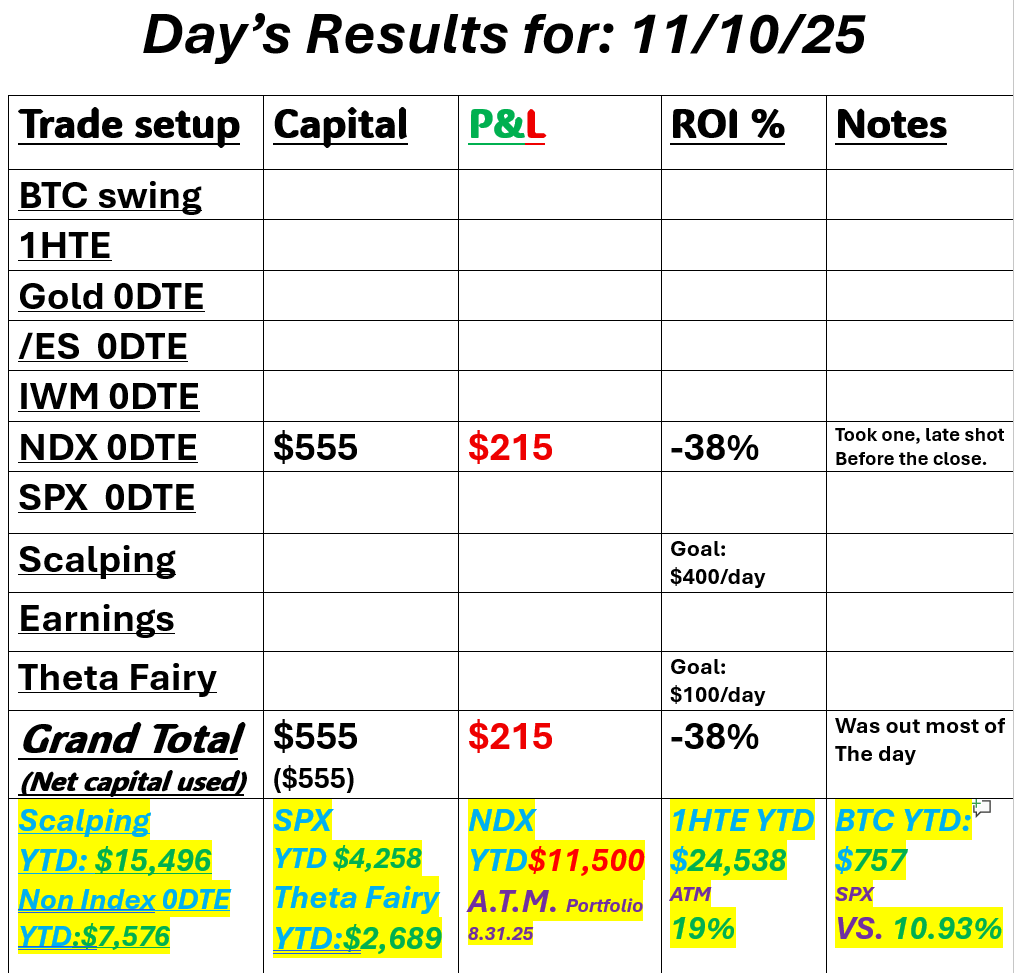

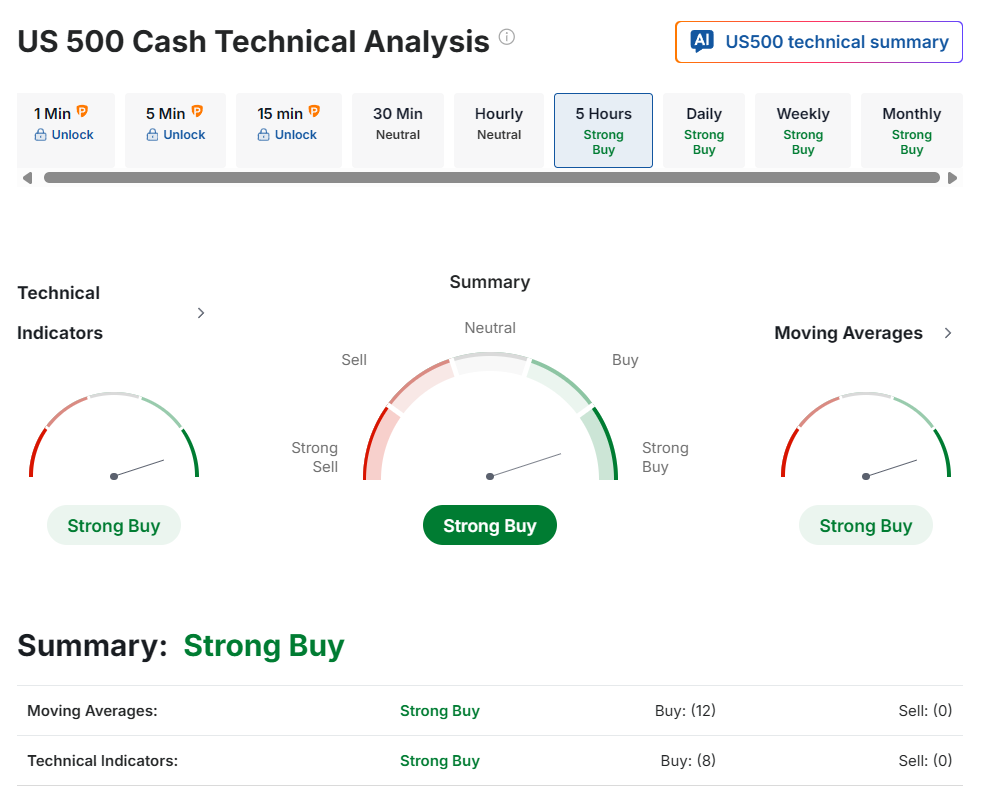

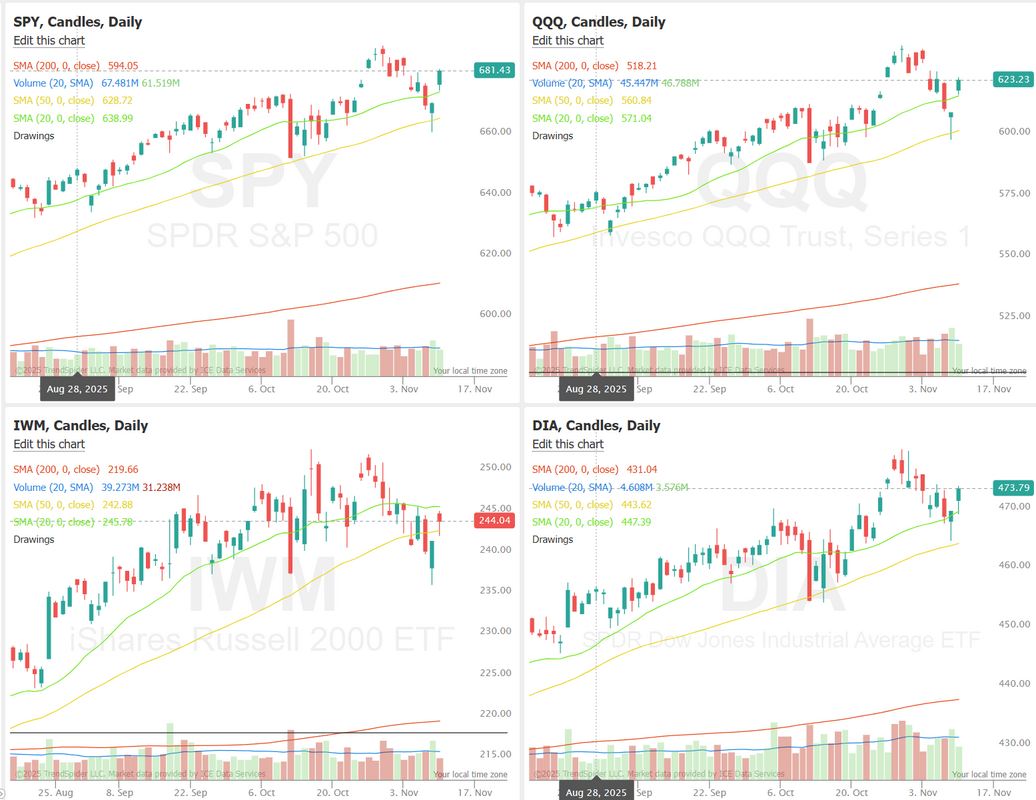

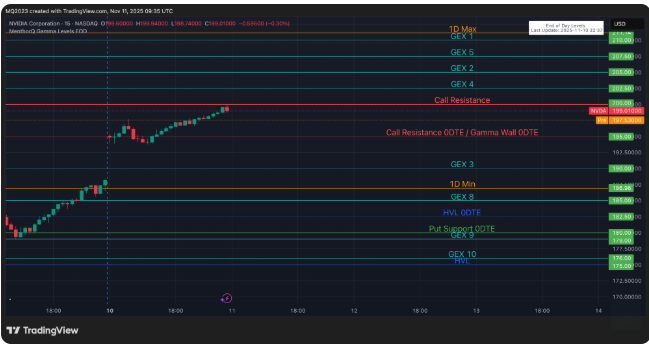

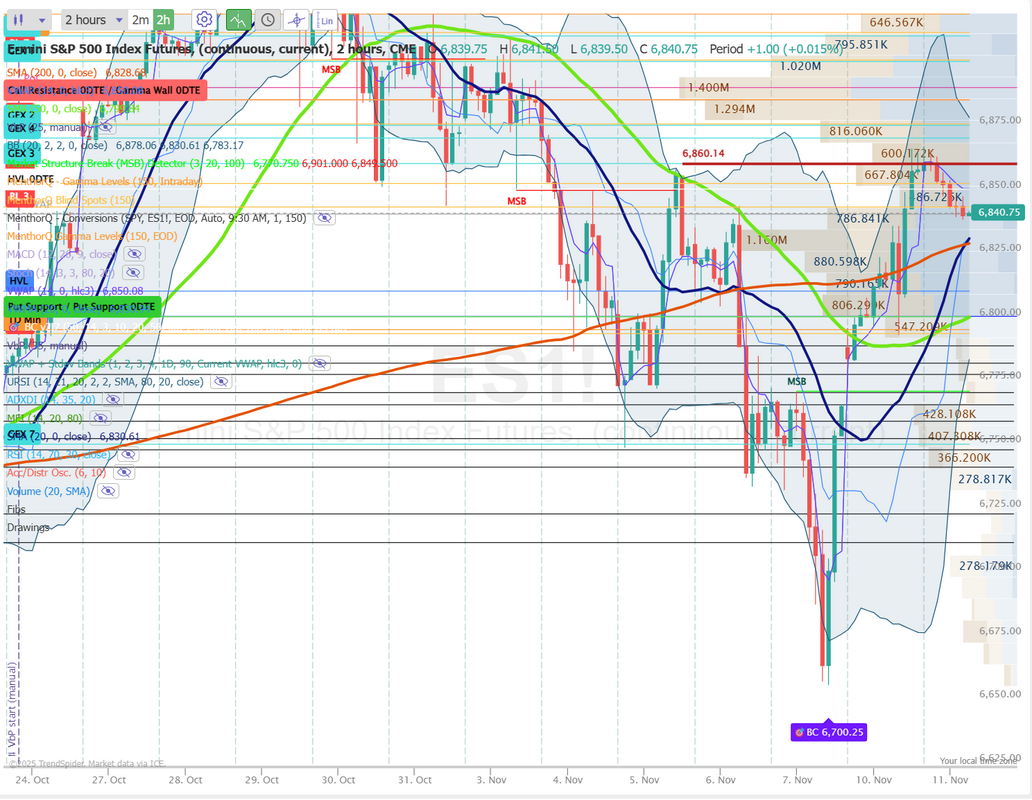

Does yesterday change the trend?We had a monster rebound yesterday after five very weak trading sessions. News that an end to the Govt. shutdown was near was enough to initiate a big relief rally. That makes sense. Some moves are harder to understand but this has generally been the pattern on re-openings. The real question is about its sustainability. Will this usher in another bull leg or is it only temporary? Futures are a tad weak this morning as we start the process of finding out. Word is it could be as early as tomorrow to get the Govt. back open. Let's see if it becomes a "buy the rumor, sell the news" event or not. I was out of commission most of the day yesterday with some low blood pressure issues. I did take one trade late in the day, looking for an NDX retrace going into the close but quickly got stopped out. Here's a look at it. Not much of a day for me. Let's take a look at the market. Technicals are pointing bullish after yesterdays big push higher. Yesterday's move higher was a solid gap up move. The question now is, will this gap get filled? Futures are suggesting it's a real possibility this morning. The SPX option score is rebounding sharply after a brief pullback, aligning with a short-term bounce in spot prices following recent weakness. The score’s quick recovery to higher levels suggests renewed option market confidence and possibly a shift toward increased call positioning or reduced hedging activity. Price action shows the index stabilizing after testing support near recent lows, hinting that volatility compression could favor range-bound consolidation before the next directional move. In the near term, maintaining momentum above the mid-range levels will be key for sustaining bullish sentiment, while a drop in the option score could quickly reintroduce short-term downside pressure. I wanted to take a moment and look at the bellwether A.I. stock (Nvidia). There seems to be a bit of a waning in A.I. stocks as more concerns of valuations and profitability come online. It seems to be at a crucial level. NVIDIA’s price action is consolidating near a key call resistance zone around $200, where significant gamma exposure (GEX) concentration suggests dealers may begin to hedge defensively if momentum stalls. The Gamma Wall at $195 marks a notable inflection level holding above it keeps the short-term tone stable, while a break below could open room toward support levels near $190 and $185. On the upside, if NVIDIA can sustain strength through $200, option positioning could fuel a gamma squeeze toward the next resistance clusters around $205–$210. The setup highlights a tightly balanced market where option flows may heavily influence short-term direction. Of course, it goes without saying that as NVDA goes so goes most of the tech and A.I. marketplace. This is a key one to watch. December S&P 500 E-Mini futures (ESZ25) are down -0.22%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.39% this morning, pointing to a lower open on Wall Street after yesterday’s rally amid renewed concerns over the valuations of some of the biggest beneficiaries of the AI boom. Sentiment weakened as Nvidia (NVDA) fell over -1% in pre-market trading after Japan’s SoftBank Group disclosed it had sold its entire $5.83 billion stake in the chipmaker, reigniting valuation concerns. Separately, CoreWeave (CRWV), which provides rental access to powerful AI chips, slumped more than -9% in pre-market trading after cutting its full-year revenue guidance. Also adding to the negative sentiment on Tuesday was a Wall Street Journal report stating that China will expedite rare earth export approvals for most firms while excluding those tied to the U.S. military. The move added fresh uncertainty about the durability of the trade truce between the world’s two largest economies. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. The Magnificent Seven stocks advanced, with Nvidia (NVDA) climbing over +5% to lead gainers in the Dow and Alphabet (GOOGL) rising more than +4%. Also, chip stocks rallied, with Micron Technology (MU) gaining over +6% and Advanced Micro Devices (AMD) rising more than +4%. In addition, TreeHouse Foods (THS) jumped over +22% after Investindustrial agreed to acquire the food processing company for about $2.9 billion. On the bearish side, health insurance stocks slumped after lawmakers moved closer to ending the shutdown without securing an extension of Affordable Care Act subsidies, with Oscar Health (OSCR) tumbling more than -17% and Centene (CNC) sliding over -8% to lead losers in the S&P 500. A record 42-day U.S. government shutdown is poised to end as soon as Wednesday after the Senate passed a temporary funding bill, with Democrats providing enough votes to push the measure through. The package now heads to the Republican-controlled House for a final vote before advancing to President Trump’s desk. Once the government reopens, a wave of delayed economic reports is expected to be released, helping to clarify the outlook for interest rates. “Reopening would not only boost sentiment, but also open the way for data releases, which could provide more insight into the health of the U.S. jobs market and, more broadly, the U.S. economy ahead of next month’s Federal Reserve interest-rate decision,” said Fiona Cincotta at City Index. Meanwhile, Vail Hartman, Delaney Choi, and Ian Lyngen at BMO Capital Markets noted that it would take several weeks for the market to receive all the data delayed since the start of the shutdown. Jim Reid of Deutsche Bank stated that, based on historical precedent from the 2013 shutdown, September’s jobs report could be one of the first to be released, potentially within three business days of the government’s reopening. Assuming the government reopens and data collection resumes, Fed officials will still face data compiled through retroactive surveys and other methods—if they are published at all. Analysts cautioned that the Bureau of Labor Statistics would likely be unable to gather and process data for both the October and November CPI reports ahead of the December FOMC meeting. And this comes at a time when the Fed is the most divided in recent memory. St. Louis Fed President Alberto Musalem said on Monday that he expects the U.S. economy to rebound sharply early next year, emphasizing that policymakers should exercise caution when considering further rate cuts. “It is very important that we tread with caution, because I believe there’s limited room for further reductions without monetary policy becoming overly accommodative,” Musalem said. At the same time, San Francisco Fed President Mary Daly said the economy is likely experiencing a slowdown in demand and cautioned against keeping rates too high for too long. Also, Fed Governor Stephen Miran said that better-than-expected inflation data and continued signs of labor market weakness support the case for a third consecutive rate cut in December. U.S. rate futures have priced in a 63.6% chance of a 25 basis point rate cut and a 36.4% chance of no rate change at the December FOMC meeting. The bond market is closed today for the Veterans Day holiday. Will they or won't they?One big question is will the FED lower rates again at its next meeting? A big part of that guessing game comes down to interpreting the data that had yet to be released, due to the shutdown. Several observers are noting that it will take quite a while to compile and release all that backlogged data. It's likely that some will still be pending when the FED needs to make a decision. Futures are almost down to a coin toss as to whether or not we get another cut this year. My lean or bias today: I'm going to lean or look for more bearishness. Yesterdays pop was understandable but I think the recent A.I. weakness and overall softness in the market, combined with weak futures offer the bears up another shot to refill the gap and continue the move lower. Let's take a look at some intraday levels. The daily chart on VTI doesn't offer up much guidance. Technicals and price action put us more neutral than anything. On a tighter 2-hour. chart on /ES, we have a couple of big levels and lots of tiny levels. Pretty normal after a big move like we got yesterday. There is a big Gamma wall of resistance at 6884 and a big Gamma wall of support at 6700. That leaves a lot of levels in between. I'll work to point these out in Discord as the day progresses, so keep your chat room open as the day goes forward. Warren Buffett is known for many, many wise quotes. One of my favorites is, "In the short term the market is a voting machine. In the long term it's a weighing machine." This simply means in the short term individual (or collective) opinion can move stocks is crazy ways but ultimately, at the end of the day, fundamentals come home to roost. There have been (and will continue to be) many Meme stocks that had spectacular runs in the short term, only to come back to reality over time, as fundamentals took focus. It may be too early to call the A.I. stocks to this category of investments but it's something I'm certainly watching, and we are selectively building small, short positions in several of them in our ATM portfolio.

I look forward to seeing you all in the live trading room today. Today may not offer up the opportunities of yesterday, but I think it will still be a good one.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |