast, but it is interesting. 73.6% of S&P 500 Stocks are within 10% of their 52-week Highs... This is the highest level since July 2021 December S&P 500 E-Mini futures (ESZ24) are trending down -0.32% this morning as market participants awaited crucial U.S. producer inflation data and earnings reports from some of the biggest U.S. banks. In yesterday’s trading session, Wall Street’s major indexes ended in the red. PayPal Holdings (PYPL) slid over -3% after Bernstein downgraded the stock to Market Perform from Outperform. Also, chip stocks lost ground, with Advanced Micro Devices (AMD) slumping -4% to lead losers in the Nasdaq 100 and Intel (INTC) dropping more than -1%. In addition, Delta Air Lines (DAL) fell over -1% after the airline posted downbeat Q3 results and issued soft Q4 adjusted EPS guidance. On the bullish side, MongoDB (MDB) climbed more than +6% and was the top percentage gainer on the Nasdaq 100 after Piper Sandler listed ten reasons to buy the stock. The U.S. Bureau of Labor Statistics report released on Thursday showed that consumer prices rose +0.2% m/m in September, stronger than expectations of +0.1% m/m. On an annual basis, headline inflation cooled to +2.4% in September from +2.5% in August, stronger than expectations of +2.3%. Also, the core CPI, which excludes volatile food and fuel prices, unexpectedly strengthened to +3.3% y/y in September from +3.2% y/y in August, stronger than expectations of no change at +3.2% y/y. In addition, the number of Americans filing for initial jobless claims in the past week increased by +33K to a 14-month high of 258K, compared with the 231K expected. “The Fed said the last mile getting toward their inflation target is going to be tough, and that is what we are seeing,” said David Donabedian at CIBC Private Wealth US. “But we still expect the Fed to cut rates by a quarter point in November, and likely a similar cut at the December meeting.” Chicago Fed President Austan Goolsbee stated on Thursday that he wasn’t overly concerned with a hotter-than-expected September inflation report and maintained his stance that the Fed has moved beyond focusing solely on price pressures. “The overall trend over 12 to 18 months is clearly that inflation has come down a lot and the job market has cooled to a level which is around where we think full employment is,” Goolsbee said. Also, New York Fed President John Williams said, “Looking ahead, based on my current forecast for the economy, I expect that it will be appropriate to continue the process of moving the stance of monetary policy to a more neutral setting over time.” At the same time, Atlanta Fed President Raphael Bostic said he would be “totally comfortable” skipping a rate cut at the next Fed meeting, noting that the “choppiness” in recent inflation and employment data might justify keeping rates unchanged in November. U.S. rate futures have priced in an 84.4% probability of a 25 basis point rate cut and a 15.6% chance of no rate change at the next central bank meeting in November. Meanwhile, the third-quarter corporate earnings season gets underway, with some of the biggest U.S. banks, including JPMorgan Chase (JPM) and Wells Fargo (WFC), slated to report their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.7% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in July. On the economic data front, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. September PPI will come in at +0.1% m/m and +1.6% y/y, compared to the previous figures of +0.2% m/m and +1.7% y/y. The U.S. Core PPI will also be closely watched today. Economists expect September figures to be +0.2% m/m and +2.7% y/y, compared to the previous numbers of +0.3% m/m and +2.4% y/y. The U.S. Michigan Consumer Sentiment preliminary reading will be reported today as well. Economists estimate this figure to arrive at 70.9 in October, compared to 70.1 in September. In addition, market participants will be looking toward speeches from Dallas Fed President Lorie Logan, Chicago Fed President Austan Goolsbee, and Fed Governor Michelle Bowman. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.092%, down -0.07%. PPI should be the driver for today's market so no levels or bias again today. We'll let the market do what it's going to do. Trade docket for today: Very simple. /ES (thetafairy), /MNQ (scalping), JPM, FAST, QQQ/SPY, 0DTE's. I'll see you all in the trading room. Let's see if we can bring our SPX debit cover home fro a win today!

Welcome to Thursday and CPI day. We've got two days of inflation data coming at us. Yesterday was a mixed bag for me. The perfect run might be coming to an end. They all do. We made money yesterday but my net liq ended down -$1,800 yesterday and we've got both our SPX calls rolled to today. CPI will, of course, be the driver today. Check out our results below: Let's take a look at the markets: Bullish bias remains. SPY and DIA pushing to new ATH's December S&P 500 E-Mini futures (ESZ24) are down -0.15%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.23% this morning as investors refrained from making any big bets ahead of a key U.S. inflation report that could offer clues on the Federal Reserve’s policy path. The minutes of the Federal Open Market Committee’s September 17-18 meeting, released Wednesday, showed that some officials favored a smaller, quarter-point cut. “Some participants observed that they would have preferred a 25-basis-point reduction of the target range at this meeting, and a few others indicated that they could have supported such a decision,” according to the FOMC minutes. Despite the debate, the minutes noted a “substantial majority” supported the outsized half-point rate cut. Also, nearly all participants agreed that the upside risks to inflation have diminished, while downside risks to employment have increased. In addition, Fed officials aimed to communicate to the public that their policy “recalibration” should not be “interpreted as evidence of a less favorable economic outlook or as a signal that the pace of policy easing would be more rapid than participants’ assessments of the appropriate path.” “Fed minutes were pretty ‘ho-hum,’ which could actually be a good thing for stock investors,” said David Russell at TradeStation. “Policymakers agree inflation is fading and they see potential weakness in job growth. That keeps rate cuts on the table if needed. The bottom line is that Powell might have the market’s back headed into the year-end.” In yesterday’s trading session, Wall Street’s major indices closed higher, with the benchmark S&P 500 notching a new record high, the blue-chip Dow posting a 1-1/2 week high, and the tech-heavy Nasdaq 100 climbing to a 2-3/4 month high. Norwegian Cruise Line (NCLH) surged nearly +11% and was the top percentage gainer on the S&P 500 after Citigroup upgraded the stock to Buy from Neutral with a price target of $30. Also, Pfizer (PFE) rose more than +3% after the Financial Times reported that the company’s CEO, Albert Bourla, is expected to meet with activist investor Starboard Value next week. In addition, Arcadium Lithium (ALTM) soared over +30% after Rio Tinto agreed to acquire the company for $6.7 billion. On the bearish side, Boeing (BA) slid more than -3% and was the top percentage loser on the Dow after withdrawing its offer to around 33,000 striking machinists and halting negotiations with their union. Also, Alphabet (GOOGL) fell over -1% on news that the U.S. Justice Department is weighing a breakup of Google. Dallas Fed President Lorie Logan stated on Wednesday that she backed last month’s unusually large interest rate cut but favors smaller reductions ahead, citing “still real” upside risks to inflation and “meaningful uncertainties” about the economic outlook. “Following last month’s half-percentage-point cut in the fed funds rate, a more gradual path back to a normal policy stance will likely be appropriate from here to best balance the risks to our dual-mandate goals,” Logan said. Also, San Francisco Fed President Mary Daly stated she anticipates the U.S. central bank will keep reducing interest rates this year to protect the labor market. “I think that two more cuts this year, or one more cut this year, really spans the range of what is likely in my mind, given my projection for the economy,” Daly said. Meanwhile, U.S. rate futures have priced in an 83.7% chance of a 25 basis point rate cut and a 16.3% chance of no rate change at the next central bank meeting in November. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. September CPI will come in at +0.1% m/m and +2.3% y/y, compared to the previous numbers of +0.2% m/m and +2.5% y/y. The U.S. Core CPI will also be closely watched today. Economists anticipate the core CPI to be +0.2% m/m and +3.2% y/y in September, compared to the previous figures of +0.3% m/m and +3.2% y/y. A survey conducted by 22V Research showed that 42% of investors anticipate a “mixed/negligible” market reaction to the consumer inflation report, 32% predict a “risk-off” response, and only 25% expect it to be “risk-on.” U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 231K, compared to last week’s number of 225K. In addition, market participants will be anticipating speeches from Fed Governor Lisa Cook, New York Fed President John Williams, and Richmond Fed President Tom Barkin. Third-quarter corporate earnings season begins in earnest on Friday, with major banks such as JPMorgan Chase (JPM) and Wells Fargo (WFC) set to report their quarterly results. The S&P 500’s estimated earnings growth rate is 5%, based on estimates from LSEG. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.080%, up +0.33%. Trade docket for today: /6A, /6B, /MNQ,QQQ scalping, /ZN?, DAL, DPZ, IWM?, QQQ/SPY, 0DTE's No bias or levels today or tomorrow on CPI/PPI days.

See you in the trading room! Welcome to Wedsnesday! FOMC minutes today and CPI/PPI coming up later this week. We had a really solid day yesterday. I say that because the trend was NOT my friend yesterday. I kept looking for a retrace that never materialized. That said, I continued to "trade scared" and booked profits when I could, even if they were smaller capture rates than we would like. It worked and we had another bang up day. See our results below. We've gotten used to having the daily Theta fairys back. Last night the entry wasn't there. We may have some opportunities with CPI and PPI the next couple days. Let's take a look at the markets: As is usually the case, the neutral rating for yesterday didn't last long. We are now back to bullish bias. In terms of directional bias however, we are still stuck in a pinching wedge channel. The breakout is coming. We just don't know when or in what direction. December S&P 500 E-Mini futures (ESZ24) are trending down -0.02% this morning as market participants awaited the Federal Reserve’s September meeting minutes and remarks from Fed officials. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Palo Alto Networks (PANW) climbed over +5% and was the top percentage gainer on the Nasdaq 100 after Exane BNP Paribas initiated coverage of the stock with an Outperform rating and a price target of $410. Also, megacap technology stocks advanced, with Netflix (NFLX) rising more than +2% and Microsoft (MSFT) gaining over +1%. In addition, Nvidia (NVDA) rose more than +4% after Hon Hai announced it is constructing the world’s largest facility to manufacture Nvidia’s GB200 AI chips. On the bearish side, Roblox (RBLX) fell over -2% after Hindenburg Research revealed a short position in the gaming platform. Economic data released on Tuesday showed that the U.S. trade deficit fell to -$70.40B in August from -$78.90B in July (revised from -$78.80B), marking the smallest deficit in five months. Fed Governor Adriana Kugler said Tuesday that the U.S. central bank should maintain its focus on returning inflation to its 2% target, albeit with a “balanced approach” that prevents an “undesirable” slowdown in employment growth and economic expansion. Also, Atlanta Fed President Raphael Bostic said the Fed must balance competing risks considering how fast it will continue to reduce interest rates in the coming months. “I’m still laser-focused on the inflation target and making sure that we get that to target,” Bostic said. In addition, Boston Fed President Susan Collins remarked that rate cuts should be careful and data-driven. Meanwhile, U.S. rate futures have priced in an 86.7% chance of a 25 basis point rate cut and a 13.3% chance of no rate change at the next central bank meeting in November. Today, investors will closely monitor the release of the Federal Reserve’s minutes from the September meeting, which may provide further insights into how policymakers are thinking about the future pace of easing. Also, market participants will be looking toward a batch of speeches from Fed officials Bostic, Logan, Goolsbee, Barkin, Williams, Jefferson, Collins, and Daly. On the economic data front, investors will likely focus on U.S. Crude Oil Inventories data, which is set to be released in a couple of hours. Economists estimate this figure to be 2.000M, compared to last week’s value of 3.889M. U.S. Wholesale Inventories data will be reported today as well. Economists anticipate the August figure to be +0.2% m/m, the same as in July. The focus remains on the September reading of the U.S. Consumer Price Index, scheduled for release on Thursday, which is expected to show a decline in inflation to +2.3% y/y from +2.5% y/y in August. Third-quarter corporate earnings season begins in earnest on Friday, with major banks such as JPMorgan Chase (JPM) and Wells Fargo (WFC) set to report their quarterly results. The S&P 500’s estimated earnings growth rate is 5%, based on estimates from LSEG. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.020%, down -0.40%. My directional bias is bullish today. I don't think the FOMC minutes are going to tip the apple cart over today. It should be just what the market is expecting. We'll see if I'm right. Trade docket for today: /ES (theta fairy) later tonight or very early in the A.M. right before CPI data release. /MNQ,/NQ,QQQ scalping., /ETH, /LE, /MCL, /NG, /SI, DAL, DPZ, 0DTE's. No levels for me today. FOMC minutes release should NOT be a big catalyst BUT...you never know so we'll wait until later today to execute the bulk of our 0DTE setups.

I pulled another $1,500 profit out of my account yesterday as I've been doing for the past three weeks. It's so comforting to know when you get $30,000 of bills pouring in you can handle it with just a few weeks of trading profits. I'm super grateful for trading and especially grateful to our trading community that we've built. You folks are awesome. See you all in the live zoom shortly. Welcome back traders! Well... I don't know what to say. We had another exceptional day yesterday, making almost $4,000 dollars profit in less than six hours. It's been an amazing run. In the last three weeks, on a $100,000 portfolio I've brought in over $40,000 in pure profit. You'll note the low return on the NDX debit cover 0DTE. I'll admit it. I'm trading scared. These runs NEVER last and we WILL have a losing day again. Probably many. That's just how it works but, I'm doing everything to push it off as long as I can. Trading scared is not neccessarily a bad thing. It focuses you on risk management and cutting losses quickly. Here's our results below: Our day trades get all the focus and require the most work but let me toot my horn for a bit on our very, very diversified model portfoio. We've got things in our portfolio (Pairs trades, Commodities, Oil, Nat gas, Silver, Currency, Crypto etc) that most people never even think or know to trade. Most are completely non correlated to the equity markets. I think we've got a good shot of making 9% returns for the month on those positions. That's over 100% a year for those like me that didn't major in math! There's a trade setup for everyone. If you can't be happy with our positions you can't be happy as a trader because, we do it all. Scalping is killing it for us! The Theta fairy has been back more regularly and earnings plays continue to contribute to our success. Folks...all I can say is what we are doing is working. Let's try to not get ahead of ourselves and press our luck or deviate from our plan. Let's look at the markets. Technically the slide yesterday put us into a neutral rating. I've been calling our levels neutral for a few days now. We are in a chop zone. Admittedly a large chop zone but the markets are forming a wedge pattern and looking to break out. We've got CPI/PPI inflation data later this week. Will that be enough to get stuff moving agian? I guess we'll find out soon enough. IWM is in danger of losing it's 50DMA as interest rates spike on concern we won't get much else out of the FED this year in terms of rate cuts. All the other indices are just treading water. They look vunerable here IMHO. December S&P 500 E-Mini futures (ESZ24) are up +0.36%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.40% this morning, signaling a partial rebound from yesterday’s slump, while investors awaited further comments from Federal Reserve officials, with all eyes on Thursday’s key U.S. inflation report and the start of earnings season. In yesterday’s trading session, Wall Street’s major indexes closed lower. Amazon.com (AMZN) fell over -3% after Wells Fargo Securities downgraded the stock to Equal Weight from Overweight. Also, insurance companies offering property and casualty insurance in Florida slumped as Hurricane Milton strengthened to a Category 5 storm, with Heritage Insurance Holdings (HRTG) plummeting more than -23% and HCI Group (HCI) plunging over -17%. In addition, Apple (AAPL) dropped more than -2% after Jefferies downgraded the stock to Hold from Buy with a price target of $212.92. On the bullish side, Super Micro Computer (SMCI) surged over +15% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the server company reported strong shipments of its graphics processing units, fueled by artificial intelligence demand. Also, Pfizer (PFE) rose more than +2% after the Wall Street Journal reported that activist investor Starboard Value acquired a roughly $1 billion stake in the drugmaker. Economic data released on Monday showed that U.S. consumer credit rose +$8.93B in August, weaker than expectations of +$11.80B. Minneapolis Fed President Neel Kashkari stated on Monday that he believes the economy remains resilient and the labor market, despite showing some signs of softening, is still strong, with the Fed’s rate cuts intended to maintain these conditions. “The balance of risks has shifted away from high inflation towards maybe higher unemployment,” Kashkari said. “And that’s why I thought dialing back policy was the right move.” Also, St. Louis Fed President Alberto Musalem said he backed the U.S. central bank’s decision to lower interest rates by a half point last month but emphasized that he would prefer any further reductions to be gradual. “I believe it will likely be appropriate to further reduce the target range for the federal funds rate over time toward a neutral posture,” Musalem said. In addition, Fed Governor Adriana Kugler stated on Tuesday that the central bank should maintain its focus on returning inflation to its 2% target, albeit with a “balanced approach” that prevents an “undesirable” slowdown in employment growth and economic expansion. Kugler said she would support further cuts “if progress on inflation continues as I expect.” U.S. rate futures have priced in an 88.7% chance of a 25 basis point rate cut and an 11.3% chance of no cut at the conclusion of the Fed’s November meeting. Meanwhile, the crisis in the Middle East continued to unsettle investors, with fighting intensifying on Monday on multiple fronts after a year of war. The Israel Defense Forces stated that they intercepted the majority of a barrage of rockets launched toward Tel Aviv by Hamas and other groups backed by Iran. Market participants are keenly awaiting U.S. inflation data, the Fed’s minutes from the September meeting, and the start of the third-quarter earnings season this week. Financial sector earnings begin on Friday, with reports from JPMorgan Chase (JPM), Wells Fargo (WFC), and Blackrock (BLK). Food and beverage giant PepsiCo (PEP) is set to announce its Q3 earnings results today. Today, investors will also focus on U.S. Trade Balance data, which is set to be released in a couple of hours. Economists forecast this figure to stand at -$70.10B in August, compared to the previous figure of -$78.80B. In addition, market participants will be anticipating speeches from Atlanta Fed President Raphael Bostic, Boston Fed President Susan Collins, and Fed Vice Chair Philip Jefferson. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.018%, down -0.28%. My lean or bias today is neutral again. Futures are up nicely as I type but unless we break out above resistance levels it still just results in chop. Our trade docket for today: /MNQ, QQQ scalping (killing it BTW), /ES (Theta Fairy), FANG/OXY, FDX, INTU/ORCL, IWM, MRK/MRNA, PEP, WYNN, SPY/QQQ, VXX, 0DTE's. The best overall indicator for me of what the "market" is doing is the VTI. Total market index. It's rolled over and triggered a sell. Its a mild sell but a sell, nonetheless. Keep an eye on VWAP at 281. We break that and I'm adding to my short positions. Let's take a look at the intra-day 0DTE levels: #1. /ES; Three weeks. Three full weeks of just treading water! Movement is coming. We just don't know when. There are only two levels I'm focused on today. 5790 is a resistance area that's been hit too many times to count. Bulls need to break through and hold this level. 5744 is a huge support. It's right around the 200 period M.A. on the 2 hr. chart. A break below here could get ugly. #2. /NQ; Similar story here. Bulls need to break above (and hold) 20269. Support is 19993 and also correspondes to the 200 period M.A. on the 2hr. chart. A dip below that level could trigger some big sell side algos. #3. BTC: We didn't get any crypto 0DTE's working yesterday because the edge just wasn't there. Resistance is weak at 63,750 and support is strong at 62,000. We'll see what we can find today as far as setups go. I'm going to work on "trading scared" again today. Let's not try to get rich. Let's focus on slow, consistent, steady gains througout the day.

Welcome back to a new week traders! Our last Friday was just off the charts success. I've been doing my best to temper the excitement in the trading room. No...we will not just make $5,000+ a day forever! Losses will come. It's just the way it works, but for right now, it's been an amazing couple of weeks. Check out our results below: Let's take a look at the markets: Buy mode still hanging in there. Markets continue to pinch up at or close to their ATH's. The SPY made little headway this week, briefly dipping below last week’s low before rebounding to close slightly higher at $572.98 (+0.28%). As the price approaches the apex of the rising wedge, the GoNoGo Squeeze indicator shows the oscillator bouncing at the zero line, signaling that momentum has found support and is still in the favor of the bulls. Similar to SPY, QQQ made little progress this week but managed to break out of its smaller consolidation flag by Friday, closing at $487.32 (+0.11%). Momentum has been neutral for several sessions, which could indicate that the index is nearing a larger-scale breakout in the days ahead. The IWM ETF chart looks similar to QQQ, consolidating in a tight flag pattern just above the longer-term symmetrical triangle. Although it closed lower this week at $219.15 (-0.54%), the GoNoGo Squeeze shows a max grid pattern has formed. This means that momentum has been stuck in a non-directional state for quite some time and a directional break is imminent. Looking at the I.V. and expected moves for the week. Not bad folks. We may be able to get a few more Theta fairy's off this week. I'm not saying we are going to get a "double-dip day" like last week but it looks good. Trade docket for today: Jam packed with Non-equiry correlated issues. /ES (Theta fairy), /MNQ,QQQ scalping, /HE, /6A, /6B, /6A, /BTC, /ETH, /LE, /SI, /ZN, SMCI, WYNN, 0DTE's Let's take a look at intra-day levels for us today on our 0DTE's. #1. /ES: I look at today as a neutral day. The markets been pinching here for a while. 5780 is first resistance then 5790 with 5798 being the break out level I'm looking at for bullish continuation. 5773 is first support with 5763 my main, key level I'm watching. 5763 is the big support level. It's close to the PoC and 50 period moving average on the 2 hr. chart. A break below that would signal a clear, bearish price action. #2. /NQ: There are several resistance levels it needs to break above to get a bullish continuation. 20187, 20223,20266 specifically. To the downside, I'm only focused on 20036. This is the PoC and 50 period M.A. on the 2 hr. chart. A break below this could mean "look out below". #3. Bitcoin: BTC has a bit of a hard stop to the upside at 64,284. Support is 62,233 My bias or lean today is neutral. Until we break through some of these big support/resistance levels its all just chop. Let's make it happen today folks. And no....I'm not expecting another $5,000+ day! Let's take what we can get and not get greedy.

Welcome to Friday traders.The gateway to the weekend! We've had one heck of a week. I'm so grateful for our results. This extended win streak will end. They always do but, what we are doing is working and beyond the financial rewards its also nice to know that you have a system and that system is producing, We were active most of the day yesterday with multiple entries. For the most part they paid off well. Here's a look at our results. The tenative longshoreman agreement gave us our profit on the Theta Fairy in record time. Our entry and take profit orders both triggered within almost a two hour window. We'll look to get another on this morning right before NFP data is released. Let's take a look at the markets. Futures are swinging up back to bullish bias. Not much change in the overall makeup of the indices. Will NFP be the catalyst that get the next directional move working? We'll find out today. December S&P 500 E-Mini futures (ESZ24) are trending up +0.18% this morning as investors braced for the all-important U.S. jobs report to further gauge the size of the next Federal Reserve interest rate cut. In yesterday’s trading session, Wall Street’s major indices closed lower. Constellation Brands (STZ) slid over -4% and was the top percentage loser on the S&P 500 after the company reported weaker-than-expected Q2 revenue. Also, Tesla (TSLA) fell more than -3% and was the top percentage loser on the Nasdaq 100 after Bloomberg reported that Chief Information Officer Nagesh Saldi was departing from the company. In addition, Levi Strauss (LEVI) slumped over -7% after the company reported weaker-than-expected Q3 revenue and cut its full-year revenue growth guidance. On the bullish side, MarketAxess Holdings (MKTX) climbed more than +7% and was the top percentage gainer on the S&P 500 after posting a record total average daily volume of $45.2 billion in September, an increase of 8.6% m/m and 52.5% y/y. Economic data released on Thursday showed that the U.S. ISM services index rose to 54.9 in September, stronger than expectations of 51.7 and the fastest pace of expansion in 19 months. Also, the U.S. September S&P Global services PMI was revised lower to 55.2 from the preliminary estimate of 55.4. In addition, U.S. factory orders unexpectedly fell -0.2% m/m in August, weaker than expectations of +0.1% m/m. Finally, the number of Americans filing for initial jobless claims in the past week rose +6K to 225K, compared with the 222K expected. “Amid robust consumer spending, the large services sector continues to add backbone to the expansion, likely weighing toward a smaller quarter-point rate cut from the Fed in November,” Sal Guatieri, senior economist at BMO Capital Market, said in a note. U.S. rate futures have priced in a 69.3% probability of a 25 basis point rate cut and a 30.7% chance of a 50 basis point rate cut at November’s monetary policy meeting. Meanwhile, market participants continue to keep a close watch on developments in the Middle East. Investors are worried that Israel may soon launch retaliatory strikes on Iran, possibly targeting Iran’s oil facilities, in response to Tehran’s missile attack on Israel. In other news, U.S. dockworkers agreed to end a three-day strike that had disrupted trade along the U.S. East and Gulf coasts. The International Longshoremen’s Association and the U.S. Maritime Association announced on Thursday that they have extended their prior contract until January 15th, according to a joint statement from the two organizations. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that September Nonfarm Payrolls will come in at 147K, compared to August’s figure of 142K. U.S. Average Hourly Earnings data will also be closely watched today. Economists expect September figures to be +0.3% m/m and +3.8% y/y, compared to the previous numbers of +0.4% m/m and +3.8% y/y. The U.S. Unemployment Rate will be reported today as well. Economists expect this figure to hold steady at 4.2% in September. In addition, market participants will be anticipating a speech from New York Fed President John Williams. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.853%, down -0.10%. I don't have a directional bias or lean today. NFP will be the catalyst and it should dictate a lot of todays price action. I also don't work off support/resistance levels today. NFP can be a bigger mover than FOMC days. I'll let the algos do what they do. Be patient and look for entries a little later in the day. Trade docket for today: /ES (Theta fairy), /MNQ,QQQ scalping, /MCL, FDX, FSLR, MSTR, PYPL, SPY/QQQ 4DTE's, SMCI, WYNN. See you all in the trading room! I've got some good stuff to go over on butterflies.

Welcome to Thursday traders! I hope your day went well yesterday at "work". Our work went well...yet again. We've been on an absolute rip lately and it's come at a good time for me. Apparently my bottom row of teeth need $10,000 of repair and work (bad genetics the Dentist said) and one of the roofs on the house where a hot tub sits needs $15,000 or repairs. Ugh! It's been nice to be able to pull out $1,500 a day over the last two weeks to help pay for it all and still keep the account growing. What a blessing trading has been in my life. Heres our results from yesterday. Markets still look a little bearish here. Nothing crazy bearish here. Just having a hard time making new ATH's. December S&P 500 E-Mini futures (ESZ24) are down -0.09%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.21% this morning as investors awaited a new round of U.S. economic data and remarks from a Federal Reserve official. Crude oil extended gains on Thursday as investors anticipated Israel’s response to Iran’s missile attack, with U.S. President Joe Biden urging Israel to refrain from targeting Iran’s nuclear facilities. Israel’s fighter jets struck Beirut overnight following the death of eight of its soldiers in southern Lebanon during clashes with Hezbollah. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Caesars Entertainment (CZR) climbed over +5% and was the top percentage gainer on the S&P 500 after announcing a $500 million stock buyback program. Also, chip stocks gained ground, with KLA Corp. (KLAC) advancing more than +3% and Lam Research (LRCX) rising over +2%. In addition, Salesforce (CRM) rose more than +3% and was the top percentage gainer on the Dow after Northland Securities upgraded the stock to Outperform from Market Perform with a price target of $400. On the bearish side, Nike (NKE) slumped over -6% and was the top percentage loser on the Dow after the world’s largest sportswear company reported weaker-than-expected Q1 revenue and withdrew its full-year guidance. Also, Tesla (TSLA) slid more than -3% after reporting weaker-than-expected Q3 deliveries. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls increased by 143K in September, up from 103K in August (revised from 99K) and exceeding the consensus estimate of 124K. “[Yesterday’s] ADP employment number surprised to the upside, suggesting the labor market is bending but not breaking,” said Chris Larkin at E*Trade from Morgan Stanley. “Friday’s monthly jobs report will have the final word on the current jobs picture, and more than likely, on near-term market sentiment.” Richmond Fed President Tom Barkin said on Wednesday that there is progress on inflation and signs that pricing power is diminishing in the economy, although he mentioned it is too premature for the central bank to declare victory. “It remains difficult to say that the inflation battle has yet been won,” Barkin said. “There is still work to do on inflation.” Meanwhile, U.S. rate futures have priced in a 65.9% probability of a 25 basis point rate cut and a 34.1% chance of a 50 basis point rate cut at the November FOMC meeting. Today, investors will focus on U.S. Initial Jobless Claims data. Economists estimate this figure to arrive at 222K, compared to last week’s number of 218K. The U.S. ISM Non-Manufacturing PMI and the S&P Global Services PMI will also be closely watched today. Economists forecast the September ISM Non-Manufacturing PMI to arrive at 51.7 and the September S&P Global Services PMI to be 55.4, compared to the previous values of 51.5 and 55.7, respectively. U.S. Factory Orders data will be reported today as well. Economists foresee this figure to stand at +0.1% m/m in August, compared to the previous figure of +5.0% m/m. In addition, market participants will be anticipating a speech from Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.812%, up +0.64%. My bias today is very slightly bullish. Trade docket today: /ES (theta fairy), MSTR, SMCI, /MCL, LEVI?, 0DTE's. Let's take a look at our intra-day levels for 0DTE's. /ES; Two key levels for me today. 5764 is resistance and PoC on the 2 hr. chart. Above that is very bullish for me. 5724 is current support. Below that we have plenty of downside potential. /NQ; I've got two key levels on the Nasdaq as well. 20026 is resistance and PoC while 19831 is not only support but also the 200 period M.A. on the 2hr. chart. This is a key support area. If we break below this I think we get some decent downside potential. BTC; It's a wide range today but I'm looking at 63,400 as resistance and 60,000 as support. Let's make it happen today folks! I need to keep pulling $1,500 a day of profits to fund all my life challenges!

Welcome back taraders. Yesterday was a "traders market". It's easy to go long something in a bull market, make money and feel like your a genius but it's markets like we had yesterday that test the true metal of a trader. Can you be patient enough, nimble enough, and confident enough to commit capital on a day that? I don't like bragging and I don't like braggards. If you want to set yourself up for failure, just bragg about your results. The karma Gods will surely make you look like a fool the next day. That being said, I'm super proud of our day yesterday. It was an absolute home run! More important, it illustrated how important it is to have multiple strategies working at the same time. It was a scalping mania day! We were also very patient on our 0DTE entries. See our results below: Again...braggards ALWAYS, eventually get what's coming to them but gosh darn it if yesterday wasn't amazing for us. Let's take a look at what yesterdays crazyness did to the market structure. We have flipped to a sell signal but will it last? The last time Iran did this the markets shrugged it off. Or...it this a definative change of direction? Those new ATH's will have to wait, for now. You'll notice though, very little damage was done to the SPY or DIA. December S&P 500 E-Mini futures (ESZ24) are trending down -0.37% this morning as flaring tensions in the Middle East dampened sentiment, while investors braced for the ADP National Employment numbers due later in the day. Nike (NKE) slumped over -5% in pre-market trading after the world’s largest sportswear company reported weaker-than-expected Q1 revenue and withdrew its full-year sales guidance. Market participants continue to keep a close watch on developments in the Middle East. Iran launched approximately 200 ballistic missiles at Israel on Tuesday in response to Israeli strikes on Hezbollah in Lebanon, marking a sharp but brief escalation between Middle Eastern adversaries, which risked sparking a new wave of attacks as Prime Minister Benjamin Netanyahu pledged to retaliate. Tehran warned that any retaliation would result in “vast destruction,” heightening fears of a broader regional conflict. In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Humana (HUM) plunged over -11% and was the top percentage loser on the S&P 500 after releasing its Medicare Advantage plan for 2025. Also, chip stocks lost ground, with Arm (ARM) slumping more than -4% to lead losers in the Nasdaq 100 and Intel (INTC) sliding over -3% to lead losers in the Dow. In addition, Apple (AAPL) fell nearly -3% after Barclays said that the availability of the iPhone 16 suggests “softer demand” compared to last year. On the bullish side, Paychex (PAYX) climbed about +5% and was the top percentage gainer on the S&P 500 after the payroll processing firm reported better-than-expected Q1 results. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings unexpectedly climbed to a 3-month high of 8.040M in August, stronger than expectations of 7.640M. Also, the U.S. September ISM manufacturing index remained steady from August at 47.2, below the consensus of 47.6 and marking the sixth consecutive month of contraction. In addition, the U.S. S&P Global manufacturing PMI was revised upward to 47.3 in September, though it still declined from 47.9 in August. Finally, U.S. August construction spending unexpectedly fell -0.1% m/m, weaker than expectations of +0.2% m/m. Meanwhile, U.S. rate futures have priced in a 63.2% chance of a 25 basis point rate cut and a 36.8% chance of a 50 basis point rate cut at the next FOMC meeting in November. Today, all eyes are focused on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the September ADP Nonfarm Employment Change will stand at 124K, compared to the previous number of 99K. U.S. Crude Oil Inventories data will also be released today. Economists estimate this figure to be -1.500M, compared to last week’s value of -4.471M. In addition, market participants will be anticipating speeches from Fed Governor Michelle Bowman and Richmond Fed President Thomas Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.767%, up +0.59%. My bias or lean today is...bullish! We've seen this movie before. I think we shake off yesterday and push higher today. I've also put my money where my mouth is in our scalping room. We have two bullish setups to key off today. Trade docket for today: STZ, LEVI, /MCL, /MNQ,QQQ scalping, /ZC, LW, NKE, 0DTE's Let's take a look at the intra-day levels. /ES; I've got a couple key levels I'm watching today. 5767 is the first big resistance. 5788 is the important one. That's not only the PoC, it's also the 50 period M.A. on the 2hr. chart. Above that we are back to full on bullishness. 5732 is the one key support I'm watching today. Below that we have some big potential downside. /NQ: The Nasdaq got beat up the most yesterday. It's got the most work to do. 20019 is the first resistance with 20130 next. 19892 is first support then comes 19820. If we lose 19820 it could be "look out below" I would lay on the shorts pretty heavily there. BTC: Bitcoin got beat up yesterday along with equities. It's sitting right now on its 200 period M.A. on the 2hr. chart. Thats the only level I'm watching today. If it holds through the morning we'll play it long. If it can't hold it, we go short. One final comment on having lot of "tools in the tool chest". Sometimes there are 5-7 day stretches that our scalping program doesn't find setups or worse, does find setups that just don't produce. You may think it's not a strategy you want to continue with. Then, you get a day like yesterday. It proved invaluable. The same can be said about the Theta fairy. Sometimes we go a month without getting a set up. Sometimes we get yesterday. I'm starting off the day with $300 profit already in my pocket. It's an amazing trade setup IF...you are disciplined enough to use the built in stop loss and know when NOT to trade it. Long live the Theta fairy. I'll see you all in the live trading room shortly. Let's do it again!

|

Archives

November 2024

AuthorScott Stewart likes trading, motocross and spending time with his family. |