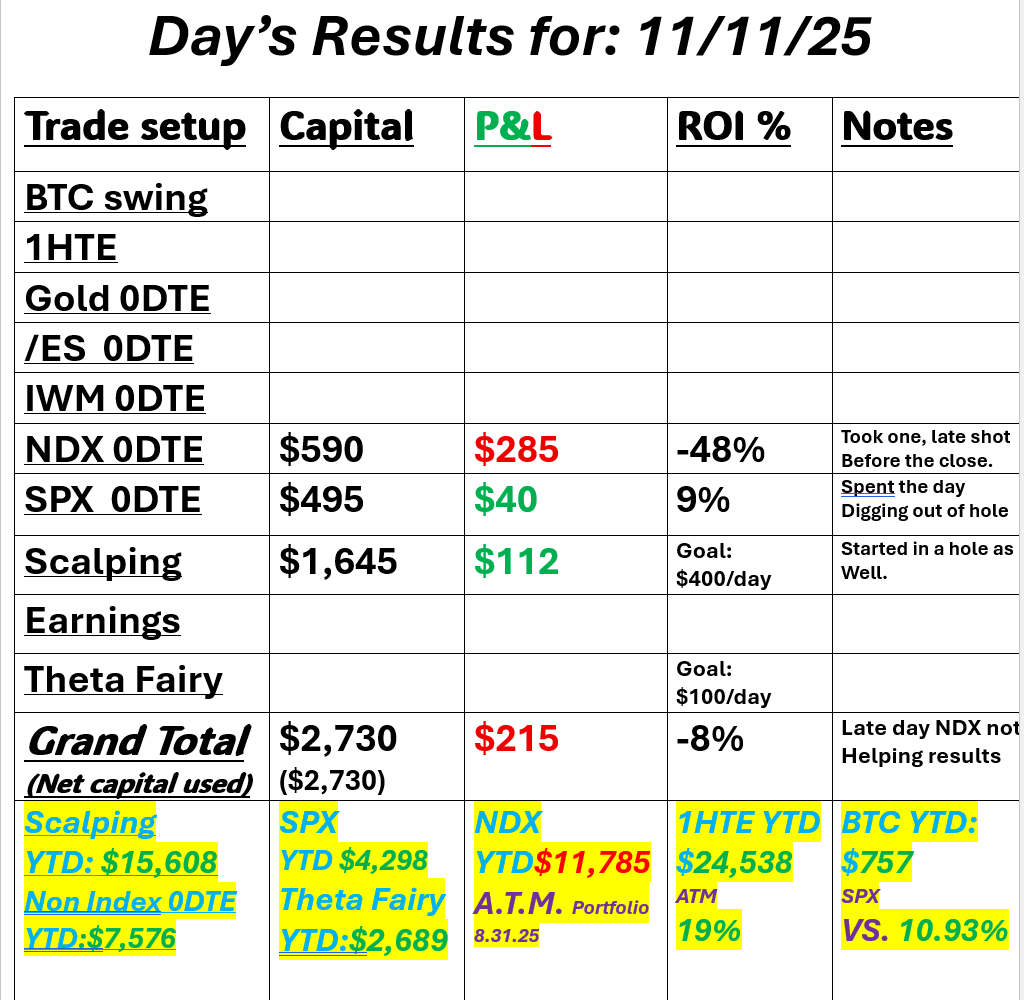

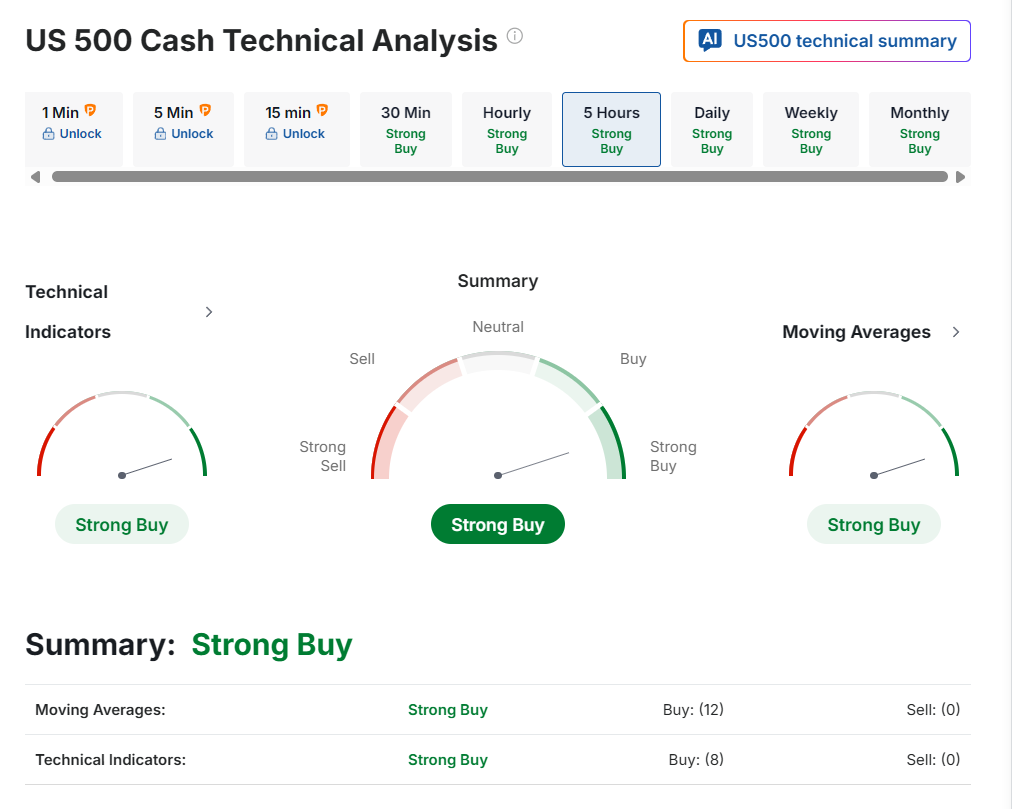

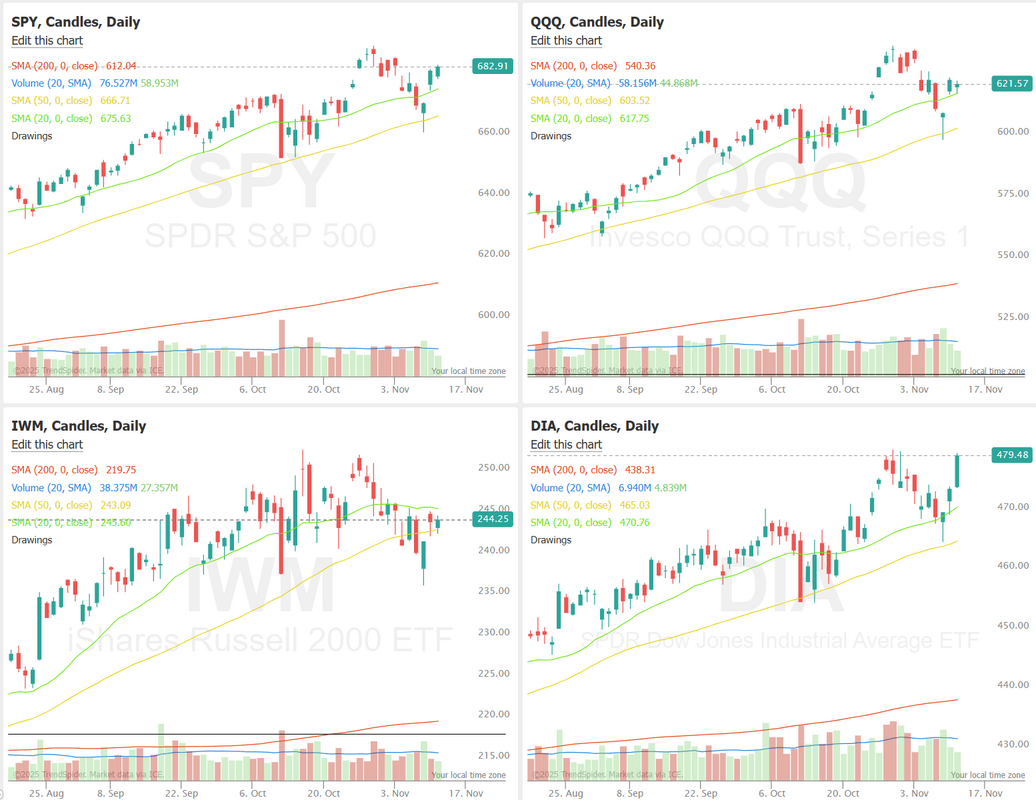

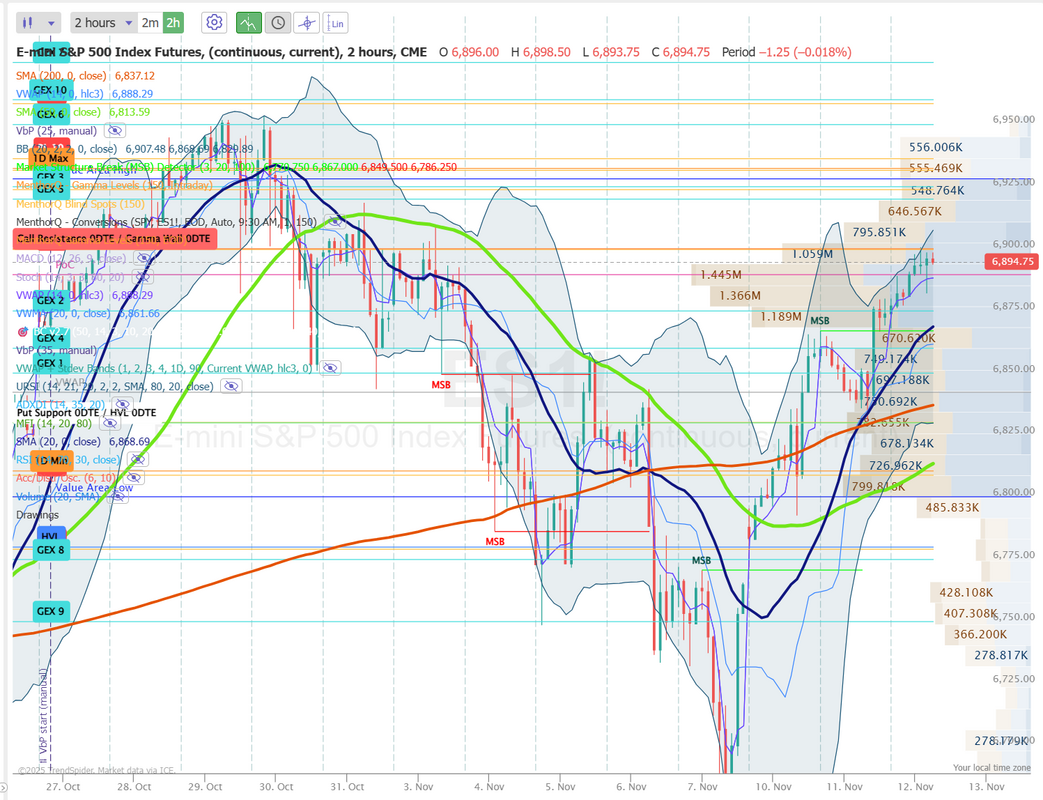

Govt. back=Risk on?It looks like the Govt. shutdown could be over as soon as today. Futures are liking it and I'm going to assume that it will be risk on trading until we do get the eventual opening. Yesterday was spent digging out of holes. I started the scalping day down about $400 and down about $250 on SPX 0DTE. I was pretty happy to be able to turn those two around however a late day NDX failed...again. Two in a row there. Here's a look at my day. Not much to show for it. Let's take a look at the markets. Technicals are popping to the upside. Futures are looking for the Govt. re-open. Price action was impressive yesterday with the Dow which absolutely popped! Everything else was pretty flat. December S&P 500 E-Mini futures (ESZ25) are trending up +0.35% this morning as optimism that the U.S. government shutdown is nearing an end boosted sentiment. A record 43-day U.S. government shutdown is poised to end as soon as today after the Senate passed a temporary funding bill. Reopening the government now depends on the House, which is set to return to Washington to consider the package. It would fund most parts of the government through January 30th and some agencies through September 30th. If approved, the bill will be sent to President Donald Trump, who has already voiced his support for the legislation. Investor focus is also on remarks from Federal Reserve officials. In yesterday’s trading session, Wall Street’s major indexes closed mixed. Paramount Skydance (PSKY) climbed over +9% and was among the top percentage gainers on the S&P 500 after the entertainment company issued above-consensus Q4 revenue guidance. Also, FedEx (FDX), often seen as a bellwether for the economy, rose more than +5% after the company projected that its profit this quarter would improve from a year ago. In addition, RealReal (REAL) jumped over +38% after the company posted better-than-expected Q3 results and raised its full-year revenue guidance. On the bearish side, Nvidia (NVDA) fell nearly -3% and was the top percentage loser on the Dow after Japan’s SoftBank Group disclosed it had sold its entire stake in the chipmaker for $5.83 billion. Once the government reopens, a wave of delayed economic reports is expected to be released, helping to clarify the outlook for interest rates. Jim Reid of Deutsche Bank stated that, based on historical precedent from the 2013 shutdown, September’s jobs report could be one of the first to be released, potentially within three business days of the government’s reopening. In the absence of official data, investors have turned to alternative indicators, including a report from ADP released on Tuesday. That report showed that the private sector lost an average of 11,250 jobs per week during the four weeks ending October 25th. The figures suggest that the labor market weakened in the latter half of October compared with the earlier part of the month. Separately, economists at Goldman Sachs estimated that U.S. payrolls fell by 50,000 in October after accounting for employees participating in the government’s deferred resignation program. Today, market participants will parse comments from a slew of Fed officials, including Williams, Paulson, Waller, Bostic, Miran, and Collins. Their remarks will be scrutinized closely amid the ongoing debate over whether another rate cut is needed at the December meeting. Meanwhile, U.S. rate futures have priced in a 63.4% chance of a 25 basis point rate cut and a 36.6% chance of no rate change at next month’s monetary policy meeting. On the earnings front, notable companies such as Cisco (CSCO), TransDigm Group (TDG), and GlobalFoundries (GFS) are slated to release their quarterly results today. According to Bloomberg Intelligence, S&P 500 companies are on track to post a +14.6% increase in Q3 profits from a year earlier, nearly twice the level analysts had projected. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.088%, up +0.44% The SPX Momentum Score shows signs of stabilization after recent short-term volatility, suggesting that bullish momentum may be regaining traction. The price has rebounded from last week’s dip and is now approaching prior resistance levels near the recent highs, supported by an improving momentum reading climbing back toward the upper range. This rebound indicates a potential shift in short-term sentiment as buyers regain control following a brief consolidation phase. However, given the choppy behavior over the past few sessions, traders appear focused on confirming sustained strength above these levels before committing to a broader directional move. Todays training session we be another Jessie Livermore segment on "How to grow your wealth starting with zero". It should be another good session. Please tune in. My lean or bias today: It should be bullish. Technicals are all pointing up. Risk on seems to be back. The Govt. WILL open up at some point. Today? We're not sure but when it does it could provide an upward pop to the indices. Even if short term in nature. Today could be tricky It could be easy to get trapped in a bearish move when the news hits and markets pop. Be diligent today. Let's take a look at the intraday levels on /ES. Several key levels. 6900* (key resistance), 6920, 6928* (key resistance) 6936, 6960* (key resistance). 6889, 6875, 6860, 6850, 6843* (key support) I look forward to seeing you all back on zoom today. See you shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |