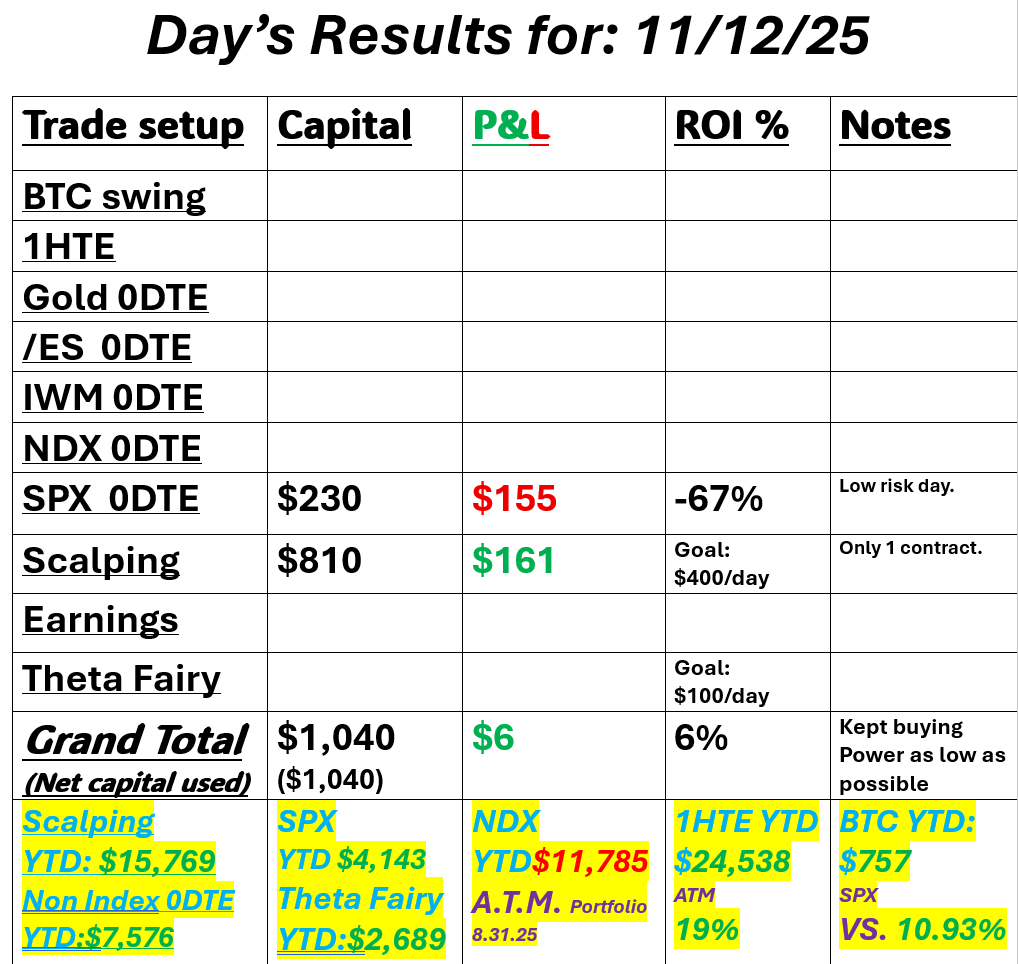

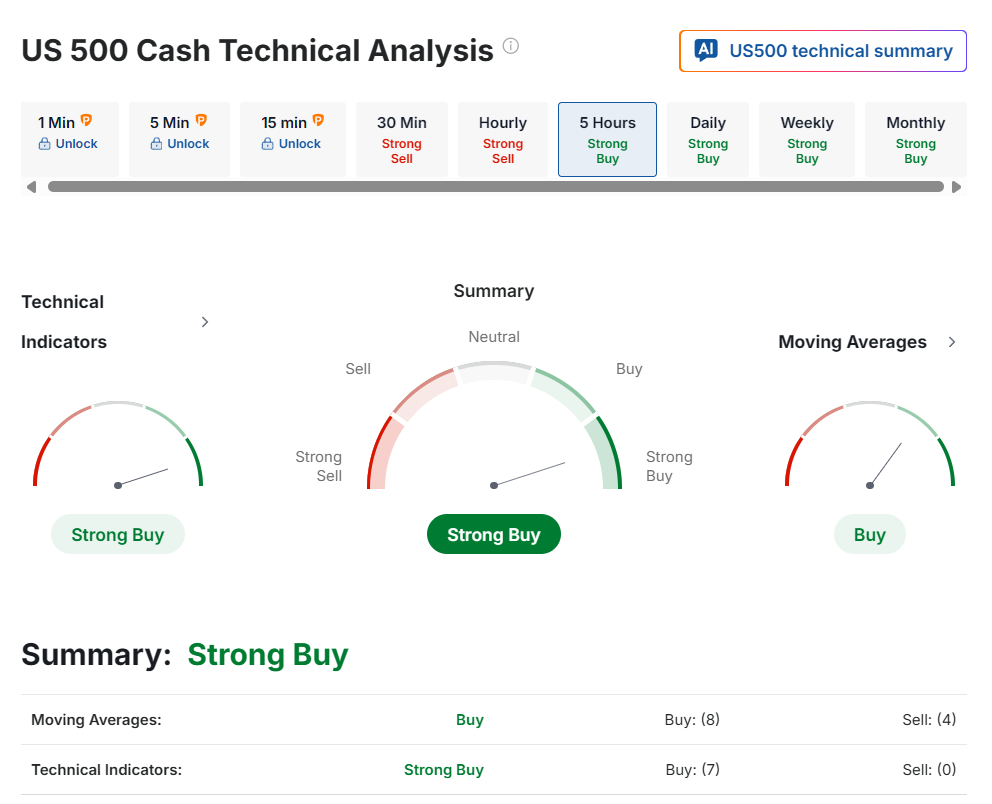

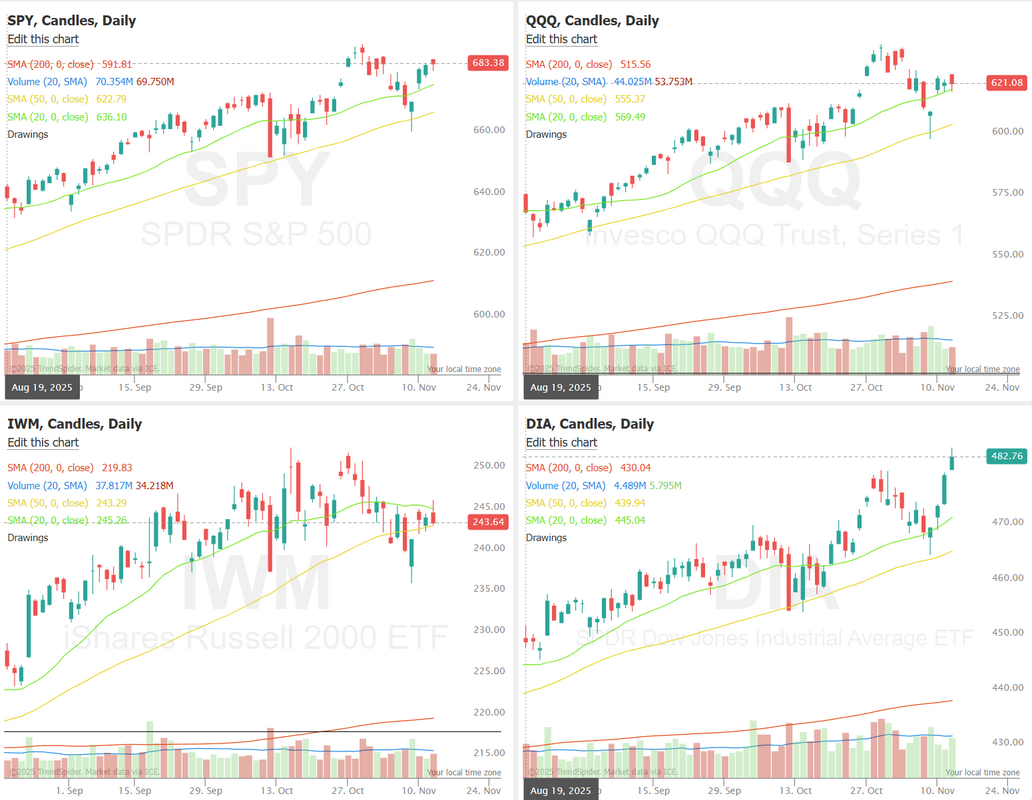

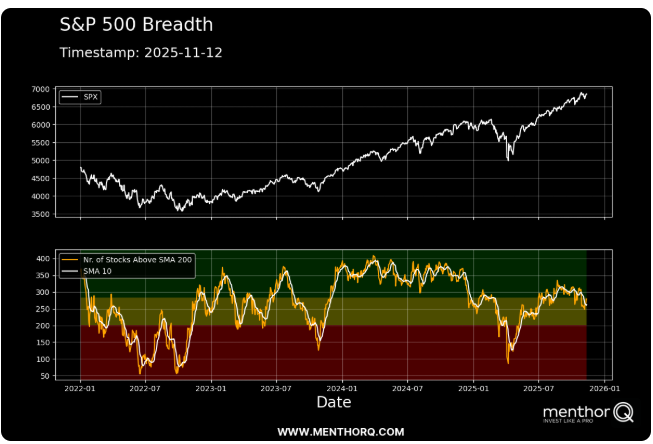

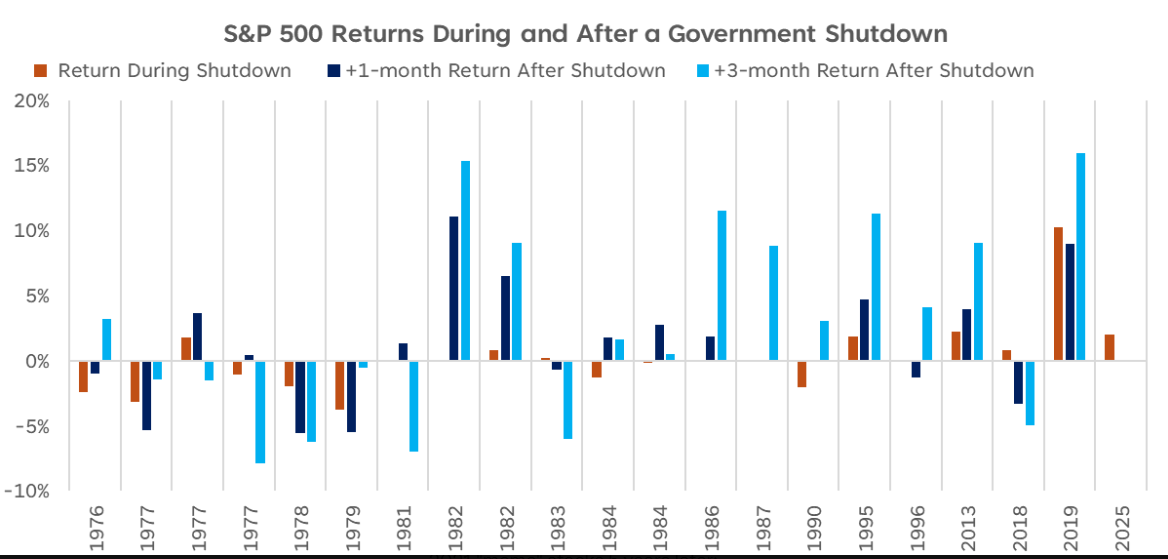

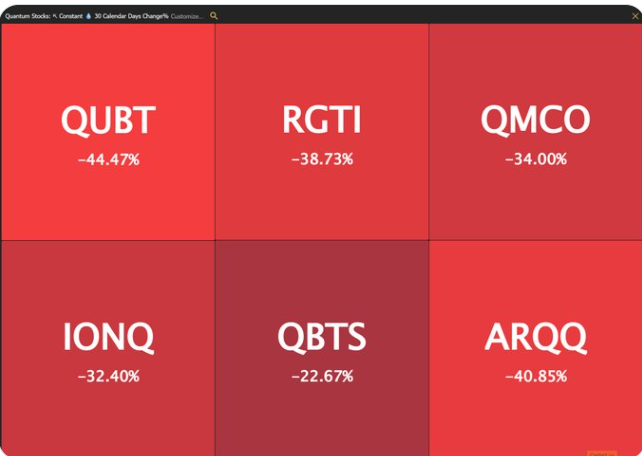

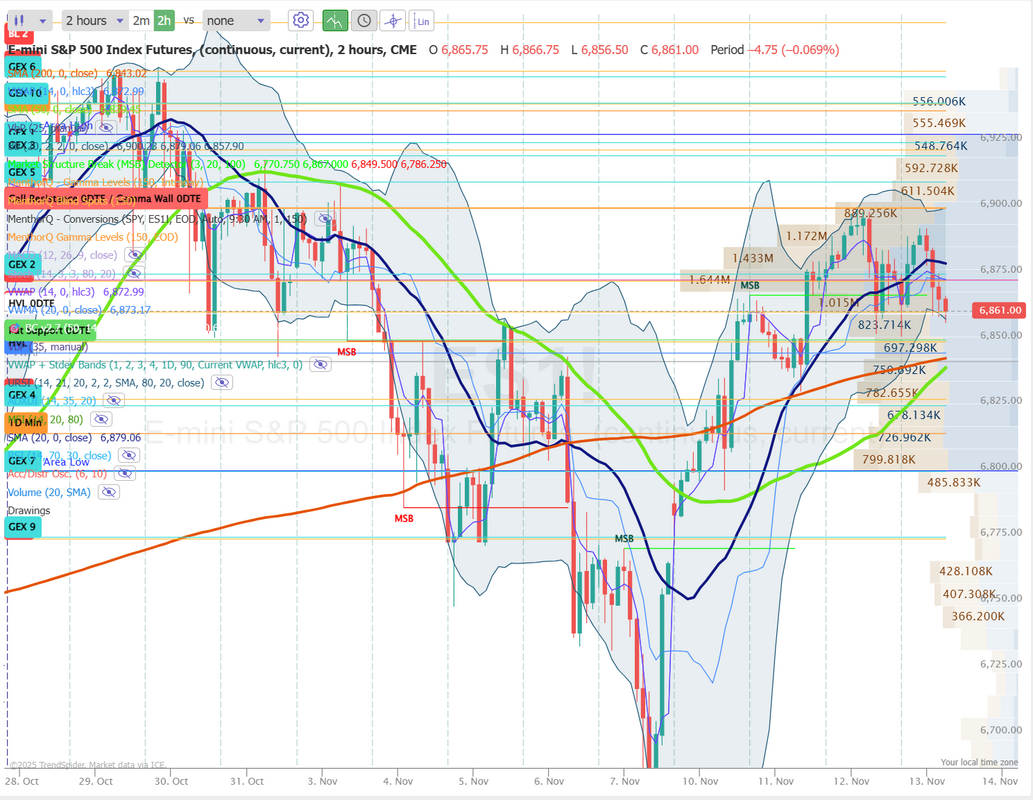

Everything's fixed!... for a few weeks.Well, the Government is back open. There's a lot of euphoria over it. Remember this isn't anything permanent. This budget fix will last a whopping 78 days before the next potential shutdown! Talk about just kicking the can down the road. That's fine for us traders. It just insures more uncertainty and volatility which is what we crave. I start my trading day early. Scanning charts, news and looking at the futures. Some mornings I just salivate and can't wait to get started. Some mornings are less exciting. Yesterday was the latter for me. If felt like a neutral technical day or even an FOMC morning where prices just float around with no inherent direction. I made a commitment to trade small and balance the cost of our SPX debit with what I thought could be a good day for scalping. It worked out o.k. I kept risk as small as I possibly could. 5-wide debit on SPX and only one contract on /MNQ scalping. The SPX didn't hit but risk was small all day. Today may be better with the potential for a "buy the rumor, sell the news" day. Do we sell back off today? It's certainly possible. Here's a look at my small day yesterday. On the plus side, our ATM asset allocation model continues to perform well. Heading into the last part of the year. Let's take a look at the markets: Technicals are still holding to a buy mode to start the day. The DIA continues to explode to the upside but everything else is a bit blah. December S&P 500 E-Mini futures (ESZ25) are down -0.05%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.08% this morning as investors weigh the outlook for the Federal Reserve’s interest rate path following the end of the longest government shutdown in U.S. history. U.S. President Donald Trump signed a spending bill to reopen the government late Wednesday, a measure passed by the Republican-controlled House after a record-long 43-day shutdown. The legislation cleared the House on a 222 to 209 vote, largely along party lines. The package extends federal government funding through January 30th and includes full-year funding for the Department of Agriculture, military construction, and the legislative branch. It will ensure that federal employees, including air-traffic controllers, receive their pay and return hundreds of thousands of furloughed government workers to their jobs. In yesterday’s trading session, Wall Street’s major indices ended mixed, with the Dow notching a new all-time high. Advanced Micro Devices (AMD) climbed +9% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after forecasting faster sales growth over the next five years, fueled by strong demand for its data center products. Also, On Holding (ONON) jumped about +18% after the company posted upbeat Q3 results and raised its full-year guidance for revenue growth and adjusted EBITDA margin. In addition, BILL Holdings (BILL) surged over +11% after Bloomberg reported that the business-payments company was exploring options, including a potential sale. On the bearish side, most members of the Magnificent Seven stocks fell, with Meta Platforms (META) and Tesla (TSLA) sliding more than -2%. The government reopening removes one source of investor uncertainty, paving the way for the release of delayed economic data, including the September jobs report, as early as next week. The data will be critical in shaping rate-cut expectations ahead of the Fed’s December meeting. Still, White House Press Secretary Karoline Leavitt said on Wednesday that the October jobs and inflation reports are “likely never” to be published because of the shutdown. “All of that economic data released will be permanently impaired, leaving our policymakers at the Fed flying blind at a critical period,” Leavitt told reporters. Fed officials remain divided over which risk is more pressing—inflation or the weakening labor market. Boston Fed President Susan Collins said on Wednesday she favored keeping rates unchanged, given still-solid growth that could slow or hinder progress in bringing down inflation. Also, Atlanta Fed President Raphael Bostic stated that inflation remains the bigger risk to the economy and that he prefers keeping rates unchanged until it’s clear the central bank is on track to achieve its 2% target. “Despite shifts in the labor market, the clearer and urgent risk is still price stability,” Bostic said. At the same time, Fed Governor Stephen Miran reiterated that U.S. monetary policy is overly restrictive, arguing that easing housing inflation is helping to reduce overall price pressures. Meanwhile, U.S. rate futures have priced in a 53.9% probability of a 25 basis point rate cut and a 46.1% chance of no rate change at the next FOMC meeting in December. Today, market participants will hear perspectives from San Francisco Fed President Mary Daly, Minneapolis Fed President Neel Kashkari, St. Louis Fed President Alberto Musalem, and Cleveland Fed President Beth Hammack. On the economic front, investors will focus on the EIA’s weekly crude oil inventories report, set to be released in a couple of hours. Economists expect this figure to be 1.0 million barrels, compared to last week’s value of 5.2 million barrels. On the earnings front, prominent companies like Walt Disney (DIS) and Applied Materials (AMAT) are scheduled to report their quarterly figures today. According to Bloomberg Intelligence, S&P 500 companies are on track to post a +14.6% increase in Q3 profits from a year earlier, nearly twice the level analysts had projected. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.072%, up +0.17%. The S&P 500 breadth chart shows encouraging short-term improvement in market participation. The number of stocks trading above their 200-day moving average is starting to rise again, diverging positively from the 10-day moving average (SMA 10), which had been flattening out. This widening gap suggests that broader segments of the market are regaining strength, with more stocks participating in the recent index rebound. If this upward breadth momentum continues, it could reinforce short-term resilience in the S&P 500, as stronger participation often supports price stability and potential continuation of the prevailing trend. Markets generally perform quite well after a Government shutdown. Quantum stocks continue to retrace and we continue to short them in our ATM portfolio. Let's take a look at the intraday levels on /ES. 6867, 6875, 6880, 6891, 6900 are resistance levels. 6860, 6850, 6843, 6839, 6827 are support. No training session for today. My "off" day on Monday threw my schedule into a bit of flux. We'll be back next Monday with a whole new training module so make sure and tune in then on our live Zoom feed.

I'll see you all shortly in the live trading room. I think today could be another good opportunity for scalping.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |