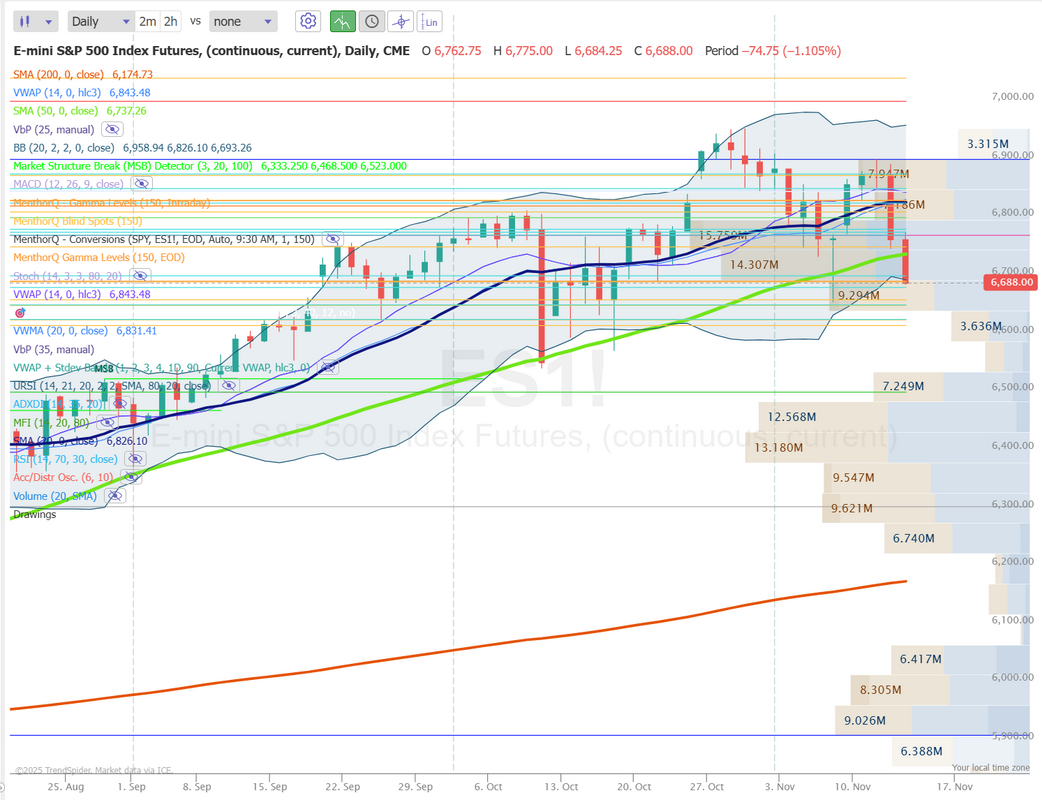

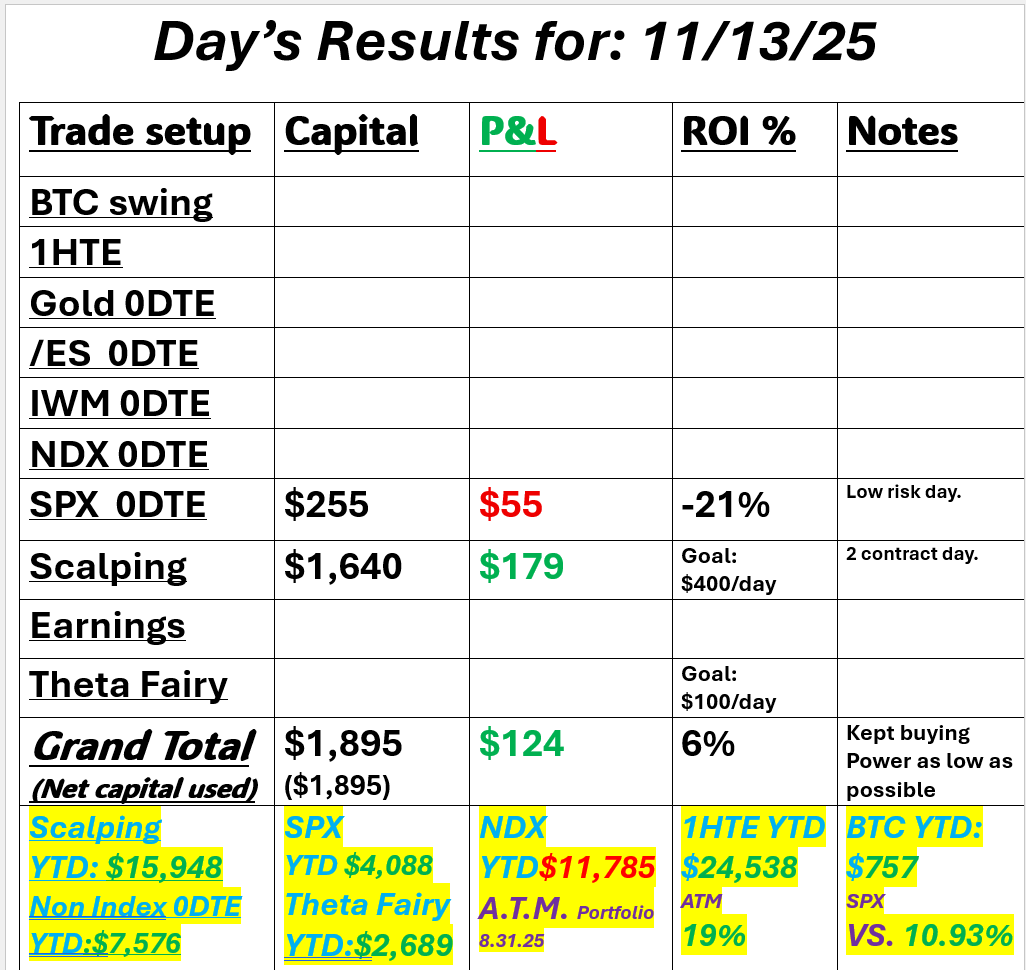

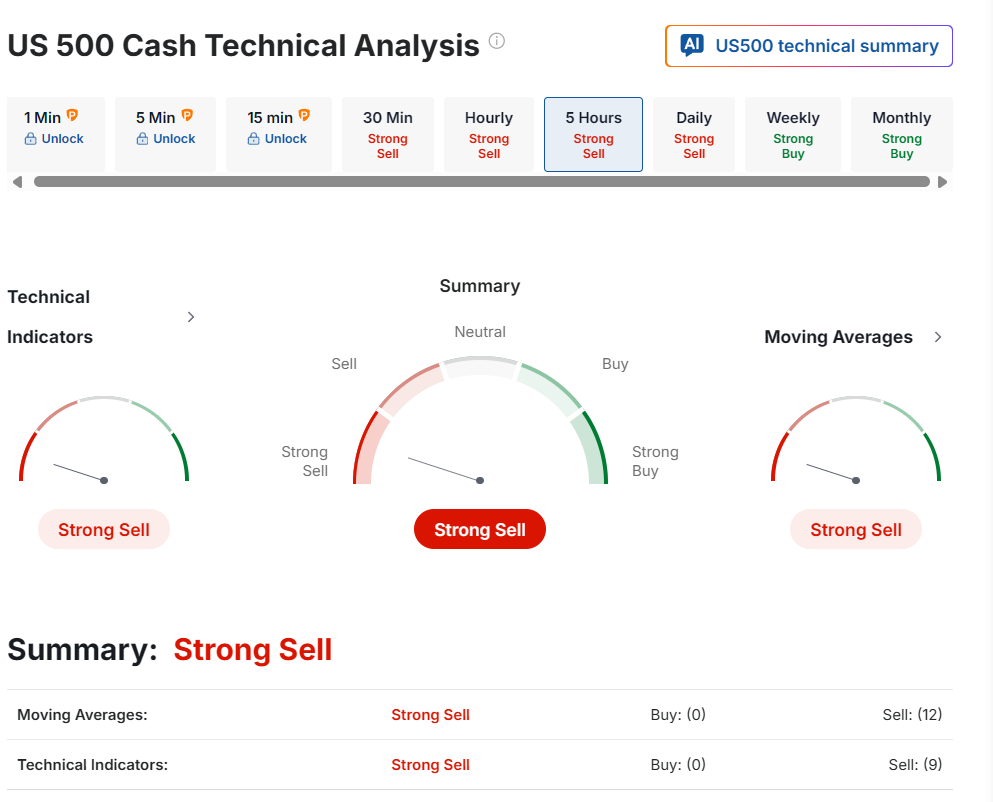

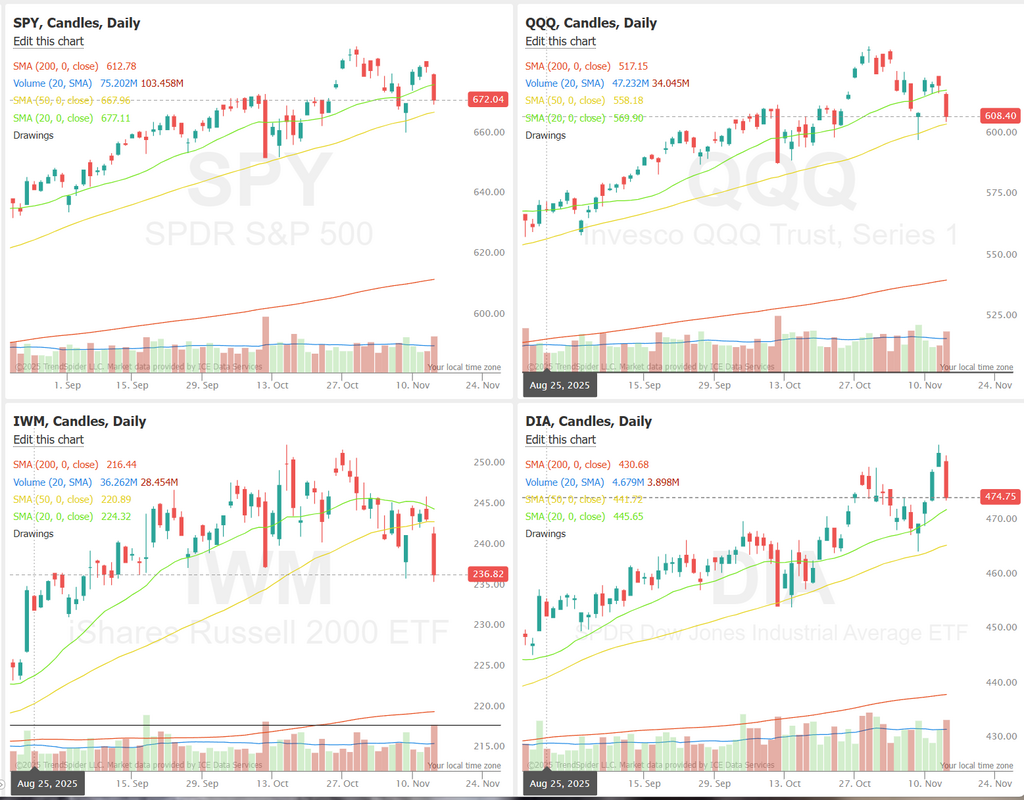

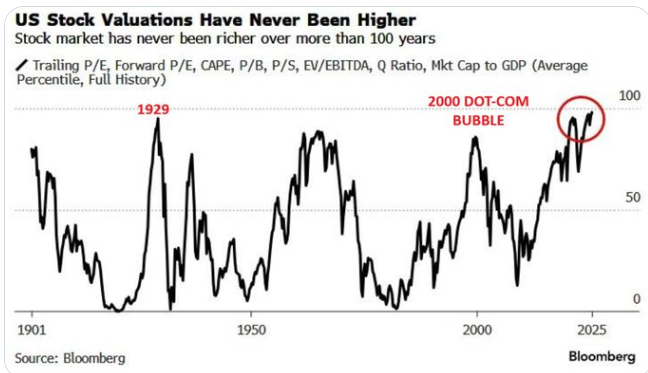

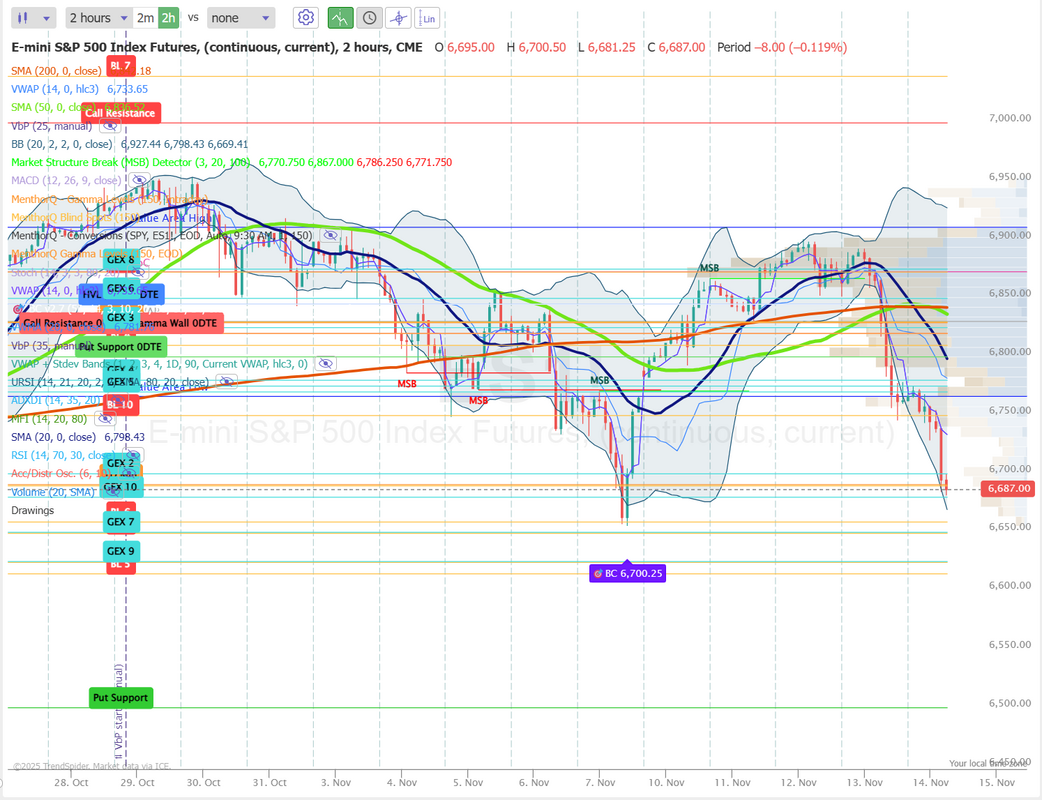

Hey 50DMA! Bye bye bye.We lost the 20DMA on the SPY and QQQ yesterday and we are losing the 50DMA this morning (as I type). We've been waiting for the bearish trend to really take hold. To quantify how big the last two days rollover is, our delta on our ATM portfolio just turned positive! We generally try to always carry a negative delta. Might be time to add some more shorts! We had a STELLAR day yesterday. Low risk...high return... small trade size. Perfect for a day like yesterday. 6% ROI on the day and small buying power. Today may be the same. Keep risk low. Let's take a look at the markets. No surprise. Bears are in full effect this morning. As mentioned, yesterday we lost the 20DMA yesterday and it sure looks like we are set to lose the 50DMA this morning. December S&P 500 E-Mini futures (ESZ25) are down -0.97%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -1.29% this morning, pointing to further losses on Wall Street as worries over stretched tech valuations persisted and investors questioned whether the Federal Reserve was still on track to cut rates in December. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed sharply lower. The Magnificent Seven stocks sank, with Tesla (TSLA) slumping over -6% and Nvidia (NVDA) falling more than -3%. Also, chip stocks slid, with Intel (INTC) and Lam Research (LRCX) dropping over -5%. In addition, Walt Disney (DIS) plunged more than -7% and was the top percentage loser on the Dow after the entertainment giant posted weaker-than-expected FQ4 revenue. On the bullish side, Cisco Systems (CSCO) rose over +4% and was the top percentage gainer on the Dow and Nasdaq 100 after the networking-equipment company reported better-than-expected FQ1 results and raised its full-year guidance. “The question now is whether the market’s recent exuberance has run its course. After a stellar rally since April, technology shares look increasingly overvalued and overstretched, with sentiment tempered by a lack of fresh catalysts and a lull in economic data,” according to Fawad Razaqzada at Forex.com. U.S. President Donald Trump signed legislation to end the longest shutdown in U.S. history late on Wednesday. The government reopening removes one source of investor uncertainty, paving the way for the release of delayed economic data, including the September jobs report, as early as next week. The Bureau of Labor Statistics is expected to issue a calendar in the coming days outlining new release dates for delayed data. President Trump’s top economic adviser, Kevin Hassett, told Fox News’ America’s Newsroom on Thursday that the October jobs report will be published without an unemployment rate reading. The data will be critical in shaping interest rate-cut expectations ahead of the Fed’s December meeting. Stubbornly high inflation and the weakening labor market are deepening the divide among Fed officials over the best path forward for interest rates. Cleveland Fed President Beth Hammack said on Thursday she remains focused on price stability even as the labor market weakens, emphasizing that reaching the central bank’s 2% inflation target is essential. Also, San Francisco Fed President Mary Daly said it is too early to determine whether policymakers should cut rates in December. In addition, St. Louis Fed President Alberto Musalem said policymakers should proceed cautiously with further rate cuts while inflation remains above the central bank’s target. Finally, Minneapolis Fed President Neel Kashkari said he did not support the last rate cut, though he remains undecided on the appropriate course of action for the December policy meeting. Meanwhile, U.S. rate futures have priced in a 49.6% chance of a 25 basis point rate cut and a 50.4% chance of no rate change at December’s policy meeting. On the trade front, a senior Trump administration official told reporters Thursday that the U.S. will eliminate tariffs on bananas, coffee, beef, and select apparel and textile goods under framework agreements with Argentina, Ecuador, Guatemala, and El Salvador, as part of efforts to address elevated food prices. Today, investors will focus on speeches from Kansas City Fed President Jeff Schmid, Dallas Fed President Lorie Logan, and Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.114%, up +0.41%. I want to take a moment to talk about (IMHO) the best way to approach the management of your hard earned capital. Three distinct approaches. #1. Scalping. #2. 0DTE's. #3. A unique asset allocation, passive portfolio. Scalping is what's kept me paying bills when I first started and had a minuscule amount of capital. It's a great way to have a good shot at generating daily income to live off, regardless of market conditions. 0DTE's keep you active and you only have to be right for a few hours a day. Our ATM portfolio takes 5 min. a day to manage. Has daily cash flow, carries shorts and well as longs. These all combine for a nice mix on days like yesterday. If you didn't make money yesterday or are worried about today it's not because you are a bad trader. You may just need a better strategy to manage your capital. This has NEVER happened: US stock market valuations have hit the highest level in modern history. Not even the periods before the 1930s Great Depression or the 2000 Dot-Com Bubble saw such expensive US stocks. US equities have never been more expensive. Let's take a look at the intraday /ES levels. Should be another exciting day. 6690 first key resistance. 6702, 6750, 6766 are all resistance zones. 6679 is first support zone. 6660 is a big potential buy zone. 6651, 6625 are last big support zones for me today. Let's finish strong today. It should be a great opportunity day. It's up to us now to capitalize! See you shortly in the live trading room.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |